Positive equity occurs when the market value of your asset exceeds the outstanding balance on your loan, offering financial flexibility and potential profit. This situation allows you to refinance, sell, or leverage your asset to meet other financial goals. Explore how positive equity can benefit your financial strategy in the rest of the article.

Table of Comparison

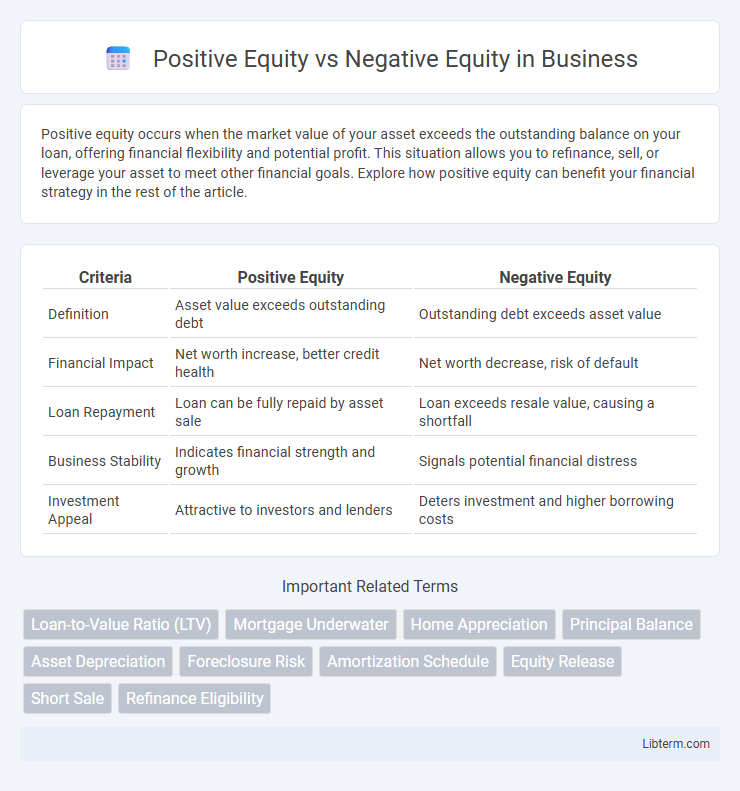

| Criteria | Positive Equity | Negative Equity |

|---|---|---|

| Definition | Asset value exceeds outstanding debt | Outstanding debt exceeds asset value |

| Financial Impact | Net worth increase, better credit health | Net worth decrease, risk of default |

| Loan Repayment | Loan can be fully repaid by asset sale | Loan exceeds resale value, causing a shortfall |

| Business Stability | Indicates financial strength and growth | Signals potential financial distress |

| Investment Appeal | Attractive to investors and lenders | Deters investment and higher borrowing costs |

Understanding Equity: A Brief Overview

Equity represents the difference between the current market value of an asset, such as a home, and the outstanding balance on any loans secured by that asset. Positive equity occurs when the market value exceeds the loan balance, providing homeowners with financial leverage and flexibility. Negative equity, often called being "underwater," happens when the loan balance surpasses the asset's value, increasing financial risk during sales or refinancing.

What is Positive Equity?

Positive equity occurs when the current market value of an asset, such as real estate, exceeds the outstanding balance on the associated loan or mortgage. This condition indicates that the owner has more ownership stake in the property than debt, providing financial security and potential borrowing power. Homeowners with positive equity can leverage this value for refinancing, home equity loans, or selling the property at a profit.

What is Negative Equity?

Negative equity occurs when the outstanding loan balance on an asset, such as a home or vehicle, exceeds its current market value. This situation typically arises during market downturns, rapid depreciation, or when the initial loan amount was significantly higher than the asset's worth. Homeowners or borrowers facing negative equity may struggle to refinance or sell the asset without incurring a financial loss.

Key Differences Between Positive and Negative Equity

Positive equity occurs when the market value of an asset exceeds the outstanding balance on the loan secured by that asset, providing financial flexibility and potential profit during a sale. Negative equity happens when the loan balance surpasses the asset's current market value, often leading to a financial loss if the asset is sold or refinancing challenges. Key differences revolve around the asset's market value relative to debt, impacting borrower options and financial stability.

Causes of Positive Equity

Positive equity occurs when the market value of an asset, such as a property or vehicle, exceeds the outstanding loan balance secured against it, often driven by rising property values, consistent mortgage payments, and home improvements that increase market worth. Factors contributing to positive equity include appreciation in real estate markets, accelerated loan amortization through extra payments, and down payments that reduce initial loan-to-value ratios. Maintaining positive equity enhances financial stability and provides opportunities for refinancing or leveraging assets for additional credit.

Factors Leading to Negative Equity

Negative equity occurs when the outstanding loan balance on a property exceeds its current market value, often driven by factors such as a significant drop in property prices, economic downturns, or unfavorable loan-to-value (LTV) ratios at the time of purchase. High-interest rates and declining neighborhood conditions can accelerate the depreciation of property values, increasing the risk of negative equity. Borrowers with limited equity face challenges in refinancing or selling their homes without incurring losses, contrasting with positive equity situations where market value surpasses mortgage debt.

Impact of Equity Status on Homeowners

Positive equity occurs when a homeowner's property value exceeds the outstanding mortgage balance, providing financial stability and greater refinancing options. Negative equity, or being "underwater," limits homeowners' ability to sell or refinance without loss, often leading to increased financial stress and potential default. Equity status significantly influences homeowners' wealth accumulation, creditworthiness, and long-term housing decisions.

Financial Strategies for Managing Equity

Maintaining positive equity requires timely mortgage payments and proactive property value monitoring to build homeowner wealth and secure better refinancing options. In contrast, managing negative equity involves strategies like loan modification, principal reduction programs, or short sales to mitigate financial losses and avoid foreclosure. Strategic equity management improves credit standing and supports long-term financial stability in volatile markets.

Recovering from Negative Equity

Recovering from negative equity requires strategic financial planning and market awareness to rebuild home value above the outstanding mortgage balance. Homeowners can focus on accelerating mortgage payments to reduce principal, monitor local property market trends for potential value increases, and consider home improvements that add equity. Refinancing options or waiting for market appreciation can also help transition from negative to positive equity, restoring financial stability.

Tips to Build and Maintain Positive Equity

Building and maintaining positive equity involves consistently paying down the principal on your mortgage while ensuring your property value appreciates through smart home improvements and market timing. Regularly monitoring local real estate trends and refinancing your loan when interest rates drop can also enhance equity growth. Maintaining positive equity protects your financial stability and provides greater flexibility for future investments or selling opportunities.

Positive Equity Infographic

libterm.com

libterm.com