Market value represents the current price at which an asset can be bought or sold in the open market, reflecting supply and demand dynamics. Understanding market value is crucial for making informed investment decisions and evaluating the true worth of properties, stocks, or goods. Explore the rest of this article to learn how market value impacts your financial strategies and asset management.

Table of Comparison

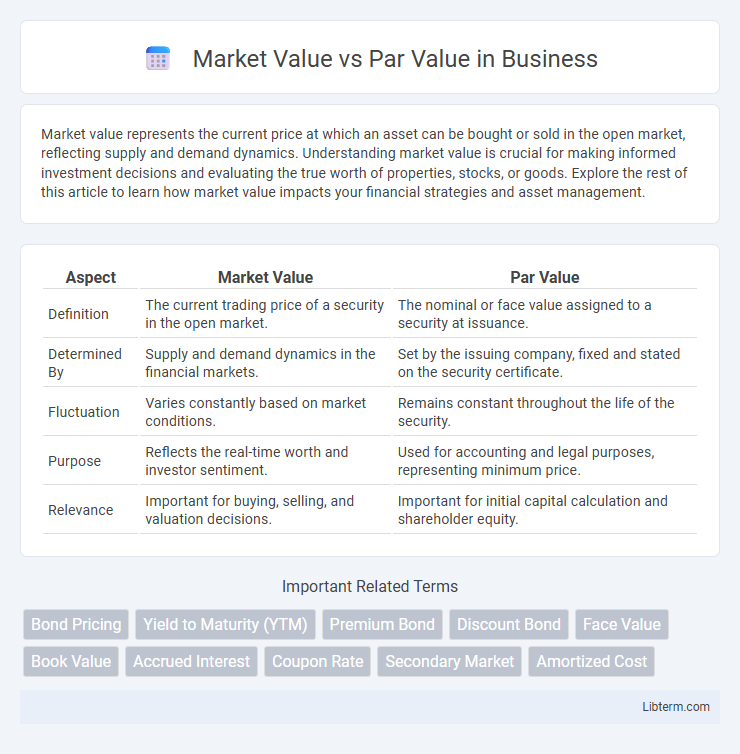

| Aspect | Market Value | Par Value |

|---|---|---|

| Definition | The current trading price of a security in the open market. | The nominal or face value assigned to a security at issuance. |

| Determined By | Supply and demand dynamics in the financial markets. | Set by the issuing company, fixed and stated on the security certificate. |

| Fluctuation | Varies constantly based on market conditions. | Remains constant throughout the life of the security. |

| Purpose | Reflects the real-time worth and investor sentiment. | Used for accounting and legal purposes, representing minimum price. |

| Relevance | Important for buying, selling, and valuation decisions. | Important for initial capital calculation and shareholder equity. |

Introduction to Market Value and Par Value

Market value represents the current price at which an asset or security can be bought or sold in the open market, reflecting real-time supply and demand dynamics. Par value, also known as face value, is the nominal value assigned to a security by the issuer, often used for accounting or legal purposes rather than market transactions. Understanding the distinction between market value and par value is crucial for investors when evaluating financial instruments and making informed decisions.

Definitions: Market Value vs Par Value

Market value refers to the current price at which an asset or security can be bought or sold in the open market, influenced by supply, demand, and investor perception. Par value is the nominal or face value assigned to a security by the issuing company, typically representing the minimum price at which shares can be issued. While par value is a fixed accounting value, market value fluctuates constantly based on market conditions and company performance.

Historical Context of Par Value

Par value originated in the 19th century as a nominal value assigned to shares, primarily serving as a legal capital floor ensuring companies did not issue stock below this minimum amount. Historically, par value held significance in protecting creditors by establishing a baseline for investor contributions during early corporate law developments. Over time, market value--determined by supply and demand on exchanges--has surpassed par value in importance for investors assessing a security's real worth.

How Market Value is Determined

Market value is determined by the forces of supply and demand in the open market, reflecting the price at which a security or asset can be bought or sold. Factors influencing market value include current financial performance, investor sentiment, economic conditions, and market trends. Unlike par value, market value fluctuates continuously based on real-time market activity and investor perceptions.

Factors Influencing Market Value

Market value of a stock is influenced by factors such as company performance, investor sentiment, industry trends, and economic conditions, which can cause significant fluctuations. Par value, typically a nominal amount set at issuance, remains fixed and does not reflect the company's current financial health or market demand. Supply and demand dynamics, earnings reports, interest rates, and geopolitical events also play critical roles in shaping the market value of securities.

The Role of Par Value in Financial Statements

Par value represents the nominal or face value assigned to a stock in a company's charter and is recorded on the balance sheet under shareholders' equity. It plays a crucial role in financial statements by establishing the legal capital requirement, ensuring that a minimum amount of capital is maintained to protect creditors. Unlike market value, which fluctuates with investor demand, par value remains constant and does not reflect the stock's trading price.

Market Value in Stock vs Bond Investments

Market value in stock investments represents the current price at which a share can be bought or sold in the market, reflecting real-time investor sentiment and company performance. In bond investments, market value fluctuates based on interest rate changes, credit risk, and time to maturity, differing from the fixed par value which is the amount paid back at maturity. Understanding market value is crucial for investors to assess potential gains or losses when trading stocks or bonds before maturity.

Practical Implications for Investors

Market value reflects the current price at which a security trades, directly influencing an investor's potential gains or losses when buying or selling stocks or bonds. Par value, often set nominally at issuance, holds minimal relevance for market transaction decisions but matters in bond repayment at maturity or regulatory capital requirements. Investors prioritize market value for portfolio valuation and trading strategies, while par value serves as a baseline for understanding issuer obligations and legal capital constraints.

Common Misconceptions about Par and Market Values

Par value is a nominal value assigned to a stock at issuance and rarely reflects its actual worth in the market, which fluctuates based on supply, demand, and company performance. A common misconception is that par value determines the price investors pay or the market value of the stock; in reality, market value is driven by investor perception and future growth potential. Unlike market value, par value primarily serves legal and accounting purposes and often holds little relevance in modern financial analysis.

Conclusion: Key Differences and Takeaways

Market value reflects the current price investors are willing to pay for a security, fluctuating based on supply, demand, and company performance, while par value is a fixed, nominal value assigned at issuance often used for legal or accounting purposes. The key difference lies in market value's dynamic nature versus par value's static, historical role. Understanding these distinctions aids investors in evaluating stock worth and making informed financial decisions.

Market Value Infographic

libterm.com

libterm.com