Purchasing stock is a strategic way to build wealth by acquiring ownership in a company with potential for growth and dividends. Understanding the stock market, evaluating company performance, and monitoring market trends are essential steps to making informed investment decisions. Explore the rest of the article to learn how you can effectively navigate stock purchases and maximize your investment returns.

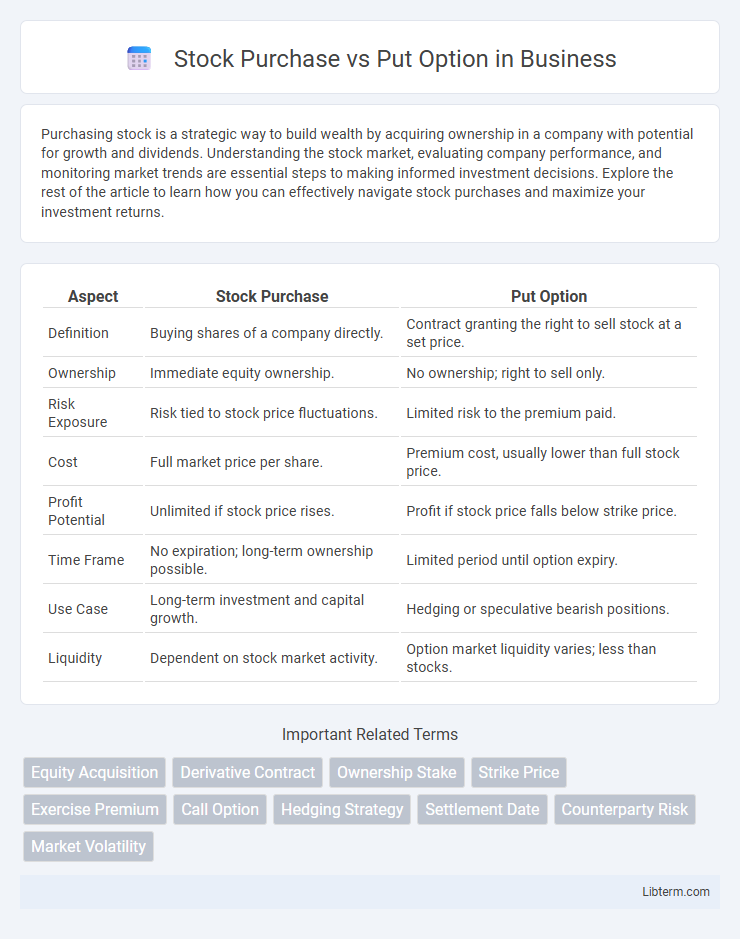

Table of Comparison

| Aspect | Stock Purchase | Put Option |

|---|---|---|

| Definition | Buying shares of a company directly. | Contract granting the right to sell stock at a set price. |

| Ownership | Immediate equity ownership. | No ownership; right to sell only. |

| Risk Exposure | Risk tied to stock price fluctuations. | Limited risk to the premium paid. |

| Cost | Full market price per share. | Premium cost, usually lower than full stock price. |

| Profit Potential | Unlimited if stock price rises. | Profit if stock price falls below strike price. |

| Time Frame | No expiration; long-term ownership possible. | Limited period until option expiry. |

| Use Case | Long-term investment and capital growth. | Hedging or speculative bearish positions. |

| Liquidity | Dependent on stock market activity. | Option market liquidity varies; less than stocks. |

Introduction to Stock Purchase and Put Option

Stock purchase involves acquiring ownership shares in a company, granting shareholders voting rights and potential dividends, representing a direct equity stake. A put option is a financial contract that grants the holder the right, but not the obligation, to sell a specified quantity of an asset at a predetermined price within a set timeframe, commonly used for hedging or speculative purposes. Both instruments serve distinct roles in investment strategies, with stock purchases focusing on ownership and long-term growth, while put options offer risk management and profit opportunities during market declines.

Key Differences Between Stock Purchase and Put Option

A stock purchase involves acquiring ownership shares directly in a company, giving the buyer voting rights and potential dividends, whereas a put option grants the right, but not the obligation, to sell shares at a predetermined price within a specific timeframe. Stock purchases require full capital investment upfront, while put options involve paying a premium for the right to sell, providing leveraged downside protection. The risk profile differs as stockholders face market volatility with potential unlimited loss or gain, whereas put option holders limit losses to the premium paid while potentially profiting from stock price declines.

How Stock Purchases Work

Stock purchases involve acquiring shares of a company's equity, granting ownership and voting rights to the buyer. Investors gain potential dividends and capital appreciation as the stock price increases. This straightforward transaction contrasts with options, where rights and obligations are defined without ownership until exercised.

Understanding Put Options

Put options grant the holder the right, but not the obligation, to sell a specific stock at a predetermined price within a set time frame, serving as a strategic tool for hedging against potential declines in stock value. Unlike directly purchasing stocks, which involves ownership and exposure to market volatility, owning put options enables investors to limit losses or profit from falling stock prices with a defined risk. Understanding the mechanics of put options, including strike price, expiration date, and premium, is essential for effective risk management and informed decision-making in equity markets.

Advantages of Buying Stocks

Buying stocks offers direct ownership in a company, allowing investors to benefit from dividend payments and potential long-term capital appreciation. Stockholders have voting rights, giving them influence over corporate decisions and governance. Owning stocks also allows for unlimited upside potential without expiration dates, unlike put options that have time constraints and limited profit opportunities.

Benefits of Using Put Options

Put options provide investors with the ability to hedge against potential declines in stock prices, offering downside protection without the need to sell the underlying shares. They require less capital outlay compared to purchasing stocks outright, enhancing portfolio flexibility and risk management efficiency. Moreover, put options can generate profit from falling markets, making them valuable tools for strategic investment and preserving capital during market volatility.

Risks Associated with Stock Purchases

Purchasing stocks carries significant risks including market volatility, where stock prices can decline rapidly due to economic downturns, company performance issues, or geopolitical events. Unlike put options that provide downside protection by allowing the sale of stocks at a predetermined price, stockholders face potential unlimited losses if the value falls substantially. Investors must also consider liquidity risks, as selling stocks quickly in a declining market may result in unfavorable prices and increased losses.

Risks Involved in Put Options

Put options carry the risk of total premium loss if the underlying stock price remains above the strike price at expiration, rendering the option worthless. Investors face time decay as the option's value diminishes rapidly as expiration approaches, especially if the stock price is stagnant or rising. Unlike owning stock, put options do not provide dividends or voting rights, and they require accurate market timing to profit, increasing the risk compared to direct stock purchases.

When to Choose Stock Purchase vs Put Option

Choose a stock purchase when you anticipate long-term growth and want ownership rights, such as voting power and dividends. Opt for a put option to hedge against potential losses or profit from a decline in stock price without owning the asset. Investors seeking downside protection or limited risk exposure commonly prefer put options over direct stock purchases.

Conclusion: Which Strategy Fits Your Investment Goals

Choosing between stock purchase and put option depends on your investment goals and risk tolerance. Stock purchase suits investors seeking ownership, dividend income, and long-term capital appreciation, while put options provide downside protection and leverage in bearish markets. Align your strategy with your market outlook, financial objectives, and risk appetite to optimize portfolio performance.

Stock Purchase Infographic

libterm.com

libterm.com