Accounts receivable represents the money owed to your business by customers who have purchased goods or services on credit. Efficient management of accounts receivable improves cash flow and ensures timely payments, which is crucial for maintaining healthy financial operations. Explore this article to discover strategies for optimizing your accounts receivable process and enhancing your company's financial stability.

Table of Comparison

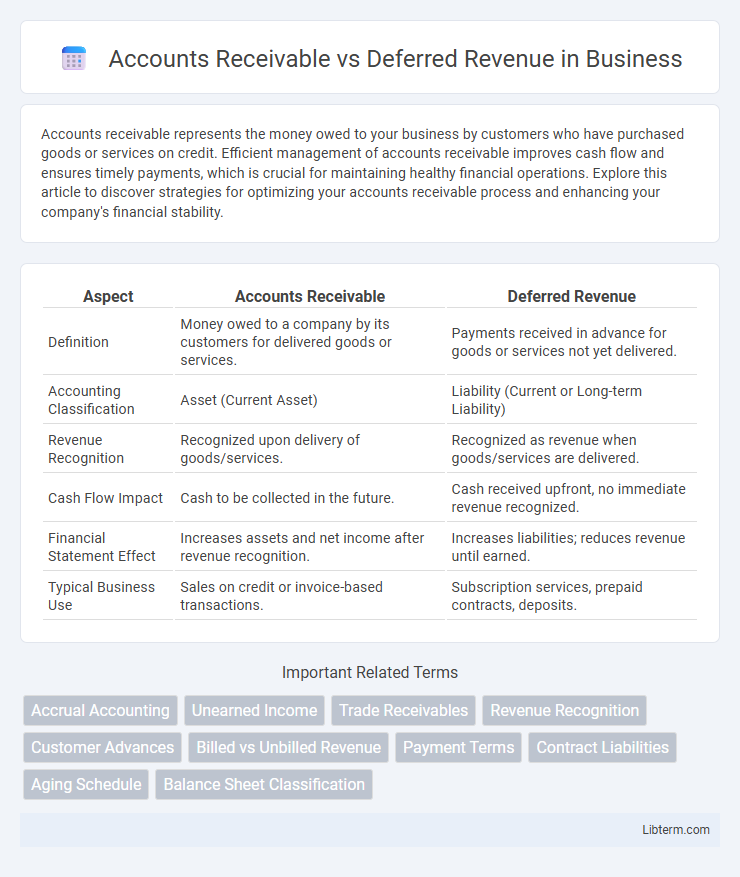

| Aspect | Accounts Receivable | Deferred Revenue |

|---|---|---|

| Definition | Money owed to a company by its customers for delivered goods or services. | Payments received in advance for goods or services not yet delivered. |

| Accounting Classification | Asset (Current Asset) | Liability (Current or Long-term Liability) |

| Revenue Recognition | Recognized upon delivery of goods/services. | Recognized as revenue when goods/services are delivered. |

| Cash Flow Impact | Cash to be collected in the future. | Cash received upfront, no immediate revenue recognized. |

| Financial Statement Effect | Increases assets and net income after revenue recognition. | Increases liabilities; reduces revenue until earned. |

| Typical Business Use | Sales on credit or invoice-based transactions. | Subscription services, prepaid contracts, deposits. |

Introduction to Accounts Receivable and Deferred Revenue

Accounts Receivable represents the outstanding invoices a company has issued to customers for goods or services delivered but not yet paid for, reflecting anticipated cash inflows. Deferred Revenue, also known as unearned revenue, denotes payments received in advance for goods or services that have not yet been delivered, indicating a liability on the balance sheet. Understanding the distinction between Accounts Receivable and Deferred Revenue is essential for accurate revenue recognition and financial reporting compliance under GAAP or IFRS standards.

Defining Accounts Receivable

Accounts Receivable represents the outstanding invoices or money owed to a company by its customers for goods or services delivered but not yet paid. It is recorded as a current asset on the balance sheet, reflecting expected cash inflows within a short period. Recognizing Accounts Receivable is crucial for managing cash flow and assessing a company's liquidity.

Understanding Deferred Revenue

Deferred revenue represents funds received by a company for goods or services yet to be delivered, classifying it as a liability on the balance sheet. Unlike accounts receivable, which tracks money owed by customers for already provided products or services, deferred revenue indicates an obligation to fulfill future performance. Recognizing deferred revenue accurately is crucial for compliance with revenue recognition standards such as ASC 606 and IFRS 15.

Key Differences Between Accounts Receivable and Deferred Revenue

Accounts Receivable represents money owed to a company for goods or services already delivered but not yet paid by customers, appearing as an asset on the balance sheet. Deferred Revenue, also known as unearned revenue, is money received in advance for products or services that have yet to be provided, recorded as a liability. The key difference is that Accounts Receivable reflects earned revenue pending collection, while Deferred Revenue indicates cash received before revenue recognition according to accounting principles.

How Each Impacts Financial Statements

Accounts Receivable represents money owed by customers for goods or services delivered, increasing assets on the balance sheet and contributing to revenue recognition on the income statement once earned. Deferred Revenue appears as a liability because it reflects cash received in advance for products or services not yet delivered, delaying revenue recognition until the obligation is fulfilled. The management of Accounts Receivable affects cash flow and working capital, while Deferred Revenue influences revenue timing and financial performance reporting.

Importance in Cash Flow Management

Accounts receivable represents money owed to a company by its customers, directly impacting positive cash flow as timely collection ensures liquidity. Deferred revenue, recorded as a liability, reflects cash received for goods or services yet to be delivered, requiring accurate recognition to avoid cash flow misrepresentation. Effective management of both accounts receivable and deferred revenue is crucial for maintaining operational stability and forecasting cash availability.

Recognition Criteria Under Accounting Standards

Accounts receivable is recognized when revenue is earned and ownership or risk has transferred to the customer, reflecting amounts owed by customers under accrual accounting principles outlined in IFRS 15 and ASC 606. Deferred revenue is recorded when payment is received before the delivery of goods or services, representing a liability until performance obligations are satisfied according to revenue recognition criteria. Proper identification of contract terms, performance obligations, and timing of control transfer are essential for accurate classification and compliance with accounting standards.

Common Examples in Business Operations

Accounts receivable commonly includes unpaid customer invoices for delivered goods or services, such as outstanding payments from clients in retail or B2B transactions. Deferred revenue typically arises from prepaid services or subscriptions, like annual software licenses or membership fees collected before service delivery. These distinctions impact cash flow and revenue recognition in accounting practices across various industries.

Implications for Financial Reporting and Analysis

Accounts Receivable represents amounts owed by customers for goods or services delivered, impacting cash flow predictions and asset valuation on the balance sheet. Deferred Revenue, as a liability, reflects payments received for goods or services yet to be fulfilled, influencing revenue recognition timing and liability reporting under Generally Accepted Accounting Principles (GAAP). Accurate differentiation between these accounts is critical for financial statement reliability, affecting key performance indicators like working capital and profitability analysis.

Best Practices for Managing Accounts Receivable and Deferred Revenue

Effective management of accounts receivable involves timely invoicing, regular follow-ups on outstanding payments, and maintaining accurate records to improve cash flow and reduce bad debts. Best practices for deferred revenue include recognizing revenue in accordance with accounting standards, regularly reviewing contracts to correctly match revenue with performance obligations, and ensuring detailed documentation to maintain transparency and compliance. Both accounts receivable and deferred revenue benefit from integrated financial software tools that automate tracking and reporting, enhancing accuracy and operational efficiency.

Accounts Receivable Infographic

libterm.com

libterm.com