Conflict of interest arises when personal, financial, or professional interests potentially compromise an individual's impartiality and decision-making in a professional setting. Organizations implement policies to identify and manage these conflicts to maintain transparency and trust. Explore the full article to understand how identifying conflicts of interest protects your integrity and promotes ethical behavior.

Table of Comparison

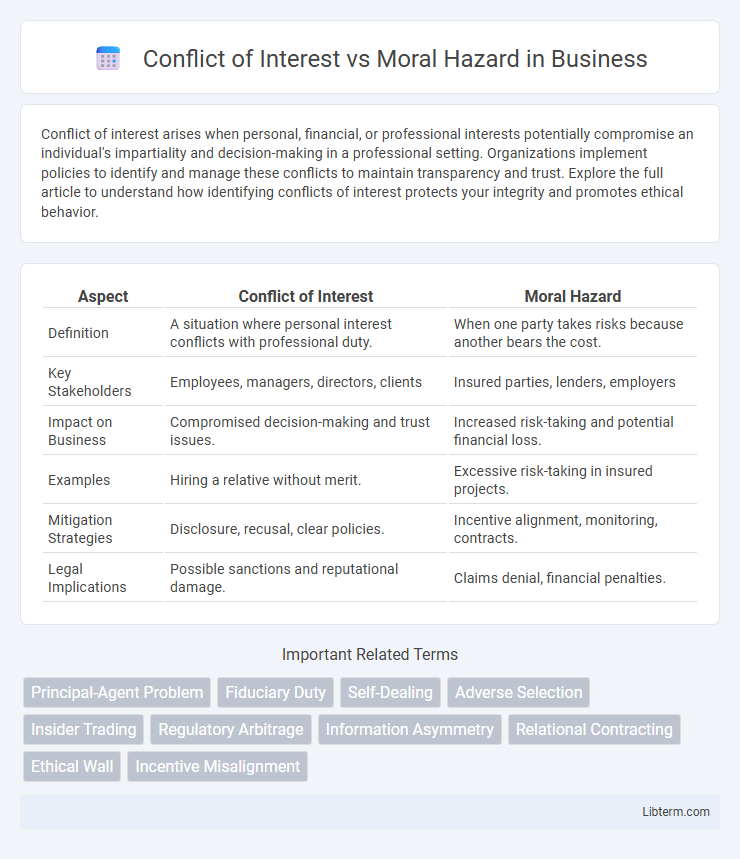

| Aspect | Conflict of Interest | Moral Hazard |

|---|---|---|

| Definition | A situation where personal interest conflicts with professional duty. | When one party takes risks because another bears the cost. |

| Key Stakeholders | Employees, managers, directors, clients | Insured parties, lenders, employers |

| Impact on Business | Compromised decision-making and trust issues. | Increased risk-taking and potential financial loss. |

| Examples | Hiring a relative without merit. | Excessive risk-taking in insured projects. |

| Mitigation Strategies | Disclosure, recusal, clear policies. | Incentive alignment, monitoring, contracts. |

| Legal Implications | Possible sanctions and reputational damage. | Claims denial, financial penalties. |

Defining Conflict of Interest

A conflict of interest arises when an individual's personal interests interfere with their professional duties, potentially compromising objectivity and decision-making. This scenario often leads to biased actions that favor personal gain over organizational or public welfare. Understanding conflict of interest is crucial for maintaining ethical standards and ensuring transparent governance in corporate, legal, and financial environments.

Understanding Moral Hazard

Moral hazard arises when one party takes excessive risks because they do not bear the full consequences of their actions, often due to asymmetric information or insurance coverage. Unlike conflicts of interest, which involve competing incentives between parties, moral hazard specifically concerns behavior changes after a transaction or agreement is in place. Understanding moral hazard is essential in finance and insurance to design contracts that align incentives and reduce risky behavior.

Key Differences Between Conflict of Interest and Moral Hazard

Conflict of interest occurs when an individual or organization has competing interests that could potentially influence their decision-making, while moral hazard refers to a situation where one party takes undue risks because they do not bear the full consequences of their actions. Conflict of interest typically involves conflicting personal or financial interests affecting objectivity, whereas moral hazard arises from asymmetric information and risk-sharing dynamics, often seen in insurance or financial markets. The key difference lies in conflict of interest focusing on compromised integrity due to competing motivations, while moral hazard emphasizes behavior changes driven by risk insulation.

Common Examples in Business and Finance

Conflict of interest occurs when an individual or entity has competing interests that could improperly influence their decisions, such as a corporate executive owning shares in a company that contracts with their employer. Moral hazard arises when one party takes excessive risks because they do not bear the full consequences, exemplified by banks engaging in risky lending practices knowing they might be bailed out by the government. Common examples in business include auditors providing consulting services to the same clients they audit (conflict of interest) and insurance companies facing increased claims when policyholders engage in riskier behavior after obtaining coverage (moral hazard).

Legal and Ethical Implications

Conflict of interest arises when personal interests interfere with professional duties, potentially leading to biased decision-making and legal breaches of fiduciary duty. Moral hazard involves situations where one party takes undue risks because they do not bear the full consequences, raising ethical concerns about accountability and fairness under contract law. Both concepts demand stringent legal frameworks and ethical guidelines to prevent exploitation and maintain trust in professional and financial environments.

Identifying Risks in Organizational Settings

Identifying risks in organizational settings requires distinguishing between conflict of interest, where personal interests may improperly influence professional decisions, and moral hazard, which arises when individuals take undue risks because they do not bear the full consequences. Effective risk management involves rigorous oversight mechanisms to detect conflicts of interest, such as undisclosed financial ties or biased decision-making processes, and mitigating moral hazard by aligning incentives with organizational goals and ensuring accountability. Robust policies, transparency, and continuous monitoring are essential to prevent these risks from undermining organizational integrity and performance.

Strategies to Mitigate Conflict of Interest

Implementing transparent disclosure policies and regular audits effectively mitigate conflicts of interest by ensuring accountability and preventing biased decision-making. Establishing clear organizational codes of conduct and strict compliance frameworks promotes ethical behavior and aligns employee incentives with company objectives. Creating independent review committees and separating decision-making authorities minimizes undue influence and fosters objective evaluations.

Approaches to Prevent Moral Hazard

Preventing moral hazard involves implementing strict monitoring mechanisms and aligning incentives through performance-based contracts to ensure individuals act in the principal's best interest. Insurance companies use deductible clauses and copayments to reduce risk-taking behavior by policyholders. Regulatory frameworks and transparent reporting further mitigate moral hazard by increasing accountability and discouraging opportunistic actions.

The Role of Transparency and Accountability

Transparency in conflict of interest situations ensures stakeholders are aware of potential biases influencing decisions, while accountability mechanisms enforce adherence to ethical standards and reduce misconduct. In cases of moral hazard, transparent disclosure of risks and behaviors aligns incentives, preventing reckless actions borne from insulated consequences. Effective governance frameworks combining transparency and accountability significantly mitigate risks associated with both conflicts of interest and moral hazards.

Best Practices for Governance and Compliance

Effective governance and compliance frameworks address Conflict of Interest by implementing transparent disclosure policies and rigorous oversight mechanisms to ensure decision-making integrity. Managing Moral Hazard requires aligning incentives with risk management through performance-based controls and accountability measures that discourage reckless behavior. Combining clear ethical guidelines with continuous monitoring promotes a culture of responsibility and reduces potential regulatory violations.

Conflict of Interest Infographic

libterm.com

libterm.com