A line of credit is a flexible financial tool that allows you to borrow funds up to a predetermined limit and repay them as needed. It offers convenient access to cash flow for managing expenses, emergencies, or investments without applying for a new loan each time. Explore the rest of the article to discover how a line of credit can optimize your financial strategy.

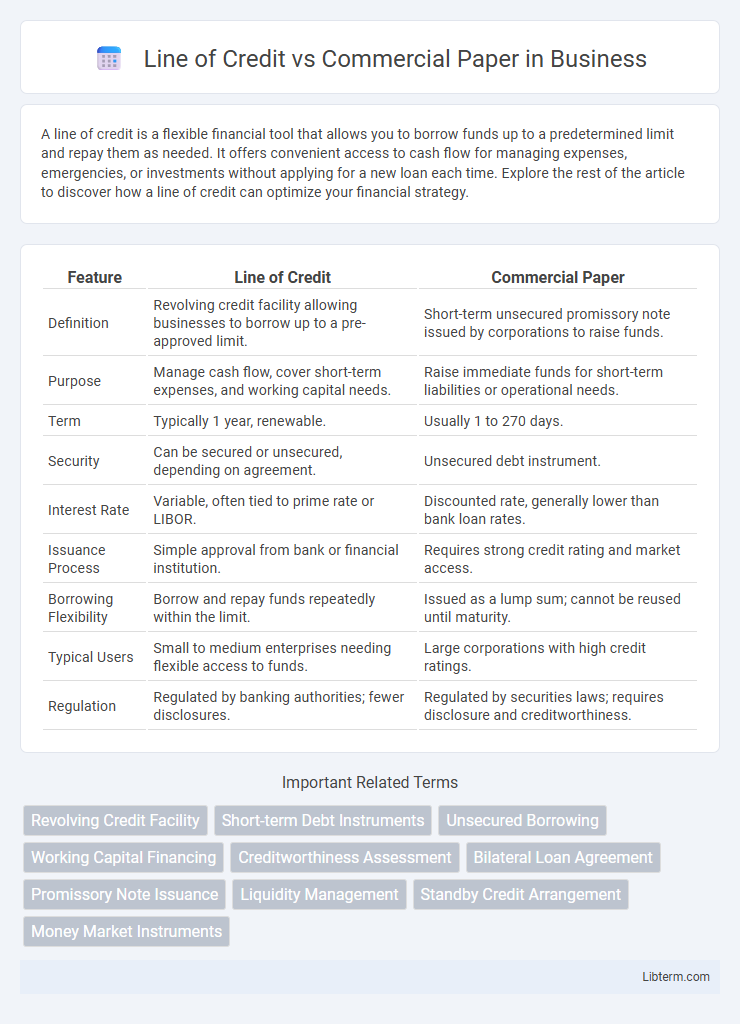

Table of Comparison

| Feature | Line of Credit | Commercial Paper |

|---|---|---|

| Definition | Revolving credit facility allowing businesses to borrow up to a pre-approved limit. | Short-term unsecured promissory note issued by corporations to raise funds. |

| Purpose | Manage cash flow, cover short-term expenses, and working capital needs. | Raise immediate funds for short-term liabilities or operational needs. |

| Term | Typically 1 year, renewable. | Usually 1 to 270 days. |

| Security | Can be secured or unsecured, depending on agreement. | Unsecured debt instrument. |

| Interest Rate | Variable, often tied to prime rate or LIBOR. | Discounted rate, generally lower than bank loan rates. |

| Issuance Process | Simple approval from bank or financial institution. | Requires strong credit rating and market access. |

| Borrowing Flexibility | Borrow and repay funds repeatedly within the limit. | Issued as a lump sum; cannot be reused until maturity. |

| Typical Users | Small to medium enterprises needing flexible access to funds. | Large corporations with high credit ratings. |

| Regulation | Regulated by banking authorities; fewer disclosures. | Regulated by securities laws; requires disclosure and creditworthiness. |

Introduction to Line of Credit and Commercial Paper

A Line of Credit (LOC) is a flexible financing arrangement provided by financial institutions allowing businesses to borrow funds up to a predetermined limit as needed, facilitating short-term liquidity management. Commercial Paper (CP) is an unsecured, short-term debt instrument issued by corporations to raise immediate working capital, typically with maturities ranging from a few days to 270 days. Both LOC and CP serve as critical tools for managing cash flow and operational expenses in corporate finance.

Definition and Key Features of Line of Credit

A Line of Credit (LOC) is a flexible financing arrangement that allows businesses to borrow up to a predetermined limit, repay, and redraw funds as needed, providing short-term liquidity for operational expenses. Key features of a Line of Credit include revolving credit availability, interest charged only on the amount borrowed, and variable repayment terms tailored to the borrower's cash flow cycle. Unlike Commercial Paper, which is a fixed-term unsecured promissory note issued at a discount for short-term funding, a LOC offers ongoing access to funds without the need for repeated issuance.

Definition and Key Features of Commercial Paper

Commercial paper is a short-term, unsecured promissory note issued by corporations to raise funds for immediate liquidity needs, typically maturing within 270 days. Key features include its negotiability, lack of collateral, discount issuance below face value, and issuance primarily by large, creditworthy firms to finance accounts receivable and inventory. Unlike lines of credit, commercial paper offers lower borrowing costs but lacks the flexibility of revolving funds and requires high credit ratings to access the market.

Eligibility Criteria for Line of Credit vs Commercial Paper

Eligibility criteria for a Line of Credit typically require businesses to demonstrate a strong credit history, steady cash flow, and often collateral or a personal guarantee to secure the borrowing limit. In contrast, Commercial Paper issuance demands high credit ratings, generally from well-established corporations with substantial creditworthiness and access to capital markets, often requiring short-term debt ratings from recognized agencies. While Lines of Credit are accessible to small and medium enterprises with bank relationships, Commercial Paper is more suited for large corporations able to meet stringent regulatory and investor confidence standards.

Application and Approval Process Comparison

A Line of Credit offers businesses flexible access to funds up to a predetermined limit, with a relatively straightforward application process that typically requires financial statements, credit history, and collateral evaluation. In contrast, Commercial Paper is a short-term unsecured promissory note issued primarily by large corporations with high credit ratings, involving a more rigorous approval process focused on creditworthiness, market conditions, and regulatory compliance. The Line of Credit approval emphasizes ongoing financial health and lender risk tolerance, while Commercial Paper issuance depends heavily on market trust and the issuer's credit rating, often requiring engagement with underwriting institutions and credit rating agencies.

Interest Rates and Costs Analysis

Line of credit interest rates typically range from 5% to 12%, depending on the borrower's creditworthiness and market conditions, offering flexible borrowing with variable costs tied to usage. Commercial paper usually carries lower interest rates, often between 1% and 4%, reflecting its short-term, unsecured nature and reliance on the issuer's credit rating. While lines of credit involve ongoing fees and variable interest, commercial paper requires issuance costs but can provide cheaper short-term financing for corporations with strong credit profiles.

Repayment Terms and Flexibility

Lines of credit offer flexible repayment terms, allowing borrowers to draw funds up to a set limit and repay either partially or in full at any time, often with interest charged only on the amount used. Commercial paper requires full repayment at maturity, typically within 270 days, with fixed terms and no option for early repayment without penalties. The revolving nature of lines of credit provides greater liquidity and adaptability for managing short-term cash flow compared to the rigid structure of commercial paper.

Typical Use Cases: Line of Credit vs Commercial Paper

Lines of credit are typically used by businesses to manage short-term cash flow needs, cover operating expenses, or bridge gaps between receivables and payables. Commercial paper is commonly issued by large corporations to finance inventory purchases, meet short-term liabilities, or fund working capital requirements with lower interest rates than bank loans. Both instruments serve as flexible financing tools but differ in accessibility and duration, with lines of credit offering revolving credit and commercial paper providing fixed-term funding.

Risks and Drawbacks of Each Financing Option

Lines of credit pose risks such as fluctuating interest rates that can increase borrowing costs and the potential for reduced access when lenders tighten credit, impacting cash flow stability. Commercial paper carries risks including short maturity periods that require frequent refinancing, exposing issuers to rollover risk and market volatility, which may hinder liquidity. Both options can lead to financial strain if mismanaged, with lines of credit potentially resulting in over-borrowing and commercial paper creating refinancing pressure during economic downturns.

Which Financing Solution Suits Your Business Needs?

Line of credit offers flexible, revolving access to funds, ideal for managing cash flow fluctuations and short-term operational expenses, while commercial paper provides a cost-effective, short-term unsecured promissory note typically used by established businesses to finance working capital needs quickly. Businesses seeking ongoing funding with variable repayment schedules may benefit more from a line of credit, whereas those requiring lump-sum financing with a fixed maturity date often prefer commercial paper. Evaluating factors such as creditworthiness, financing duration, cost, and repayment flexibility helps determine the optimal solution tailored to specific business financial strategies.

Line of Credit Infographic

libterm.com

libterm.com