Opportunity cost represents the value of the next best alternative foregone when making a decision, emphasizing the trade-offs involved in resource allocation. Understanding opportunity cost helps you make more informed choices by revealing what you sacrifice when selecting one option over another. Explore this article to learn how mastering the concept can improve your decision-making in business and personal finance.

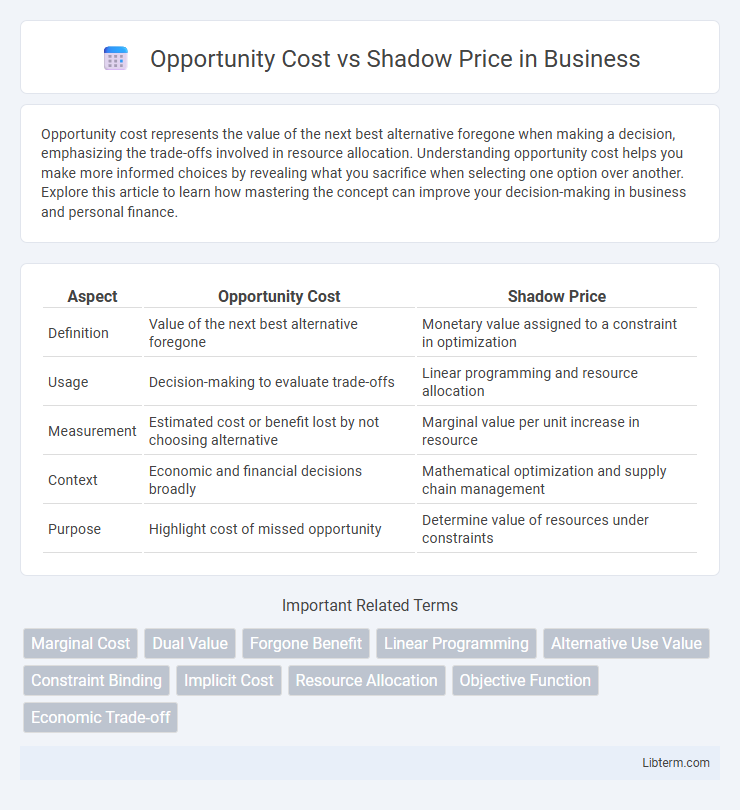

Table of Comparison

| Aspect | Opportunity Cost | Shadow Price |

|---|---|---|

| Definition | Value of the next best alternative foregone | Monetary value assigned to a constraint in optimization |

| Usage | Decision-making to evaluate trade-offs | Linear programming and resource allocation |

| Measurement | Estimated cost or benefit lost by not choosing alternative | Marginal value per unit increase in resource |

| Context | Economic and financial decisions broadly | Mathematical optimization and supply chain management |

| Purpose | Highlight cost of missed opportunity | Determine value of resources under constraints |

Introduction to Opportunity Cost and Shadow Price

Opportunity cost represents the value of the next best alternative foregone when making a decision, reflecting the trade-offs involved in resource allocation. Shadow price quantifies the implicit value of a constrained resource in optimization problems, often derived from linear programming models. Understanding opportunity cost and shadow price is vital for effective economic decision-making and resource management.

Defining Opportunity Cost

Opportunity cost represents the value of the next best alternative foregone when a decision is made, reflecting the true economic cost of resource allocation. It quantifies potential benefits lost by choosing one option over another. This concept is fundamental in economics for optimizing resource use and evaluating trade-offs in decision-making.

What is Shadow Price?

Shadow price represents the monetary value assigned to one additional unit of a constrained resource in optimization problems, reflecting its true economic worth when market prices are unavailable or distorted. It quantifies the increase or decrease in the objective function's value if the constraint's limit is relaxed by one unit. Unlike opportunity cost, which considers the next best alternative foregone, the shadow price specifically measures the marginal value of resources within linear programming and economic models under restriction.

Key Differences Between Opportunity Cost and Shadow Price

Opportunity cost measures the value of the next best alternative foregone when a decision is made, reflecting real economic trade-offs in resource allocation. Shadow price represents the implicit monetary value assigned to a constraint in optimization problems, indicating how much the objective function improves with one additional unit of a resource. Key differences include opportunity cost being a conceptual economic metric for decision-making, whereas shadow price is a quantitative value derived from linear programming and sensitivity analysis in constrained optimization.

Importance in Economic Decision-Making

Opportunity cost quantifies the value of the next best alternative foregone, serving as a fundamental metric in economic decision-making by highlighting trade-offs and resource allocation efficiency. Shadow price represents the implicit value of a constraint in optimization problems, reflecting how much the objective function would improve with a one-unit relaxation of that constraint. Together, understanding opportunity cost and shadow price ensures optimal resource distribution by balancing alternative benefits with the marginal worth of binding constraints.

Real-World Examples of Opportunity Cost

Opportunity cost quantifies the value of the next best alternative forgone, illustrated by a farmer choosing to plant wheat over corn, sacrificing potential corn revenues for wheat profits. In contrast, shadow price represents the monetary value assigned to a constraint in linear programming, such as the implicit worth of an additional hour of machine time in production optimization. Real-world applications of opportunity cost are evident in investment decisions like allocating capital to stock markets instead of real estate, where investors weigh expected returns and risks of mutually exclusive options.

Applications of Shadow Price in Business

Shadow price plays a crucial role in business decision-making by quantifying the marginal value of scarce resources, allowing firms to prioritize investments and optimize resource allocation under constraints. It is widely applied in project evaluation, cost-benefit analysis, and supply chain management to determine the true economic worth of inputs not directly priced in the market. Unlike opportunity cost, which broadly measures foregone alternatives, shadow price offers a precise numerical value used in linear programming and optimization models to guide strategic business choices.

Opportunity Cost vs. Shadow Price in Resource Allocation

Opportunity cost quantifies the value of the next best alternative foregone when allocating scarce resources, serving as a crucial metric in economic decision-making. Shadow price represents the implicit valuation of a resource in constraint optimization problems, reflecting its marginal worth when market prices are unavailable or distorted. Comparing opportunity cost and shadow price aids in optimizing resource allocation by balancing economic trade-offs and identifying the true economic value of limited inputs.

Implications for Managers and Policymakers

Opportunity cost quantifies the value of the next best alternative foregone, guiding managers and policymakers in resource allocation decisions to maximize efficiency and profitability. Shadow price reflects the monetary value of a resource constraint in optimization models, helping decision-makers evaluate the impact of relaxing these constraints on overall outcomes. Understanding the distinction between opportunity cost and shadow price enables informed strategic planning, budget optimization, and effective policy formulation under scarcity conditions.

Conclusion: Choosing the Right Metric

Opportunity cost reflects the value of the next best alternative forgone, making it essential for evaluating economic decisions in resource allocation. Shadow price quantifies the marginal value of relaxing a constraint in optimization problems, offering precise insights for resource management in linear programming. Selecting the right metric depends on whether the focus is on forgone alternatives (opportunity cost) or on marginal constraint valuation (shadow price) for accurate decision-making.

Opportunity Cost Infographic

libterm.com

libterm.com