The perfect storm occurs when multiple adverse weather conditions combine to create an exceptionally intense and destructive event. Understanding factors like high winds, heavy rainfall, and storm surges can help you better prepare for such emergencies. Discover more about the causes, impacts, and safety tips in the rest of the article.

Table of Comparison

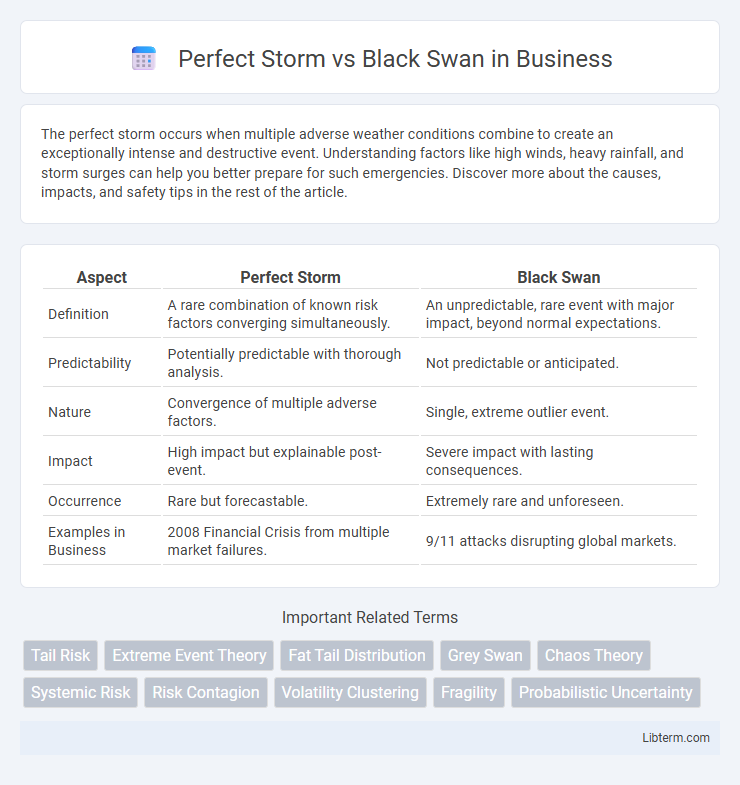

| Aspect | Perfect Storm | Black Swan |

|---|---|---|

| Definition | A rare combination of known risk factors converging simultaneously. | An unpredictable, rare event with major impact, beyond normal expectations. |

| Predictability | Potentially predictable with thorough analysis. | Not predictable or anticipated. |

| Nature | Convergence of multiple adverse factors. | Single, extreme outlier event. |

| Impact | High impact but explainable post-event. | Severe impact with lasting consequences. |

| Occurrence | Rare but forecastable. | Extremely rare and unforeseen. |

| Examples in Business | 2008 Financial Crisis from multiple market failures. | 9/11 attacks disrupting global markets. |

Understanding the "Perfect Storm" Phenomenon

A "Perfect Storm" occurs when multiple rare and severe events converge simultaneously, amplifying overall impact far beyond individual effects. This phenomenon often involves predictable factors aligning unusually, such as adverse weather, infrastructural vulnerabilities, and human errors, creating catastrophic outcomes in fields like meteorology, finance, and disaster management. Understanding the dynamics behind perfect storms helps enhance risk assessment models and disaster preparedness strategies by identifying potential event convergences.

Defining the "Black Swan" Event

A Black Swan event is characterized by its extreme rarity, severe impact, and the widespread insistence it was obvious in hindsight, as defined by Nassim Nicholas Taleb. Unlike a Perfect Storm, which results from the convergence of multiple known factors, a Black Swan is unpredictable and beyond regular expectations. These events challenge conventional risk assessment by introducing unforeseen disruptions with profound consequences.

Key Characteristics: Perfect Storm vs Black Swan

A Perfect Storm occurs when multiple predictable factors converge simultaneously, creating an extreme event with high impact and some level of anticipation, such as natural disasters or financial crises caused by several known risks combining. In contrast, a Black Swan event is characterized by extreme rarity, severe impact, and widespread surprise due to its unpredictability, often emerging from unforeseen circumstances or novel disruptions in markets or technology. Key distinctions lie in predictability and frequency: Perfect Storms arise from recognized risks intersecting, while Black Swans represent unknown unknowns, making them virtually impossible to foresee or prepare for.

Historical Examples of Perfect Storms

Historic Perfect Storms demonstrate the convergence of multiple extreme factors amplifying disaster impacts, such as the 1991 "Perfect Storm" off the New England coast, where a nor'easter merged with a tropical cyclone and cold front, resulting in massive waves and significant maritime damage. Another example includes the North Sea Flood of 1953, when a severe storm surge coincided with a high tide, leading to catastrophic flooding and thousands of fatalities in the Netherlands, the UK, and Belgium. These events highlight how interconnected weather systems and timing create compounded effects characteristic of Perfect Storm scenarios.

Notable Black Swan Events in History

Notable Black Swan events in history include the 2008 Global Financial Crisis, which triggered a severe worldwide economic downturn, and the September 11, 2001 terrorist attacks that profoundly altered global security policies. The COVID-19 pandemic of 2020 also stands as a key Black Swan event, drastically impacting public health systems and economies globally. These events are characterized by their extreme rarity, severe impact, and the widespread surprise they caused, distinguishing them from perfect storms, which involve a convergence of several predictable factors.

Causality and Predictability: A Comparative Analysis

The Perfect Storm arises from a convergence of multiple known risk factors, making its causality more deterministic and predictable through scenario analysis and risk modeling. In contrast, a Black Swan event is characterized by its extreme rarity, unpredictability, and unforeseeable causes that lie outside the realm of regular expectations. While Perfect Storms can be anticipated by analyzing intersecting risk variables, Black Swans evade prediction due to their novel and unprecedented nature.

Impact and Consequences on Global Systems

The Perfect Storm combines multiple predictable factors converging to create a significant crisis, causing widespread disruption across global economic systems, supply chains, and political stability. Black Swan events are rare, unpredictable, and have severe consequences that can trigger cascading failures in financial markets, international trade, and critical infrastructure. Both phenomena expose vulnerabilities in global systems but differ in their predictability, where Perfect Storms allow for some preparedness, whereas Black Swans often leave entities scrambling for crisis management and systemic resilience.

Risk Management Strategies for Both Events

Risk management strategies for a Perfect Storm involve comprehensive scenario planning and layered defenses to anticipate simultaneous risk factors across multiple domains. In contrast, Black Swan risk management emphasizes flexibility, robust stress testing, and maintaining high levels of liquidity to withstand rare, unpredictable events. Both approaches prioritize adaptive frameworks, but Perfect Storm strategies focus on convergence of known risks, while Black Swan requires preparedness for unknown, high-impact disruptions.

Lessons Learned: Mitigation and Preparedness

The Perfect Storm highlights the importance of integrating multiple risk factors into comprehensive disaster preparedness plans, emphasizing coordinated response efforts to mitigate compounded crises. Black Swan events stress the necessity of building adaptive, flexible strategies that accommodate unforeseen, high-impact disruptions in risk management frameworks. Lessons learned underscore investing in robust monitoring systems and fostering organizational agility to enhance resilience against both predictable and unpredictable catastrophic events.

Future Outlook: Navigating Uncertainty in a Complex World

Perfect Storm scenarios arise from the convergence of multiple predictable risk factors amplifying impact, whereas Black Swan events are rare, unforeseen occurrences with massive consequences. Future outlooks demand robust risk management frameworks that emphasize adaptive strategies, scenario planning, and resilience building to navigate these uncertainties effectively. Leveraging advanced data analytics and AI can enhance early detection of emerging threats, shifting decision-making from reactive to proactive in complex environments.

Perfect Storm Infographic

libterm.com

libterm.com