Fixed cost is an essential concept in business accounting, referring to expenses that remain constant regardless of production levels or sales volume. These costs include rent, salaries, and insurance, which must be covered even if your business activity fluctuates. Explore this article further to understand how managing fixed costs can improve your financial strategy.

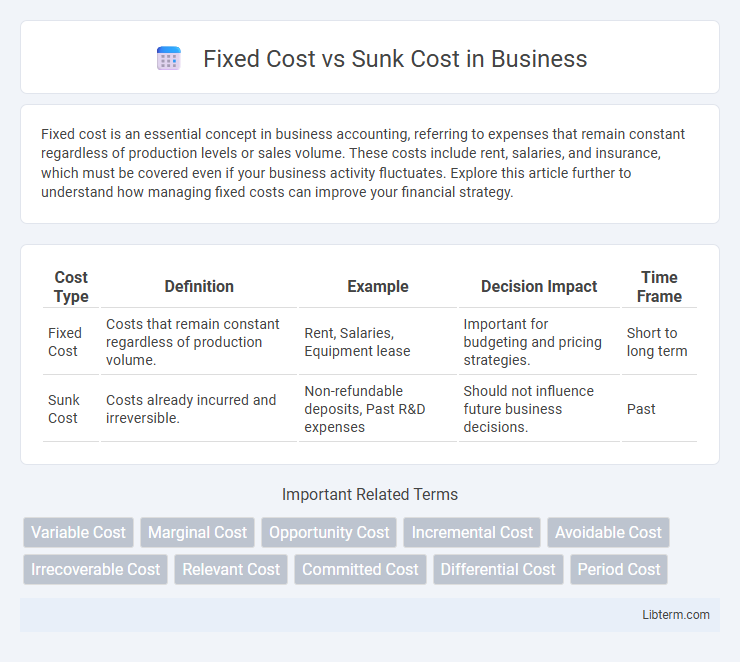

Table of Comparison

| Cost Type | Definition | Example | Decision Impact | Time Frame |

|---|---|---|---|---|

| Fixed Cost | Costs that remain constant regardless of production volume. | Rent, Salaries, Equipment lease | Important for budgeting and pricing strategies. | Short to long term |

| Sunk Cost | Costs already incurred and irreversible. | Non-refundable deposits, Past R&D expenses | Should not influence future business decisions. | Past |

Introduction to Fixed Cost and Sunk Cost

Fixed costs are expenses that remain constant regardless of production levels, such as rent, salaries, and insurance, playing a crucial role in budget planning and financial forecasting. Sunk costs refer to past expenditures that cannot be recovered and should not influence future business decisions, including research and development expenses or specialized machinery purchases. Understanding the distinction between fixed costs and sunk costs is essential for effective cost management and strategic decision-making in business operations.

Defining Fixed Costs

Fixed costs are expenses that remain constant regardless of production levels, such as rent, salaries, and insurance. These costs must be paid even if the business temporarily halts operations. Unlike sunk costs, fixed costs can sometimes be adjusted over time but are essential for maintaining baseline business functions.

Understanding Sunk Costs

Sunk costs refer to expenses that have already been incurred and cannot be recovered, distinguishing them from fixed costs which are ongoing expenses related to production levels. Understanding sunk costs is crucial for effective decision-making, as ignoring these irretrievable costs helps businesses avoid the sunk cost fallacy and optimize future investments. Firms that focus on marginal costs rather than sunk costs improve resource allocation and avoid throwing good money after bad.

Key Differences Between Fixed and Sunk Costs

Fixed costs are ongoing expenses that remain constant regardless of production levels, such as rent or salaried wages. Sunk costs represent past expenditures that cannot be recovered and should not influence future decision-making, like money spent on obsolete equipment. The key difference lies in fixed costs being relevant for current and future budgeting, while sunk costs are irrelevant for future financial considerations.

Examples of Fixed Costs in Business

Fixed costs in business include expenses such as rent for office or factory space, salaries of permanent staff, and depreciation on equipment, which remain constant regardless of production levels. These costs must be paid even if the business temporarily halts operations, distinguishing them from variable costs tied to output. Unlike sunk costs, which are past expenditures that cannot be recovered, fixed costs represent ongoing financial commitments integral to business operations.

Examples of Sunk Costs in Decision Making

Sunk costs in decision making include expenses like non-refundable deposits on equipment, past marketing campaign expenditures, and initial research and development costs that cannot be recovered once spent. These costs should be disregarded when evaluating future options since they do not affect the incremental benefit or loss of a decision. Understanding the difference between fixed costs, which may vary with production, and sunk costs aids businesses in making rational financial choices without being influenced by irretrievable past expenses.

Impact of Fixed Costs on Financial Planning

Fixed costs, which remain constant regardless of production levels, significantly influence financial planning by establishing a baseline expense that must be covered to achieve profitability. These recurring expenses, such as rent, salaries, and insurance, impact cash flow management and budgeting strategies, requiring businesses to ensure consistent revenue streams. Misjudging fixed costs can lead to inaccurate break-even analysis and cash shortages, hindering long-term financial stability and growth.

Why Sunk Costs Should Not Influence Future Decisions

Sunk costs represent past expenditures that cannot be recovered and should not influence future business decisions because they do not affect the marginal cost or benefits of current choices. Fixed costs remain constant regardless of production levels, but sunk costs are irretrievable and irrelevant to prospective outcomes, making rational economic decision-making hinge on ignoring sunk costs. Considering sunk costs can lead to the sunk cost fallacy, where investments continue based on past losses rather than future value.

Common Misconceptions About Fixed and Sunk Costs

Fixed costs are often mistakenly treated as sunk costs, yet fixed costs can change over time, whereas sunk costs are past expenses that cannot be recovered and should not influence future decisions. Many assume fixed costs always remain constant regardless of output, but they may vary in the long term as business conditions shift. Understanding that sunk costs are irrelevant for marginal decision-making is crucial for accurate financial and managerial analysis.

Practical Tips for Managing Fixed and Sunk Costs

Identify fixed costs such as rent, salaries, and equipment leases to ensure consistent budgeting and cash flow management. Avoid letting sunk costs, like past investments or obsolete inventory, influence new financial decisions by focusing only on future costs and benefits. Implement regular cost reviews and financial forecasting to adjust strategies effectively and optimize resource allocation.

Fixed Cost Infographic

libterm.com

libterm.com