Mutual funds and unit trusts are popular investment vehicles that pool money from multiple investors to create a diversified portfolio of assets. These funds offer professional management and the advantage of spreading risk across various securities, making them suitable for both novice and experienced investors. Discover how mutual funds and unit trusts can enhance your investment strategy by reading the full article.

Table of Comparison

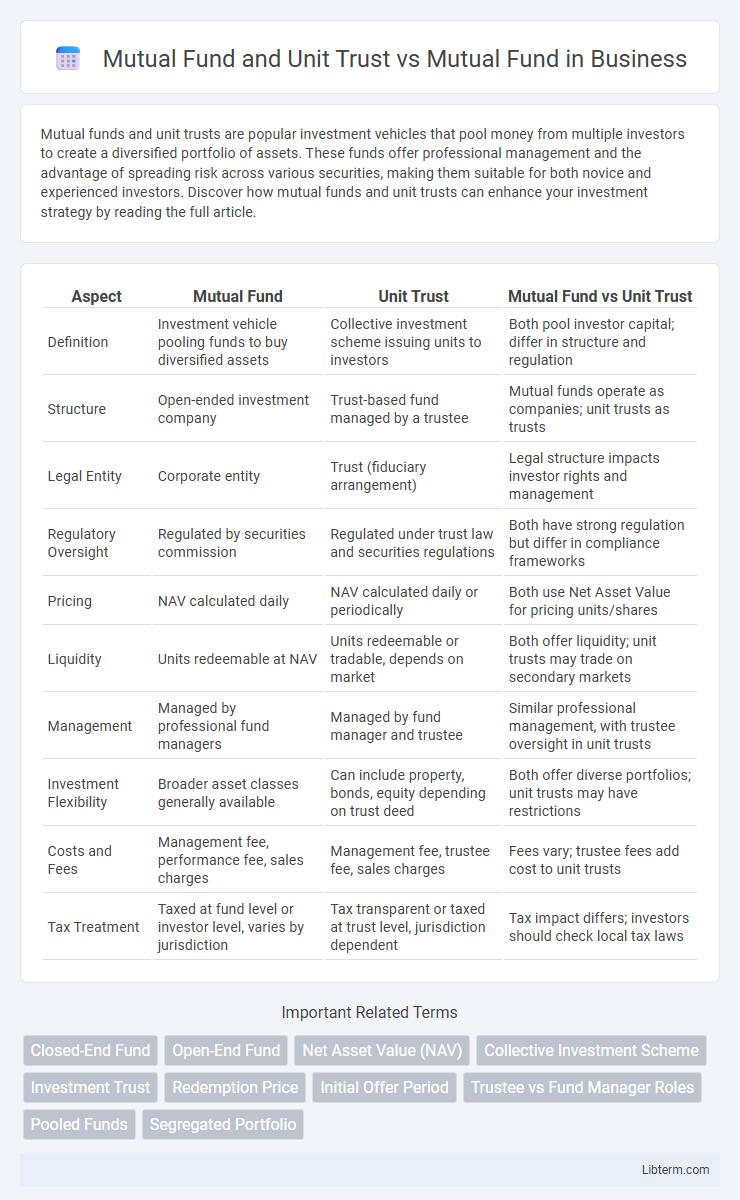

| Aspect | Mutual Fund | Unit Trust | Mutual Fund vs Unit Trust |

|---|---|---|---|

| Definition | Investment vehicle pooling funds to buy diversified assets | Collective investment scheme issuing units to investors | Both pool investor capital; differ in structure and regulation |

| Structure | Open-ended investment company | Trust-based fund managed by a trustee | Mutual funds operate as companies; unit trusts as trusts |

| Legal Entity | Corporate entity | Trust (fiduciary arrangement) | Legal structure impacts investor rights and management |

| Regulatory Oversight | Regulated by securities commission | Regulated under trust law and securities regulations | Both have strong regulation but differ in compliance frameworks |

| Pricing | NAV calculated daily | NAV calculated daily or periodically | Both use Net Asset Value for pricing units/shares |

| Liquidity | Units redeemable at NAV | Units redeemable or tradable, depends on market | Both offer liquidity; unit trusts may trade on secondary markets |

| Management | Managed by professional fund managers | Managed by fund manager and trustee | Similar professional management, with trustee oversight in unit trusts |

| Investment Flexibility | Broader asset classes generally available | Can include property, bonds, equity depending on trust deed | Both offer diverse portfolios; unit trusts may have restrictions |

| Costs and Fees | Management fee, performance fee, sales charges | Management fee, trustee fee, sales charges | Fees vary; trustee fees add cost to unit trusts |

| Tax Treatment | Taxed at fund level or investor level, varies by jurisdiction | Tax transparent or taxed at trust level, jurisdiction dependent | Tax impact differs; investors should check local tax laws |

Understanding Mutual Funds and Unit Trusts

Mutual funds and unit trusts both pool investors' money to invest in diversified portfolios of stocks, bonds, or other securities, but unit trusts issue units reflecting ownership in the trust's assets, while mutual funds typically use shares. Understanding mutual funds and unit trusts involves recognizing that mutual funds are managed by professional fund managers who actively or passively invest based on the fund's objectives, whereas unit trusts often have a fixed portfolio managed according to specific investment guidelines. Both investment vehicles offer liquidity, diversification, and professional management, making them suitable for investors seeking risk spreading without direct stock or bond picking.

Key Differences Between Unit Trusts and Mutual Funds

Unit trusts pool investors' money into a trust structure managed by a trustee, while mutual funds operate as corporations issuing shares to investors. Unit trusts typically have a fixed pool of assets with price determined by net asset value (NAV), whereas mutual funds issue and redeem shares at NAV, allowing for more liquidity. Key differences include legal structure, pricing mechanism, and regulatory oversight, impacting investor rights and fund management style.

How Mutual Funds Operate

Mutual funds operate by pooling capital from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers. Unit trusts function similarly, but their structure involves issuing units to investors that represent a fixed proportion of the trust's total assets, and they are often governed by a trustee to hold assets on behalf of investors. Both vehicles provide diversification and professional management, but mutual funds typically offer more flexibility in pricing and redemption due to their open-ended structure.

Structure of Unit Trusts Explained

Unit trusts are collective investment schemes structured as trusts where investors hold units representing a portion of the underlying assets, managed by a trustee and a manager. Unlike mutual funds, which are typically organized as companies issuing shares, unit trusts involve a fiduciary relationship with the trustee who holds legal title to the assets on behalf of unitholders. This structure offers transparency and segregation of assets, ensuring that investors' interests are protected through defined roles and regulatory oversight.

Investment Strategies: Mutual Fund vs Unit Trust

Mutual funds and unit trusts differ primarily in their investment strategies and structure; mutual funds typically employ active management strategies with a focus on achieving specific financial goals through diversified portfolios. Unit trusts often operate on a fixed portfolio structure, valuing transparency and stability by investing in a predetermined selection of assets. Understanding these distinctions helps investors align their risk tolerance and financial objectives with the appropriate fund type.

Fees and Charges: A Comparative Analysis

Mutual funds generally charge management fees ranging from 0.5% to 2% annually, while unit trusts may have higher initial sales charges, often 1% to 5%, alongside annual management fees. Mutual funds typically feature lower expense ratios due to their open-end structure and regulatory advantages. Investors should compare total fees including entry, exit, and ongoing charges to assess the cost-effectiveness between mutual funds and unit trusts.

Liquidity and Accessibility in Both Structures

Mutual funds and unit trusts both offer liquidity with daily redemption options, allowing investors to easily buy or sell units at the net asset value (NAV). Unit trusts are often accessible through platforms or financial advisors, providing flexibility to retail investors, while mutual funds may have minimum investment thresholds but are widely available through brokerage accounts and employer-sponsored plans. The transparent pricing and regulated trading in both structures ensure ease of access, but mutual funds typically benefit from broader distribution channels enhancing liquidity.

Performance and Risk Factors

Mutual funds and unit trusts both pool investor money into diversified portfolios, but mutual funds often offer more flexibility in trading and liquidity, impacting performance and risk profiles. Unit trusts typically have a fixed number of units traded on exchanges, which can lead to price variations from the net asset value, influencing performance volatility. Risk factors in mutual funds are managed through active portfolio adjustments, whereas unit trusts may have less frequent rebalancing, affecting responsiveness to market changes and overall risk exposure.

Investor Suitability: Who Should Invest?

Mutual funds and unit trusts both offer diversified investment portfolios but differ slightly in structure and regulation, making them suitable for different types of investors. Mutual funds, typically regulated under securities laws, are ideal for investors seeking liquidity, professional management, and diverse asset allocation with lower minimum investment thresholds. Unit trusts, often favored by conservative investors or those preferring a trust-based structure, provide transparency and stability through a trustee, appealing to individuals prioritizing steady income and capital preservation.

Choosing Between Mutual Fund and Unit Trust

Choosing between mutual funds and unit trusts depends on factors like regulatory environment, liquidity, and cost structures; mutual funds are often regulated under stricter securities laws and may offer greater transparency. Unit trusts are commonly structured as trusts holding assets on behalf of investors and can provide more flexible pricing mechanisms. Investors should evaluate fund management fees, redemption policies, and tax implications when deciding the optimal investment vehicle.

Mutual Fund and Unit Trust Infographic

libterm.com

libterm.com