A merger combines two companies into a single entity to enhance market share, reduce costs, and increase competitive advantage. This strategic move can unlock new growth opportunities and streamline operations for improved efficiency. Explore the full article to understand how mergers impact your business and what to consider before proceeding.

Table of Comparison

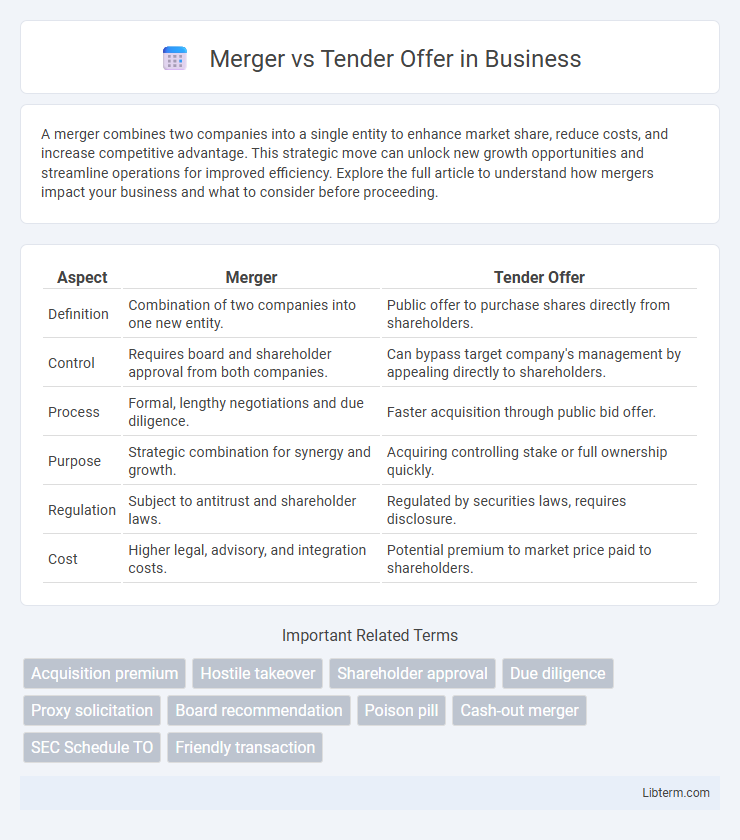

| Aspect | Merger | Tender Offer |

|---|---|---|

| Definition | Combination of two companies into one new entity. | Public offer to purchase shares directly from shareholders. |

| Control | Requires board and shareholder approval from both companies. | Can bypass target company's management by appealing directly to shareholders. |

| Process | Formal, lengthy negotiations and due diligence. | Faster acquisition through public bid offer. |

| Purpose | Strategic combination for synergy and growth. | Acquiring controlling stake or full ownership quickly. |

| Regulation | Subject to antitrust and shareholder laws. | Regulated by securities laws, requires disclosure. |

| Cost | Higher legal, advisory, and integration costs. | Potential premium to market price paid to shareholders. |

Understanding Mergers and Tender Offers

Mergers involve the consolidation of two companies into a single legal entity, often aimed at achieving synergies and expanding market share. Tender offers occur when one company proposes to purchase shares directly from shareholders at a premium, bypassing management approval to gain control. Both strategies play crucial roles in corporate restructuring, but differ in process, regulatory requirements, and stakeholder involvement.

Key Differences Between Mergers and Tender Offers

Mergers involve the combination of two companies into a single entity through mutual agreement, typically requiring approval from both companies' boards and shareholders, resulting in a consolidated operation and shared ownership. Tender offers are public bids made by one company to purchase shares directly from shareholders of another company, often bypassing the target company's management and aiming for immediate control without full integration. Key differences include the negotiation process, with mergers emphasizing collaborative approval and tender offers focusing on acquiring control via open market transactions, and the regulatory scrutiny, which varies based on deal structure and shareholder involvement.

Legal Framework Governing Mergers and Tender Offers

The legal framework governing mergers involves comprehensive statutory provisions under corporate and securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934, as well as state-level regulations like Delaware General Corporation Law. Tender offers are regulated primarily by the Williams Act, which mandates disclosure requirements and stipulates procedural rules to protect shareholders during acquisition attempts. Both frameworks emphasize fairness, transparency, and shareholder rights but differ in procedural complexity, timelines, and regulatory oversight.

Advantages of Mergers

Mergers offer significant advantages such as enhanced operational synergies, cost efficiencies, and expanded market share, fostering long-term growth and competitive positioning. They provide smoother integration of corporate cultures and assets compared to tender offers, reducing the risk of hostile takeovers and shareholder resistance. Additionally, mergers often facilitate better access to new technologies and resources, optimizing overall business value and stakeholder returns.

Advantages of Tender Offers

Tender offers provide shareholders direct access to a premium purchase price, often exceeding market value, which can accelerate liquidity and maximize returns. They enable acquirers to bypass lengthy regulatory approvals and shareholder negotiations typical in mergers, resulting in faster transaction completion. Tender offers also allow partial acquisition of target companies, offering strategic flexibility without the need for full integration.

Disadvantages and Risks of Mergers

Mergers pose significant disadvantages including complex integration processes that can lead to cultural clashes and loss of key employees, impacting operational efficiency. Financial risks are heightened due to potential overvaluation, hidden liabilities, and massive restructuring costs. Regulatory scrutiny and lengthy approval timelines further increase uncertainty, potentially stalling business growth and destabilizing stakeholder confidence.

Disadvantages and Risks of Tender Offers

Tender offers pose significant risks including hostile takeovers, which can destabilize company management and culture. Shareholders may face pressure to sell their stocks at a premium that might not reflect long-term company value, leading to potential financial losses. Regulatory scrutiny and legal challenges increase the complexity and cost of tender offers compared to mergers.

Impact on Shareholders: Mergers vs Tender Offers

Mergers typically result in shareholders receiving cash, new shares, or a combination based on negotiated terms, often leading to a more streamlined integration and potential long-term value creation. Tender offers provide shareholders the opportunity to sell their shares directly to the acquiring company at a premium, allowing for immediate liquidity but possibly creating uncertainty about the company's future. Shareholder impact varies as mergers may dilute or consolidate ownership while tender offers can shift control swiftly depending on acceptance rates.

Case Studies: Successful Mergers and Tender Offers

The landmark merger of Disney and Pixar in 2006 showcases a successful merger that leveraged complementary strengths to dominate the animation industry, boosting Disney's market value significantly. In contrast, the tender offer by Carl Icahn for Yahoo! in 2008 demonstrated how aggressive tender bids can pressure target companies to unlock shareholder value, resulting in a lucrative buyout for investors. These cases highlight strategic differences where mergers emphasize integration and synergy, while tender offers focus on direct shareholder appeal to achieve control.

Choosing the Right Strategy: Factors to Consider

Selecting between a merger and a tender offer involves evaluating control objectives, cost implications, and stakeholder reactions; mergers typically require board approval and may provide smoother integration, while tender offers can expedite acquisition by directly appealing to shareholders. Legal and regulatory considerations, such as antitrust laws and disclosure requirements, significantly influence the strategic choice, with tender offers often invoking stricter scrutiny. Market conditions, target company valuation, and desired timeline also play critical roles in determining the most effective approach for achieving acquisition goals.

Merger Infographic

libterm.com

libterm.com