A perpetual bond is a fixed-income security with no maturity date, offering investors a stream of interest payments indefinitely. These bonds are ideal for investors seeking steady income without the pressure of principal repayment. Explore the rest of the article to understand how perpetual bonds can fit into your investment strategy.

Table of Comparison

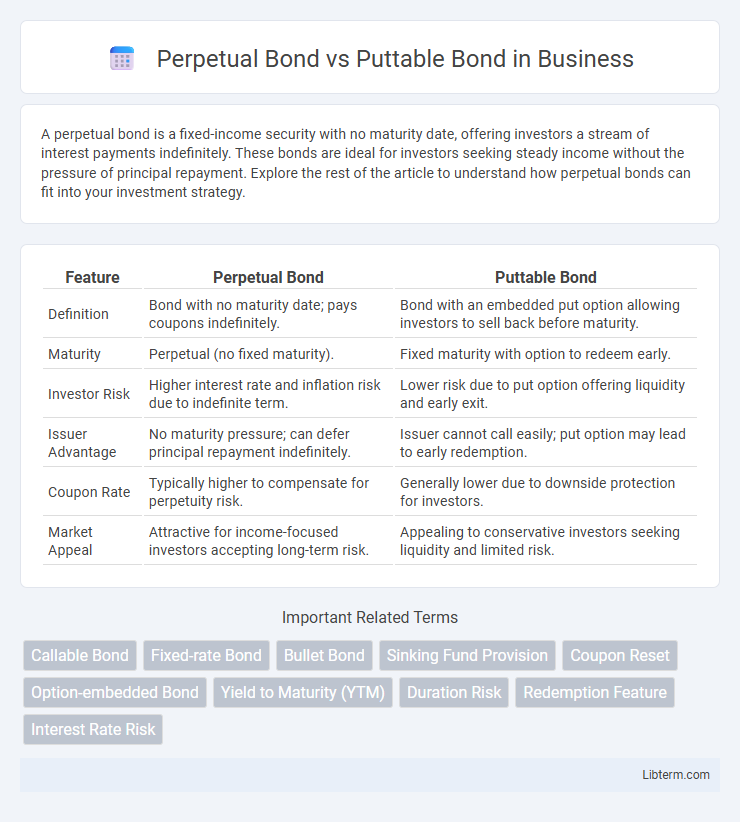

| Feature | Perpetual Bond | Puttable Bond |

|---|---|---|

| Definition | Bond with no maturity date; pays coupons indefinitely. | Bond with an embedded put option allowing investors to sell back before maturity. |

| Maturity | Perpetual (no fixed maturity). | Fixed maturity with option to redeem early. |

| Investor Risk | Higher interest rate and inflation risk due to indefinite term. | Lower risk due to put option offering liquidity and early exit. |

| Issuer Advantage | No maturity pressure; can defer principal repayment indefinitely. | Issuer cannot call easily; put option may lead to early redemption. |

| Coupon Rate | Typically higher to compensate for perpetuity risk. | Generally lower due to downside protection for investors. |

| Market Appeal | Attractive for income-focused investors accepting long-term risk. | Appealing to conservative investors seeking liquidity and limited risk. |

Introduction to Perpetual and Puttable Bonds

Perpetual bonds are fixed-income securities with no maturity date, offering investors indefinite coupon payments and often used by corporations to raise long-term capital. Puttable bonds provide bondholders the option to sell the bond back to the issuer at a predetermined price before maturity, offering downside protection against interest rate fluctuations or credit risk. Both bond types offer unique features catering to different investor risk appetites and yield preferences in fixed-income markets.

Definition of Perpetual Bonds

Perpetual bonds, also known as consol bonds, are fixed-income securities with no maturity date, providing investors with indefinite interest payments. Unlike puttable bonds, which grant the holder the option to sell the bond back to the issuer at specified times, perpetual bonds continue to pay coupons perpetually unless called by the issuer. Issuers utilize perpetual bonds primarily for long-term capital funding without repayment obligations, enhancing financial flexibility.

Definition of Puttable Bonds

Puttable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, providing downside protection against interest rate increases or credit deterioration. In contrast, perpetual bonds have no maturity date and pay interest indefinitely, lacking the repurchase option offered by puttable bonds. The put option in puttable bonds enhances investor security by allowing early redemption under specified conditions.

Key Features of Perpetual Bonds

Perpetual bonds have no maturity date, offering investors indefinite interest payments, unlike puttable bonds which provide holders the right to sell the bond back to the issuer before maturity. These bonds usually feature fixed coupon rates and higher yields to compensate for the absence of principal repayment. Perpetual bonds are often issued by financial institutions seeking long-term capital and are considered hybrid instruments, blending debt and equity characteristics.

Key Features of Puttable Bonds

Puttable bonds grant the bondholder the right to sell the bond back to the issuer at predetermined dates before maturity, offering enhanced protection against interest rate risk and credit deterioration. Key features include embedded put options, predefined put dates, and specified put prices, which provide investors with liquidity and downside risk management. These bonds typically have lower yields compared to non-puttable bonds due to the added flexibility and reduced risk exposure for investors.

Interest Rate Risks Comparison

Perpetual bonds carry higher interest rate risk due to their indefinite maturity, causing price volatility when rates fluctuate since investors cannot recover principal at a specific date. Puttable bonds reduce interest rate risk as they grant bondholders the option to sell back the bond to the issuer before maturity, providing a safety mechanism if rates rise. The embedded put option in puttable bonds acts as a hedge, limiting potential price declines compared to perpetual bonds exposed to sustained rate changes.

Redemption and Maturity Differences

Perpetual bonds have no maturity date, meaning they pay coupons indefinitely without a fixed redemption date, whereas puttable bonds come with a predetermined maturity date and give bondholders the right to redeem the bond before maturity. The key redemption difference lies in the puttable bondholder's option to sell the bond back to the issuer at specified dates or conditions, providing enhanced liquidity and risk management. Perpetual bonds lack this put feature, exposing investors to potentially indefinite interest rate and credit risk without guaranteed principal repayment.

Suitability for Investors

Perpetual bonds suit investors seeking steady, long-term income without maturity concerns, often appealing to institutions aiming to enhance yield in low-interest environments. Puttable bonds attract investors desiring flexibility and risk mitigation by allowing the option to sell the bond back to the issuer before maturity, ideal for those anticipating interest rate fluctuations. Investors prioritizing capital preservation and liquidity typically prefer puttable bonds, while those with higher risk tolerance and an income focus lean toward perpetual bonds.

Advantages and Disadvantages of Each Bond Type

Perpetual bonds offer issuers the advantage of no maturity date, reducing refinancing risk and providing long-term capital, but investors face interest rate risk and lack principal repayment certainty. Puttable bonds grant investors the right to sell the bond back to the issuer before maturity, offering downside protection and enhanced flexibility, though issuers may face higher coupons and earlier redemption risk. The trade-off involves perpetual bonds providing steady income without maturity, while puttable bonds balance investor control with potential issuer costs.

Conclusion: Choosing Between Perpetual and Puttable Bonds

Perpetual bonds offer investors indefinite interest payments without a maturity date, providing stable income but limited liquidity and price sensitivity to interest rate changes. Puttable bonds grant bondholders the option to redeem the bond before maturity, enhancing flexibility and reducing interest rate risk exposure. Investors seeking consistent income with long-term commitment may prefer perpetual bonds, while those valuing downside protection and exit options often favor puttable bonds.

Perpetual Bond Infographic

libterm.com

libterm.com