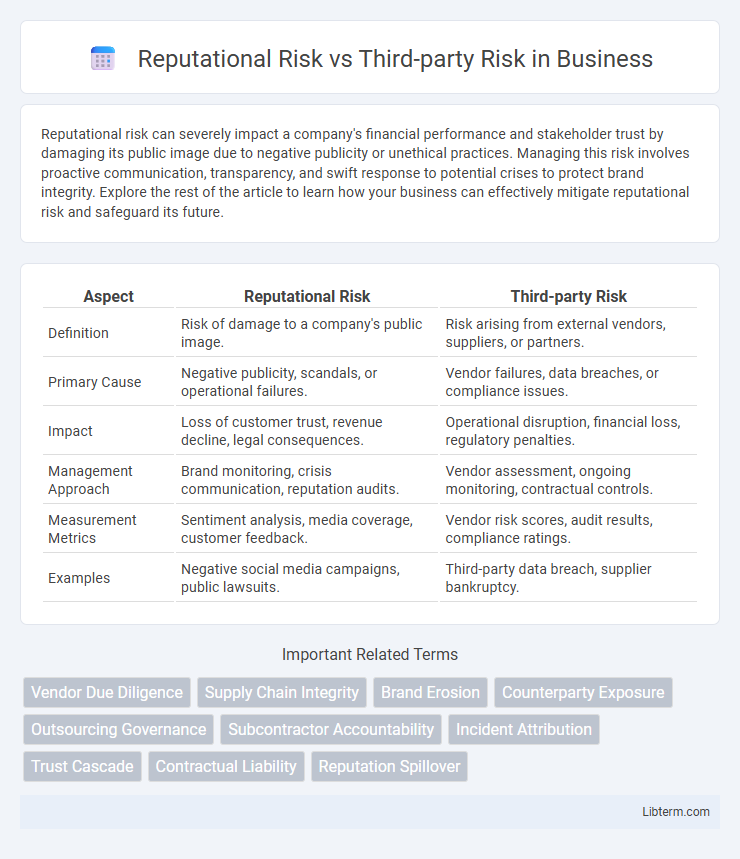

Reputational risk can severely impact a company's financial performance and stakeholder trust by damaging its public image due to negative publicity or unethical practices. Managing this risk involves proactive communication, transparency, and swift response to potential crises to protect brand integrity. Explore the rest of the article to learn how your business can effectively mitigate reputational risk and safeguard its future.

Table of Comparison

| Aspect | Reputational Risk | Third-party Risk |

|---|---|---|

| Definition | Risk of damage to a company's public image. | Risk arising from external vendors, suppliers, or partners. |

| Primary Cause | Negative publicity, scandals, or operational failures. | Vendor failures, data breaches, or compliance issues. |

| Impact | Loss of customer trust, revenue decline, legal consequences. | Operational disruption, financial loss, regulatory penalties. |

| Management Approach | Brand monitoring, crisis communication, reputation audits. | Vendor assessment, ongoing monitoring, contractual controls. |

| Measurement Metrics | Sentiment analysis, media coverage, customer feedback. | Vendor risk scores, audit results, compliance ratings. |

| Examples | Negative social media campaigns, public lawsuits. | Third-party data breach, supplier bankruptcy. |

Introduction to Reputational Risk and Third-party Risk

Reputational risk arises from potential damage to an organization's public image, often triggered by negative events, poor customer experiences, or ethical breaches. Third-party risk involves vulnerabilities introduced through external partners, suppliers, or vendors that can impact business operations and compliance. Managing both risks requires comprehensive frameworks to safeguard brand reputation and ensure reliable, trustworthy third-party relationships.

Defining Reputational Risk in Modern Organizations

Reputational risk in modern organizations refers to the potential loss or damage to a company's public image and stakeholder trust resulting from adverse events, unethical behavior, or negative publicity. It affects brand value, customer loyalty, and market competitiveness, making it a critical concern for corporate governance and risk management. Reputational risk often intersects with third-party risk, as supplier misconduct or partner failures can directly impact an organization's reputation.

Understanding Third-party Risk: Scope and Impact

Third-party risk encompasses the potential threats and vulnerabilities arising from relationships with suppliers, vendors, contractors, and service providers, significantly affecting operational continuity and data security. Understanding the scope involves evaluating these external entities' compliance, financial stability, and cybersecurity measures to prevent disruptions and reputational damage. The impact of third-party risk extends beyond immediate business operations, often influencing brand reputation, customer trust, and regulatory standing.

Key Differences Between Reputational and Third-party Risks

Reputational risk involves potential damage to a company's public image or brand value due to negative events, whereas third-party risk arises from vulnerabilities linked to suppliers, partners, or vendors. Key differences include their origins--reputational risk is driven by internal or external perceptions, while third-party risk stems from external entities' actions or failures. Managing reputational risk focuses on communication and brand protection, while third-party risk management emphasizes due diligence, contract oversight, and operational controls.

How Third-party Relationships Influence Reputational Risk

Third-party relationships significantly influence reputational risk as organizations rely on external vendors, suppliers, and partners whose actions directly impact brand perception and trustworthiness. Failures in third-party compliance, data security breaches, or unethical behaviors can lead to negative media coverage and loss of customer confidence, amplifying reputational damage. Effective third-party risk management involves rigorous due diligence, continuous monitoring, and clear contractual obligations to mitigate potential threats to an organization's reputation.

Common Sources of Reputational and Third-party Risks

Common sources of reputational and third-party risks include data breaches, supply chain disruptions, regulatory non-compliance, and unethical business practices by vendors or partners. These risks often stem from inadequate due diligence, poor vendor management, and insufficient monitoring of third-party activities. Organizations must prioritize transparency and robust risk assessment frameworks to mitigate the potential impact on brand reputation and operational stability.

Real-world Examples Highlighting Both Risks

Reputational risk materialized in 2017 when Equifax suffered a massive data breach, eroding customer trust and causing stock prices to plummet. Third-party risk became evident in 2013 when Target's security breach, traced to a compromised HVAC vendor, exposed millions of customer accounts and triggered extensive financial losses. These real-world examples underscore the critical need for robust security protocols to mitigate both reputational and third-party risks in business operations.

Strategies for Identifying and Assessing Each Risk

Reputational risk identification involves continuous monitoring of social media, customer feedback, and public sentiment to detect potential threats to brand image, while assessment relies on impact analysis of negative events on customer trust and market value. Third-party risk is identified through thorough due diligence processes, including vendor audits, compliance checks, and cybersecurity assessments, with evaluation focusing on the third party's operational stability and regulatory adherence. Employing risk scoring models and integrated risk management platforms enhances the precision of both reputational and third-party risk assessment, enabling proactive mitigation strategies.

Best Practices for Mitigating Reputational and Third-party Risks

Best practices for mitigating reputational and third-party risks include conducting thorough due diligence on vendors and partners, implementing continuous monitoring systems for third-party performance and compliance, and establishing clear contractual obligations with accountability measures. Organizations should foster transparent communication channels and invest in employee training on ethical standards to prevent reputational damage linked to third-party actions. Leveraging advanced risk assessment tools and integrating risk management frameworks such as ISO 31000 enhances early detection and mitigation of potential threats.

Future Trends in Managing Reputational and Third-party Risks

Emerging technologies such as AI-powered analytics and blockchain are increasingly applied to enhance transparency and predict reputational and third-party risks with greater precision. Companies are adopting integrated risk management platforms that unify data from diverse sources, enabling real-time monitoring and proactive mitigation strategies. Regulatory frameworks are evolving to mandate stricter due diligence and continuous oversight of third-party engagements, emphasizing the alignment of reputational safeguards with compliance requirements.

Reputational Risk Infographic

libterm.com

libterm.com