Diagonal integration enhances efficiency by combining functions from different stages and departments within a company, leading to streamlined operations and cost savings. It fosters innovation and better control over the supply chain, giving Your business a competitive edge. Explore the rest of the article to understand how diagonal integration can transform your organizational strategy.

Table of Comparison

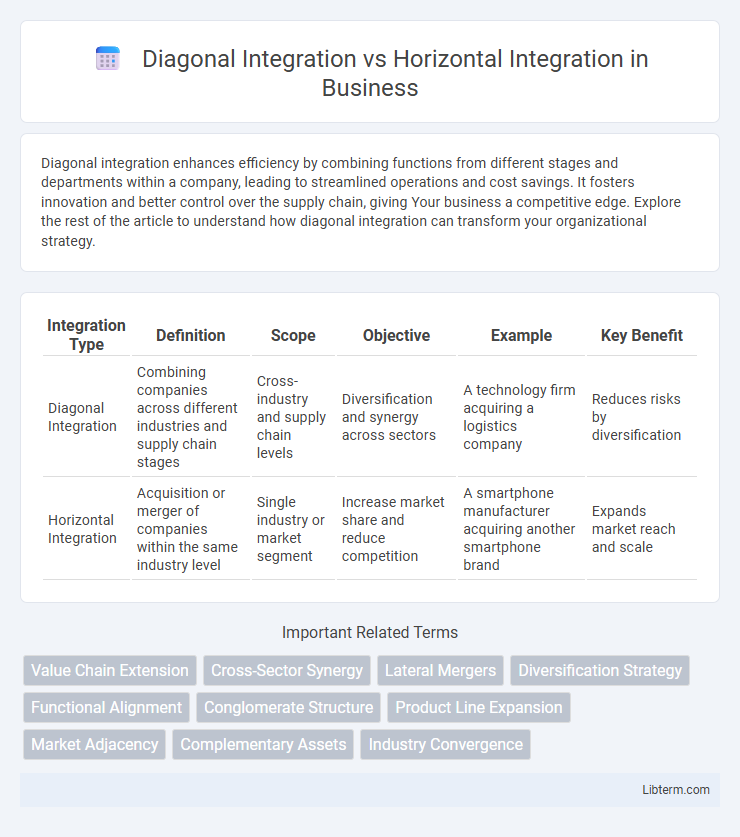

| Integration Type | Definition | Scope | Objective | Example | Key Benefit |

|---|---|---|---|---|---|

| Diagonal Integration | Combining companies across different industries and supply chain stages | Cross-industry and supply chain levels | Diversification and synergy across sectors | A technology firm acquiring a logistics company | Reduces risks by diversification |

| Horizontal Integration | Acquisition or merger of companies within the same industry level | Single industry or market segment | Increase market share and reduce competition | A smartphone manufacturer acquiring another smartphone brand | Expands market reach and scale |

Introduction to Business Integration Strategies

Diagonal integration combines companies at different stages of production or distribution channels, enhancing efficiency and control across diverse business functions. Horizontal integration involves merging or acquiring firms within the same industry level, increasing market share and reducing competition. Both strategies aim to strengthen competitive advantage by optimizing resources and expanding business operations.

Defining Diagonal Integration

Diagonal integration refers to a business strategy where a company expands by acquiring or merging with firms operating at different levels of the supply chain that are neither strictly suppliers nor direct competitors. This form of integration allows companies to diversify their operations and enhance control over various stages of production or distribution without the direct overlap seen in horizontal integration. Unlike horizontal integration, which focuses on increasing market share by consolidating similar businesses, diagonal integration targets complementary or ancillary sectors to improve efficiency and innovation.

Understanding Horizontal Integration

Horizontal integration involves a company acquiring or merging with competitors operating at the same level of the supply chain to increase market share and reduce competition. This strategy enhances economies of scale, expands customer base, and strengthens bargaining power within the industry. In contrast, diagonal integration combines activities across different sectors or functions, aiming to diversify operations and manage complementary resources.

Key Benefits of Diagonal Integration

Diagonal integration enables businesses to diversify across different stages of production and distribution, enhancing operational flexibility and reducing dependency on a single supply chain segment. This strategic approach fosters innovation by combining distinct industry capabilities, leading to new product development and expanded market reach. Companies implementing diagonal integration benefit from increased control over quality and cost efficiency, driving competitive advantage in complex markets.

Advantages of Horizontal Integration

Horizontal integration enhances market share by consolidating companies operating at the same stage of the production process, leading to increased economies of scale and cost efficiencies. It facilitates greater market power, enabling firms to influence pricing and reduce competition within the industry. By expanding product lines and customer bases, horizontal integration strengthens brand presence and provides access to new markets, boosting overall revenue potential.

Challenges and Risks of Diagonal Integration

Diagonal integration poses challenges such as complex management due to varied business functions across different industries, leading to difficulties in achieving operational synergies and coordinating corporate strategy. The risk of diluting core competencies and brand identity is significant, as resources and attention are spread across unrelated sectors, potentially weakening competitive advantage. Financial strain can arise from higher investment requirements and unforeseen market dynamics, increasing the vulnerability to failures in areas outside a firm's expertise.

Potential Drawbacks of Horizontal Integration

Horizontal integration often leads to reduced competition, making marketplaces less dynamic and limiting consumer choices. The increased market share can trigger regulatory scrutiny and antitrust issues, potentially resulting in legal challenges and fines. Additionally, overextension across similar businesses may cause inefficiencies and difficulties in management coordination.

Real-World Examples: Diagonal vs Horizontal Integration

Diagonal integration involves a company expanding into a different stage of the production or distribution process, such as a smartphone manufacturer acquiring a retail chain to control both production and sales, like Apple owning its retail stores. Horizontal integration occurs when a firm acquires or merges with competitors operating at the same production level, exemplified by Facebook acquiring Instagram to increase market share in social media platforms. Real-world examples highlight that diagonal integration enhances control over supply chains, whereas horizontal integration primarily aims to reduce competition and increase market dominance.

Strategic Considerations for Choosing Integration Models

Diagonal integration strategically combines firms from different industries, enabling diversification and innovation by leveraging complementary capabilities and market positions. Horizontal integration focuses on acquiring or merging with competitors within the same industry to achieve economies of scale, increase market share, and reduce competition. Companies choose diagonal integration to enter new markets and enhance product offerings, whereas they opt for horizontal integration to consolidate industry power and improve operational efficiency.

Conclusion: Which Integration Approach is Best?

Diagonal integration offers a strategic advantage by combining different stages of the value chain, enhancing efficiency, and fostering innovation across diverse business functions. Horizontal integration expands market share by acquiring or merging with competitors, driving economies of scale and reducing competition. The best integration approach depends on a company's goals: diagonal integration excels in operational synergy and product development, while horizontal integration is superior for market dominance and cost reduction.

Diagonal Integration Infographic

libterm.com

libterm.com