Share capital represents the total value of funds raised by a company through the issuance of shares to investors. This capital forms the foundation of your company's equity, influencing ownership stakes and voting rights. Explore the rest of this article to learn how share capital impacts business structure and growth opportunities.

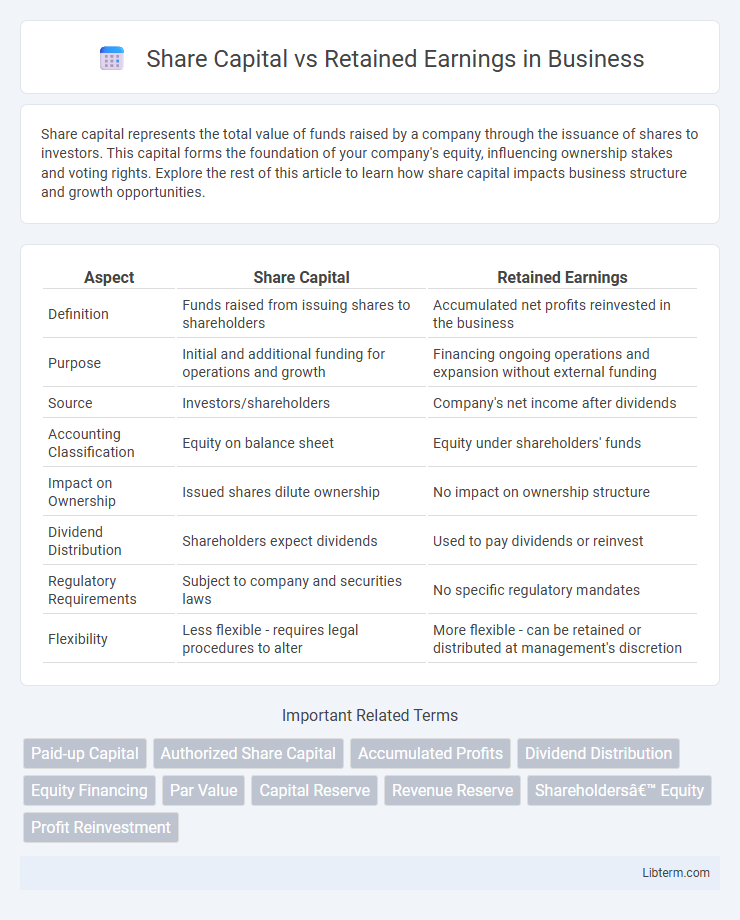

Table of Comparison

| Aspect | Share Capital | Retained Earnings |

|---|---|---|

| Definition | Funds raised from issuing shares to shareholders | Accumulated net profits reinvested in the business |

| Purpose | Initial and additional funding for operations and growth | Financing ongoing operations and expansion without external funding |

| Source | Investors/shareholders | Company's net income after dividends |

| Accounting Classification | Equity on balance sheet | Equity under shareholders' funds |

| Impact on Ownership | Issued shares dilute ownership | No impact on ownership structure |

| Dividend Distribution | Shareholders expect dividends | Used to pay dividends or reinvest |

| Regulatory Requirements | Subject to company and securities laws | No specific regulatory mandates |

| Flexibility | Less flexible - requires legal procedures to alter | More flexible - can be retained or distributed at management's discretion |

Introduction to Share Capital and Retained Earnings

Share capital represents the funds raised by a company through the issuance of shares to shareholders, reflecting their equity ownership and initial investment in the business. Retained earnings consist of the accumulated net profits that a company reinvests in its operations instead of distributing as dividends, serving as a key source of internal financing. Both elements are crucial in assessing a company's financial structure and capital management strategies.

Defining Share Capital

Share capital represents the total value of shares issued by a company to shareholders as equity financing, establishing ownership rights and voting power. It is recorded on the company's balance sheet under shareholders' equity and is a fixed amount unless new shares are issued or buybacks occur. Distinct from retained earnings, which are accumulated profits reinvested in the business, share capital reflects the initial and subsequent investment contributions from shareholders.

Understanding Retained Earnings

Retained earnings represent the cumulative net income a company has reinvested in its operations rather than distributed as dividends to shareholders. Unlike share capital, which reflects the initial and subsequent investments made by shareholders, retained earnings accumulate from the company's ongoing profitability and are crucial for funding growth, paying down debt, or financing new projects. Understanding retained earnings provides insight into a company's ability to generate internal financing and sustain long-term financial health.

Key Differences Between Share Capital and Retained Earnings

Share capital represents the funds raised by a company through the issuance of shares to shareholders, reflecting the initial and additional investments made to finance business operations. Retained earnings consist of the accumulated net profits that have been reinvested in the company rather than distributed as dividends, serving as a key indicator of a company's profitability over time. Unlike share capital, which remains constant unless new shares are issued, retained earnings fluctuate based on the company's financial performance and dividend policy.

Importance of Share Capital in Business Growth

Share capital represents the initial funds invested by shareholders, providing essential financial resources that enable businesses to fund expansion, acquire assets, and support operational activities. Unlike retained earnings, which are profits reinvested from business operations, share capital offers a stable and predictable capital base crucial for securing external financing and establishing creditor confidence. Maintaining a strong share capital structure attracts investors and fosters sustainable business growth by underpinning long-term strategic initiatives.

Role of Retained Earnings in Financial Stability

Retained earnings play a crucial role in maintaining a company's financial stability by serving as an internal source of funding for growth, debt repayment, and unexpected expenses, reducing reliance on external financing. Unlike share capital, which represents funds raised from shareholders through the issuance of stock, retained earnings accumulate from net profits that are reinvested into the business rather than distributed as dividends. This reinvestment enhances the company's equity base, improves liquidity, and supports long-term sustainability by cushioning against financial volatility.

Impact on Company Valuation

Share capital represents the funds raised by issuing shares, serving as a primary indicator of the company's equity base and directly influencing market capitalization. Retained earnings reflect accumulated profits reinvested into the business, enhancing intrinsic value by supporting growth and operational stability. Investors evaluate the balance between these components to assess valuation, where strong retained earnings often signal sustainable profitability while share capital indicates the company's capital structure and potential dilution risks.

Shareholder Perspectives: Dividends vs. Capital Growth

Shareholders view share capital as the initial investment reflecting ownership rights and voting power, while retained earnings represent accumulated profits reinvested for business expansion and value appreciation. Dividends provide shareholders with regular income derived from retained earnings, appealing to those prioritizing immediate returns. Capital growth, driven by reinvested retained earnings, attracts long-term investors seeking increased share value and wealth accumulation over time.

Managing Share Capital and Retained Earnings Effectively

Managing share capital involves monitoring issued shares and equity financing to maintain optimal ownership structure and shareholder value. Retained earnings management focuses on reinvesting profits strategically to support business growth, debt reduction, and dividend policies. Effective coordination of both ensures balanced financial stability and supports sustained corporate expansion.

Conclusion: Strategic Use of Equity Components

Strategic use of share capital and retained earnings balances funding stability with growth potential, where share capital provides a foundation of permanent equity and retained earnings fuel reinvestment without dilution. Optimal capital structure leverages share capital to attract investors while using retained earnings to support operational expansion and financial flexibility. Effective management of both components enhances shareholder value and sustains long-term corporate growth.

Share Capital Infographic

libterm.com

libterm.com