Modified accrual accounting combines elements of both cash and accrual accounting to provide a more accurate financial picture for governments and nonprofit organizations. It recognizes revenues when they become measurable and available while recording expenditures when liabilities are incurred. Explore the rest of this article to understand how modified accrual accounting can impact your financial reporting and management.

Table of Comparison

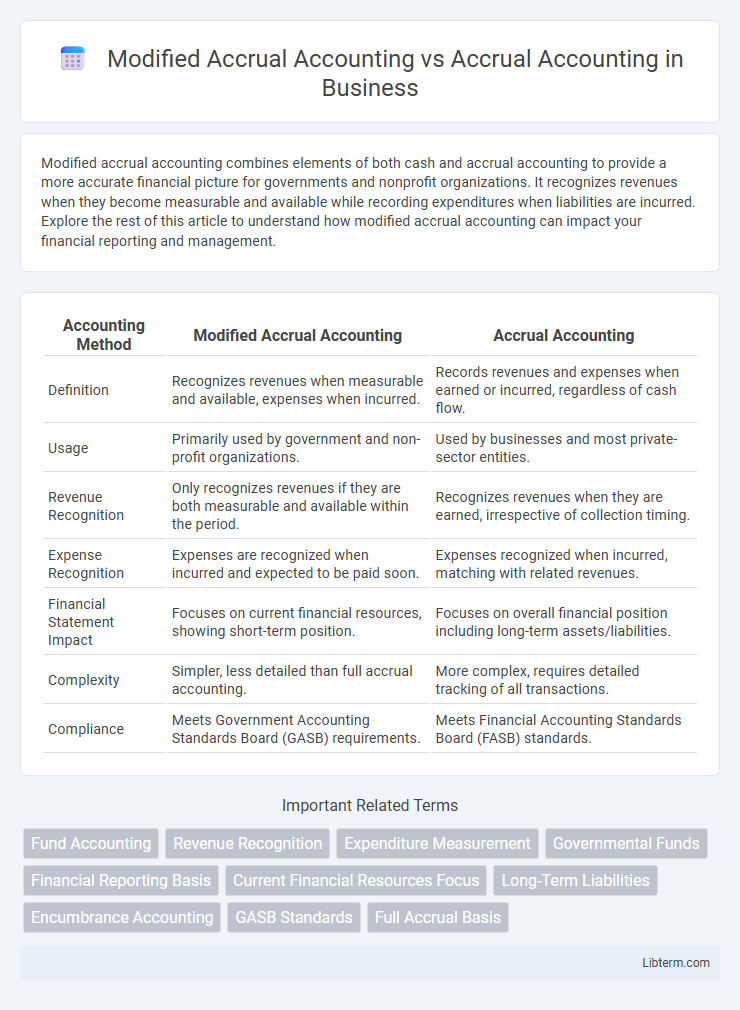

| Accounting Method | Modified Accrual Accounting | Accrual Accounting |

|---|---|---|

| Definition | Recognizes revenues when measurable and available, expenses when incurred. | Records revenues and expenses when earned or incurred, regardless of cash flow. |

| Usage | Primarily used by government and non-profit organizations. | Used by businesses and most private-sector entities. |

| Revenue Recognition | Only recognizes revenues if they are both measurable and available within the period. | Recognizes revenues when they are earned, irrespective of collection timing. |

| Expense Recognition | Expenses are recognized when incurred and expected to be paid soon. | Expenses recognized when incurred, matching with related revenues. |

| Financial Statement Impact | Focuses on current financial resources, showing short-term position. | Focuses on overall financial position including long-term assets/liabilities. |

| Complexity | Simpler, less detailed than full accrual accounting. | More complex, requires detailed tracking of all transactions. |

| Compliance | Meets Government Accounting Standards Board (GASB) requirements. | Meets Financial Accounting Standards Board (FASB) standards. |

Introduction to Accounting Methods

Modified accrual accounting blends cash basis and accrual methods by recognizing revenues when they become available and measurable and expenses when incurred, primarily used by government entities to match financial resources with the fiscal period. Accrual accounting records revenues when earned and expenses when incurred, regardless of cash flow timing, providing a comprehensive view of financial performance favored by businesses for accurate profit measurement. Understanding these accounting methods is essential for selecting appropriate financial reporting frameworks that align with organizational goals and regulatory requirements.

Overview of Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, providing a more accurate financial picture for businesses and organizations. This method aligns with Generally Accepted Accounting Principles (GAAP) and supports comprehensive financial analysis through recognition of accounts receivable and accounts payable. It contrasts with modified accrual accounting, which blends cash and accrual methods primarily used by government entities to track fiscal accountability within budget constraints.

What Is Modified Accrual Accounting?

Modified accrual accounting combines elements of both cash basis and accrual accounting, recognizing revenues when they become available and measurable, and expenditures when the related liability is incurred. This method is primarily used by government entities to provide a more accurate picture of financial resources while maintaining budgetary compliance. Unlike full accrual accounting, it does not record long-term assets and liabilities, focusing instead on current financial resources and obligations.

Key Differences Between Accrual and Modified Accrual

Accrual accounting recognizes revenues when earned and expenses when incurred, regardless of cash flow, providing a complete financial picture ideal for businesses. Modified accrual accounting, predominantly used in government finance, recognizes revenues when they become available and measurable, while expenses are recorded when incurred, focusing on short-term budgetary control. Key differences include revenue recognition timing and expense recording, with accrual offering a comprehensive long-term view and modified accrual emphasizing current financial resources and fiscal accountability.

Core Principles of Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, ensuring a more accurate reflection of an entity's financial position and performance. Modified accrual accounting, commonly used by government entities, blends accrual and cash basis principles by recognizing revenues when they are both measurable and available, and expenses when incurred, but often excludes long-term assets and liabilities. The core principle of accrual accounting is the matching of revenues with related expenses within the same period to provide a comprehensive understanding of financial results.

Principles and Features of Modified Accrual Accounting

Modified Accrual Accounting combines elements of both cash and accrual accounting by recognizing revenues when they become both measurable and available, while expenses are recorded when the related liabilities are incurred. This method is primarily used by government funds to ensure budgetary compliance and fund accountability, emphasizing the flow of current financial resources rather than long-term assets and liabilities. Key features include the focus on short-term financial resources, deferred inflows and outflows, and the exclusion of non-current assets and liabilities from the operating statements.

Benefits of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recognizing revenues and expenses when they are incurred, rather than when cash is exchanged. This method improves financial reporting and decision-making by matching income with related expenses, enhancing the ability to track profitability and financial health over time. Entities using accrual accounting benefit from better compliance with accounting standards such as GAAP, facilitating transparent and consistent financial statements for stakeholders.

Advantages of Modified Accrual Accounting

Modified accrual accounting offers enhanced budgetary control by integrating elements of cash and accrual accounting, allowing governments to recognize revenues when they become both measurable and available, improving the alignment of financial reporting with fiscal accountability requirements. This approach facilitates better short-term financial planning by emphasizing current financial resources, making it easier for public entities to manage spending within budgetary constraints. Modified accrual accounting also simplifies the tracking of restricted funds and compliance with legal mandates, providing clearer insight into resources designated for specific purposes compared to full accrual accounting.

Use Cases in Public vs Private Sector

Modified accrual accounting is predominantly used in the public sector to combine cash flow tracking with accrual-based recognition of revenues and expenditures, enhancing budgetary control and fiscal accountability in government entities. In contrast, accrual accounting is standard in the private sector, providing a comprehensive view of financial performance by recording revenues when earned and expenses when incurred, regardless of cash flow. Public sector organizations prioritize modified accrual for managing fund accounting and legal compliance, whereas private sector companies emphasize accrual accounting for accurate profit measurement and investor reporting.

Which Method Is Right for Your Organization?

Choosing between Modified Accrual Accounting and Accrual Accounting depends on your organization's financial reporting needs and compliance requirements. Modified Accrual Accounting, commonly used by government entities, recognizes revenues when they become measurable and available and expenditures when liabilities are incurred, ideal for budgets emphasizing fund balance control. Accrual Accounting, preferred by private businesses, records revenues and expenses when earned or incurred, providing a complete picture of financial performance and position suitable for stakeholders requiring detailed financial analysis.

Modified Accrual Accounting Infographic

libterm.com

libterm.com