Employee Stock Purchase Plans (ESPP) allow you to buy company shares at a discounted price, often through payroll deductions, providing a cost-effective way to build equity and benefit from your employer's growth. Participating in an ESPP can enhance your long-term financial portfolio and align your interests with the company's success. Explore this article to understand how an ESPP can maximize your investment strategy and the important tax implications to consider.

Table of Comparison

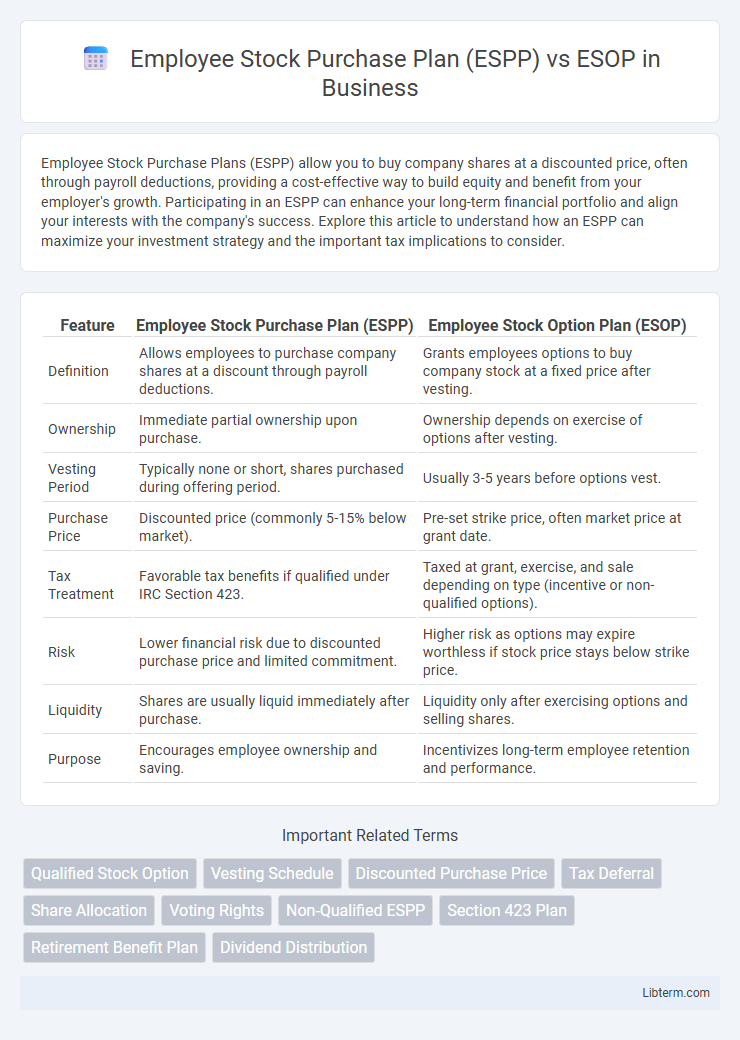

| Feature | Employee Stock Purchase Plan (ESPP) | Employee Stock Option Plan (ESOP) |

|---|---|---|

| Definition | Allows employees to purchase company shares at a discount through payroll deductions. | Grants employees options to buy company stock at a fixed price after vesting. |

| Ownership | Immediate partial ownership upon purchase. | Ownership depends on exercise of options after vesting. |

| Vesting Period | Typically none or short, shares purchased during offering period. | Usually 3-5 years before options vest. |

| Purchase Price | Discounted price (commonly 5-15% below market). | Pre-set strike price, often market price at grant date. |

| Tax Treatment | Favorable tax benefits if qualified under IRC Section 423. | Taxed at grant, exercise, and sale depending on type (incentive or non-qualified options). |

| Risk | Lower financial risk due to discounted purchase price and limited commitment. | Higher risk as options may expire worthless if stock price stays below strike price. |

| Liquidity | Shares are usually liquid immediately after purchase. | Liquidity only after exercising options and selling shares. |

| Purpose | Encourages employee ownership and saving. | Incentivizes long-term employee retention and performance. |

Introduction to Employee Stock Purchase Plans (ESPP) and Employee Stock Ownership Plans (ESOP)

Employee Stock Purchase Plans (ESPP) allow employees to buy company shares at a discount, typically through payroll deductions, promoting ownership and long-term investment. Employee Stock Ownership Plans (ESOP) function as retirement plans that allocate company stock to employees, aligning their interests with corporate performance. Both ESPP and ESOP enhance employee engagement but differ in structure, purpose, and tax implications.

What is an ESPP?

An Employee Stock Purchase Plan (ESPP) allows employees to buy company shares at a discounted price, typically through payroll deductions over a set offering period. ESPPs provide a straightforward way for employees to build ownership in their company with favorable tax benefits under qualifying plans. Unlike Employee Stock Ownership Plans (ESOPs), which involve employer contributions and are primarily retirement-focused, ESPPs emphasize voluntary employee purchase of stock at a discount.

What is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a retirement benefit plan that provides employees with ownership interest in the company through allocated shares, typically funded by the employer. ESOPs serve as a corporate finance strategy to align employee incentives with company performance, often enhancing employee motivation and retention. Unlike Employee Stock Purchase Plans (ESPPs), which allow employees to purchase stock at a discount, ESOPs distribute stock ownership as part of compensation or retirement benefits.

Key Differences Between ESPP and ESOP

Employee Stock Purchase Plans (ESPP) allow employees to buy company stock at a discounted price, often through payroll deductions, providing an accessible way to build equity. Employee Stock Ownership Plans (ESOP) are retirement plans that invest primarily in employer stock, offering employees ownership stakes and potential tax benefits. Key differences include ESPPs being voluntary stock purchase programs with potential discounts, whereas ESOPs function as retirement savings vehicles that allocate shares on behalf of employees, often tied to long-term company performance and vesting schedules.

Eligibility and Participation Criteria

Employee Stock Purchase Plans (ESPP) typically allow employees to purchase company stock at a discounted price through payroll deductions, with eligibility often extended to most full-time employees who have completed a minimum service period, commonly ranging from 30 to 90 days. In contrast, Employee Stock Ownership Plans (ESOP) primarily serve as retirement benefits, offering stock ownership to employees usually after meeting specific tenure requirements, which can vary widely but often require several years of service. Participation in ESPPs is generally voluntary and involves active financial contribution, whereas ESOP participation is typically automatic upon meeting eligibility criteria and ties directly to company contribution or allocation formulas.

Tax Implications: ESPP vs ESOP

Employee Stock Purchase Plans (ESPPs) typically offer favorable tax treatment when shares are purchased at a discount and held for the required holding period, resulting in ordinary income tax on the discount and capital gains tax on gains. Employee Stock Ownership Plans (ESOPs) provide tax benefits including tax-deferred growth of shares and potential tax-deductible contributions made by the employer, with distributions taxed as ordinary income upon withdrawal. Understanding the distinct tax implications is crucial for employees to optimize benefits from ESPPs and ESOPs based on their financial goals and tax situations.

Benefits for Employees: ESPP vs ESOP

Employee Stock Purchase Plans (ESPP) offer employees the benefit of purchasing company shares at a discounted price, often through payroll deductions, providing an accessible way to build ownership and wealth over time. Employee Stock Ownership Plans (ESOP) grant employees ownership interests typically through company contributions, promoting long-term financial security and aligning employees' interests with company performance. ESPPs enable immediate investment opportunities with potential discounted gains, while ESOPs focus on retirement savings and fostering a deeper sense of participation in the company's success.

Employer Perspectives and Objectives

Employers implement Employee Stock Purchase Plans (ESPPs) primarily to enhance workforce motivation and retention by offering employees the opportunity to purchase company shares at a discounted price, fostering a sense of ownership and alignment with corporate performance. In contrast, Employee Stock Ownership Plans (ESOPs) serve as a strategic tool for succession planning, enabling employers to transfer ownership to employees while generating tax advantages and strengthening organizational commitment. Both plans support employee engagement but differ in structure, with ESPPs focused on voluntary stock purchases and ESOPs designed as retirement benefit programs that hold shares in trust.

Financial Risks and Considerations

Employee Stock Purchase Plans (ESPP) involve employees buying company stock at a discount, posing financial risks like stock price volatility and potential loss of investment if the stock value declines. Employee Stock Ownership Plans (ESOP) offer retirement benefits through company stock ownership but carry risks related to the company's financial health and stock liquidity at retirement. Both plans require careful consideration of diversification to avoid overconcentration in employer stock, which can increase financial vulnerability.

Choosing the Right Plan for Your Organization

Choosing the right plan for your organization depends on your goals: Employee Stock Purchase Plans (ESPPs) offer employees discounted shares, fostering immediate ownership and engagement, while Employee Stock Ownership Plans (ESOPs) provide a broader retirement benefit through employee shareholdings. ESPPs can improve cash flow and employee morale by encouraging stock purchases during open enrollment periods, whereas ESOPs serve as a mechanism for succession planning and enhanced long-term employee motivation. Evaluating factors such as company size, financial stability, and employee demographic is crucial to determine whether the immediate benefits of an ESPP or the retirement-focused structure of an ESOP aligns best with your organizational strategy.

Employee Stock Purchase Plan (ESPP) Infographic

libterm.com

libterm.com