Asset-heavy businesses require significant investment in physical assets like machinery, buildings, or inventory, which can lead to substantial capital expenditures. Managing these assets effectively is crucial to maximize operational efficiency and profitability. Explore the rest of the article to understand how asset-heavy models impact your business strategy and financial planning.

Table of Comparison

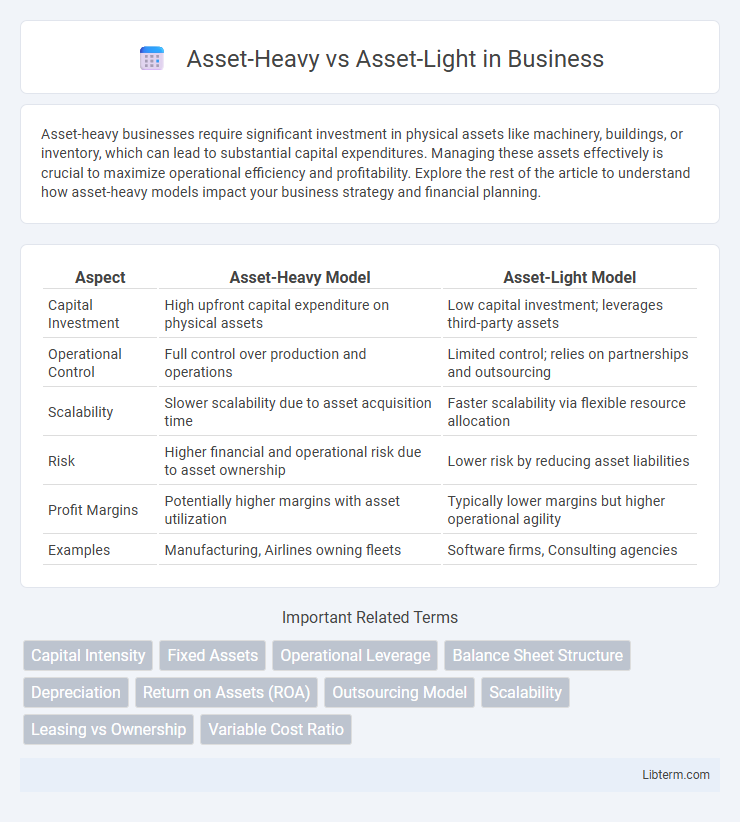

| Aspect | Asset-Heavy Model | Asset-Light Model |

|---|---|---|

| Capital Investment | High upfront capital expenditure on physical assets | Low capital investment; leverages third-party assets |

| Operational Control | Full control over production and operations | Limited control; relies on partnerships and outsourcing |

| Scalability | Slower scalability due to asset acquisition time | Faster scalability via flexible resource allocation |

| Risk | Higher financial and operational risk due to asset ownership | Lower risk by reducing asset liabilities |

| Profit Margins | Potentially higher margins with asset utilization | Typically lower margins but higher operational agility |

| Examples | Manufacturing, Airlines owning fleets | Software firms, Consulting agencies |

Defining Asset-Heavy and Asset-Light Models

Asset-heavy models rely on substantial physical assets such as manufacturing plants, equipment, and real estate to generate revenue, often leading to higher capital expenditure and fixed costs. Asset-light models focus on leveraging intangible assets, outsourcing production, or utilizing third-party resources, which reduces capital requirements and enhances operational flexibility. Companies adopting asset-light strategies emphasize scalability and agility by minimizing ownership of physical assets while maintaining control over core competencies like branding and innovation.

Key Differences Between Asset-Heavy and Asset-Light

Asset-heavy models require substantial investment in physical assets such as manufacturing plants, machinery, and real estate, leading to higher fixed costs and capital expenditure. Asset-light models emphasize outsourcing and leverage intangible assets like brand, technology, or intellectual property, resulting in greater operational flexibility and lower upfront investment. The key difference lies in the degree of asset ownership and capital commitment, impacting scalability, risk exposure, and profit margins.

Pros and Cons of Asset-Heavy Strategies

Asset-heavy strategies involve substantial investment in physical assets such as manufacturing plants, machinery, and real estate, providing companies with greater control over production quality and capacity scalability. These strategies can lead to higher fixed costs and reduced flexibility, making firms more vulnerable to market fluctuations and technological changes. However, asset-heavy models often result in stronger competitive advantages through barriers to entry and enhanced operational efficiency in capital-intensive industries.

Advantages and Disadvantages of Asset-Light Approaches

Asset-light approaches prioritize minimal ownership of physical assets, enabling businesses to reduce capital expenditure and enhance operational flexibility, which often leads to faster scalability and lower financial risk. However, reliance on third parties can limit control over quality and supply chain stability, potentially affecting customer satisfaction and operational consistency. This model is particularly advantageous for companies aiming to enter markets swiftly and adapt to changing demand without the burden of asset management.

Financial Implications of Asset-Heavy vs Asset-Light

Asset-heavy business models typically require significant capital investment in fixed assets, leading to higher depreciation expenses and increased financial risk due to substantial debt or equity financing. In contrast, asset-light models offer greater operational flexibility with lower capital expenditures, resulting in improved cash flow and higher return on assets (ROA). Financial implications also include asset-heavy firms facing pressure on liquidity ratios, whereas asset-light companies benefit from scalability and faster adaptation to market changes.

Impact on Scalability and Growth Potential

Asset-heavy business models require significant capital investment in physical assets, which can limit scalability due to high fixed costs and longer expansion timelines. Asset-light models leverage external resources or digital platforms, enabling faster growth and greater flexibility with lower capital expenditure. Companies adopting asset-light strategies often achieve higher scalability and improved growth potential by minimizing operational constraints and maximizing resource efficiency.

Operational Flexibility and Risk Management

Asset-heavy business models require significant capital investment in physical assets, limiting operational flexibility due to fixed costs and maintenance demands. In contrast, asset-light models leverage outsourcing and partnerships, enhancing agility and allowing rapid adaptation to market changes while mitigating financial risk. This flexibility reduces exposure to asset depreciation and market volatility, making asset-light strategies more resilient in uncertain economic environments.

Industry Examples: Asset-Heavy vs Asset-Light

The automotive industry exemplifies asset-heavy models with companies like Ford and General Motors owning extensive manufacturing plants and supply chains, while Tesla, despite being in the same sector, integrates more asset-light strategies through software and direct sales. In retail, Walmart operates an asset-heavy model with vast physical stores and distribution centers, contrasting with Amazon's asset-light approach emphasizing digital infrastructure and third-party logistics partnerships. Airlines such as Delta own significant fleets and maintenance facilities, representing asset-heavy operations, whereas budget carriers like Ryanair opt for an asset-light model by leasing aircraft and outsourcing services to minimize capital expenditure.

Choosing the Right Strategy for Your Business

Selecting the appropriate asset strategy impacts capital allocation, operational efficiency, and risk management significantly. Asset-heavy models require substantial investment in physical assets, fostering control and stability, while asset-light approaches prioritize outsourcing and flexibility, enhancing scalability and reducing fixed costs. Evaluating industry demands, cash flow stability, and growth objectives ensures alignment with long-term business goals and competitive advantage.

Future Trends in Asset-Heavy and Asset-Light Models

Future trends in asset-heavy models highlight increased integration of advanced automation and sustainable technologies to enhance operational efficiency and reduce environmental impact. Asset-light models continue to leverage digital transformation, emphasizing platform-based services and strategic partnerships to scale rapidly without significant capital investment. The evolving business landscape underscores a hybrid approach, blending asset-heavy infrastructure with asset-light agility to optimize resilience and competitiveness.

Asset-Heavy Infographic

libterm.com

libterm.com