An Initial Public Offering (IPO) marks the first time a company offers its shares to the public, providing an opportunity to raise significant capital and increase market visibility. This crucial financial event involves careful preparation, regulatory compliance, and strategic pricing to attract investors while balancing company valuation. Discover how an IPO can transform your business and what steps you need to take by reading the rest of this article.

Table of Comparison

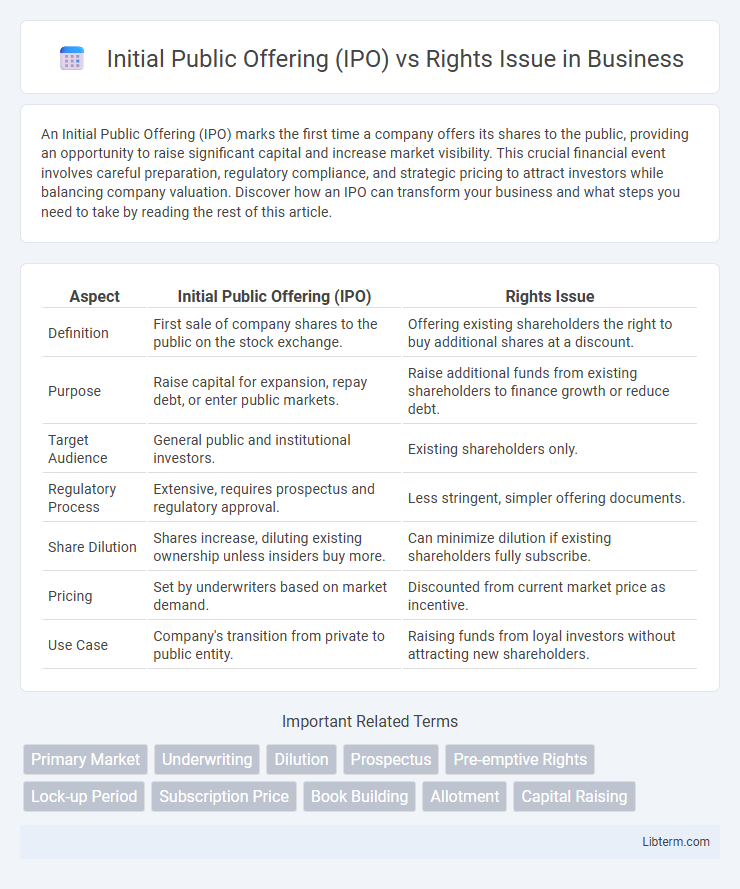

| Aspect | Initial Public Offering (IPO) | Rights Issue |

|---|---|---|

| Definition | First sale of company shares to the public on the stock exchange. | Offering existing shareholders the right to buy additional shares at a discount. |

| Purpose | Raise capital for expansion, repay debt, or enter public markets. | Raise additional funds from existing shareholders to finance growth or reduce debt. |

| Target Audience | General public and institutional investors. | Existing shareholders only. |

| Regulatory Process | Extensive, requires prospectus and regulatory approval. | Less stringent, simpler offering documents. |

| Share Dilution | Shares increase, diluting existing ownership unless insiders buy more. | Can minimize dilution if existing shareholders fully subscribe. |

| Pricing | Set by underwriters based on market demand. | Discounted from current market price as incentive. |

| Use Case | Company's transition from private to public entity. | Raising funds from loyal investors without attracting new shareholders. |

Introduction to IPOs and Rights Issues

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, enabling capital raising and expanding shareholder base. A Rights Issue allows existing shareholders to purchase additional shares at a discounted price, maintaining their proportional ownership while providing the company with fresh equity capital. Both methods serve as vital fundraising strategies but differ in market exposure, pricing mechanisms, and shareholder participation.

Definition and Key Features of IPO

An Initial Public Offering (IPO) is the first sale of a company's shares to the public, allowing it to raise capital from external investors by listing on a stock exchange. Key features of IPOs include issuing new shares to raise equity, extensive regulatory scrutiny, and wide market participation by individual and institutional investors. In contrast, a Rights Issue involves offering existing shareholders the option to purchase additional shares at a discount, focusing on equity dilution control without public listing.

Definition and Key Features of Rights Issue

A Rights Issue is a method by which a company raises additional capital by offering existing shareholders the opportunity to purchase new shares at a discounted price, typically in proportion to their current holdings. Unlike an Initial Public Offering (IPO), which introduces shares to the public for the first time, a Rights Issue allows companies to raise funds without diluting existing ownership significantly. Key features of a Rights Issue include the preemptive right for current shareholders, a fixed subscription period, and usually a lower issue price compared to the market value.

Purpose and Objectives of IPO vs Rights Issue

Initial Public Offerings (IPOs) primarily aim to raise capital from the public to fund expansion, debt repayment, or other corporate purposes while increasing market visibility and shareholder base. Rights Issues focus on raising additional capital from existing shareholders to maintain control and equity proportions without diluting ownership. IPOs target new investors for broader market participation, whereas Rights Issues provide a capital-raising opportunity exclusively to current shareholders.

Process of IPO: Step-by-Step Overview

The process of an Initial Public Offering (IPO) begins with selecting underwriters to help determine the offering price and number of shares. Following regulatory filings and due diligence, the company conducts a roadshow to attract potential investors before finalizing the pricing and allocation of shares. The shares are then officially listed on a stock exchange, enabling public trading and capital raising.

Process of Rights Issue: Step-by-Step Overview

A Rights Issue process begins with the board of directors approving the offer, followed by setting the issuance price and record date to identify eligible shareholders. Shareholders receive rights entitling them to buy additional shares proportionate to their holdings, typically exercised within a specified subscription period. Unsold shares after the subscription window may be offered to other investors or underwriters, completing the capital-raising cycle while maintaining shareholder equity proportions.

Advantages and Disadvantages of IPO

An Initial Public Offering (IPO) allows companies to raise substantial capital by selling shares to the public, enhancing liquidity and increasing market visibility. However, IPOs incur high underwriting fees, regulatory compliance costs, and expose the company to market volatility and shareholder scrutiny. Compared to a Rights Issue, IPOs offer broader investor access but involve greater complexity and potential dilution of control.

Benefits and Limitations of Rights Issue

A Rights Issue allows existing shareholders to purchase additional shares at a discounted price, providing companies with a faster and cost-effective way to raise capital without diluting existing ownership significantly. Benefits include maintaining shareholder control and improving financial flexibility, while limitations involve potential undervaluation, reduced market liquidity, and the risk of shareholder dilution if rights are not fully exercised. Compared to an Initial Public Offering (IPO), a Rights Issue avoids the extensive regulatory process and underwriting fees but may attract less new investor interest, limiting overall fundraising potential.

Key Differences Between IPO and Rights Issue

An Initial Public Offering (IPO) is the first sale of a company's shares to public investors, allowing broader market participation and raising fresh capital. In contrast, a Rights Issue offers existing shareholders the opportunity to purchase additional shares at a discounted price, maintaining ownership proportions without attracting new investors. IPOs tend to expand the shareholder base and improve market liquidity, while Rights Issues focus on capital infusion without diluting current shareholder control.

Choosing Between IPO and Rights Issue: Strategic Considerations

Choosing between an Initial Public Offering (IPO) and a Rights Issue involves strategic considerations such as capital needs, shareholder base expansion, and market conditions. IPOs provide access to new investors and enhanced public visibility but require rigorous regulatory compliance and higher costs. Rights Issues allow existing shareholders to maintain their ownership proportion while raising capital more quickly and cost-effectively, making them ideal for companies seeking to strengthen relationships with current investors.

Initial Public Offering (IPO) Infographic

libterm.com

libterm.com