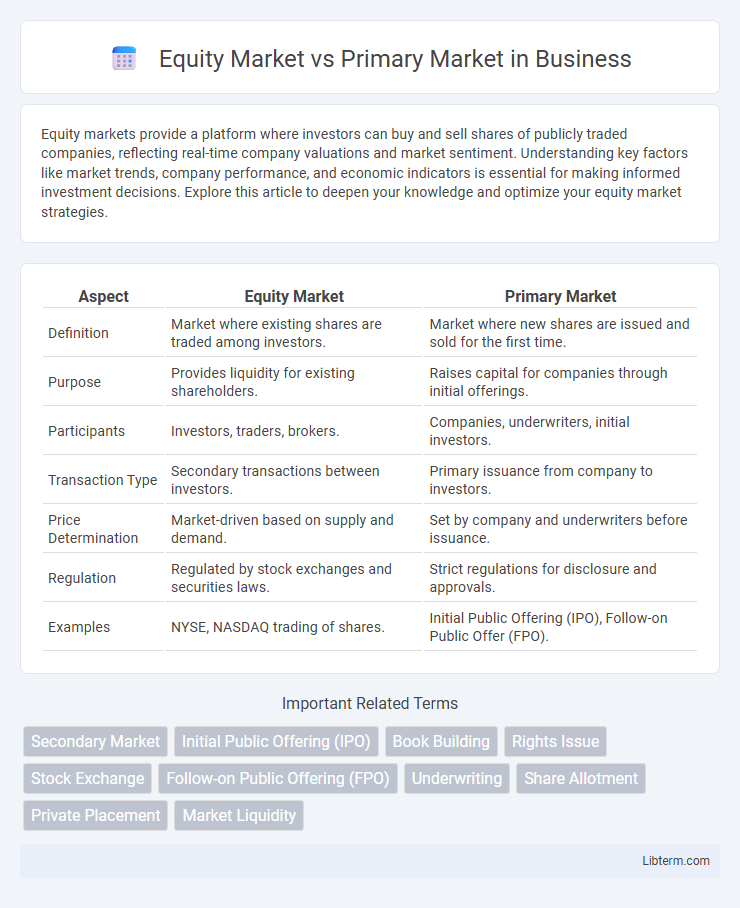

Equity markets provide a platform where investors can buy and sell shares of publicly traded companies, reflecting real-time company valuations and market sentiment. Understanding key factors like market trends, company performance, and economic indicators is essential for making informed investment decisions. Explore this article to deepen your knowledge and optimize your equity market strategies.

Table of Comparison

| Aspect | Equity Market | Primary Market |

|---|---|---|

| Definition | Market where existing shares are traded among investors. | Market where new shares are issued and sold for the first time. |

| Purpose | Provides liquidity for existing shareholders. | Raises capital for companies through initial offerings. |

| Participants | Investors, traders, brokers. | Companies, underwriters, initial investors. |

| Transaction Type | Secondary transactions between investors. | Primary issuance from company to investors. |

| Price Determination | Market-driven based on supply and demand. | Set by company and underwriters before issuance. |

| Regulation | Regulated by stock exchanges and securities laws. | Strict regulations for disclosure and approvals. |

| Examples | NYSE, NASDAQ trading of shares. | Initial Public Offering (IPO), Follow-on Public Offer (FPO). |

Introduction to Equity Market and Primary Market

The equity market refers to a platform where shares of publicly listed companies are bought and sold, providing liquidity and enabling price discovery through investor participation. The primary market, also known as the new issue market, is where companies issue new securities directly to investors for the first time, facilitating capital raising through initial public offerings (IPOs) or private placements. Understanding the distinction is crucial as the primary market creates new equity instruments, while the equity market offers a secondary venue for trading those securities among investors.

Defining the Equity Market

The equity market, also known as the stock market, is a platform where stocks and shares of publicly listed companies are bought and sold, enabling investors to gain ownership stakes. Unlike the primary market, where new securities are issued directly by companies to raise capital, the equity market facilitates secondary trading among investors. This market plays a crucial role in providing liquidity and price discovery for equities, supporting investor participation and corporate growth.

Understanding the Primary Market

The primary market is where new equity securities are created and sold for the first time, often through initial public offerings (IPOs) or private placements, allowing companies to raise capital directly from investors. Unlike the secondary equity market, which involves the trading of existing shares among investors, the primary market facilitates capital formation and corporate growth by issuing fresh shares. Efficient functioning of the primary market is crucial for maintaining liquidity and confidence in broader equity markets.

Key Differences Between Equity Market and Primary Market

The equity market primarily involves the trading of existing shares among investors, reflecting stock prices influenced by supply and demand in secondary transactions. The primary market facilitates the issuance of new securities directly from companies to investors, enabling capital raising through initial public offerings (IPOs) or follow-on public offerings (FPOs). Unlike the equity market, where shares change hands post-issuance, the primary market focuses on fresh capital inflows and company valuation at the point of issuance.

Functions and Roles of the Equity Market

The equity market facilitates the buying and selling of existing shares, providing liquidity and a platform for price discovery, while the primary market enables companies to raise capital by issuing new shares directly to investors. Equity markets play a vital role in allowing investors to trade ownership stakes, influencing corporate governance through shareholder participation. The primary market supports business growth by channeling funds from investors to companies, whereas the equity market ensures continuous trading and valuation of those securities.

Significance of the Primary Market in Capital Formation

The primary market plays a crucial role in capital formation by enabling companies to raise fresh equity capital through initial public offerings (IPOs) and private placements, directly fueling business expansion and innovation. Unlike the equity market, where existing shares are traded among investors, the primary market provides the essential platform for mobilizing savings into productive investments, thereby stimulating economic growth. The efficient functioning of the primary market ensures a continuous influx of funds essential for new projects and infrastructure development, highlighting its significance in the overall financial ecosystem.

Trading Mechanisms: Equity Market vs Primary Market

In the equity market, trading mechanisms involve the buying and selling of existing shares among investors on stock exchanges or over-the-counter platforms, facilitating liquidity and market price discovery. The primary market operates through mechanisms such as initial public offerings (IPOs) and private placements, where new securities are issued directly by companies to investors, enabling capital raising. Unlike the continuous and secondary nature of equity market trading, primary market transactions are typically one-time events that establish the initial distribution of securities.

Advantages and Disadvantages of Each Market

The equity market offers high liquidity and real-time price discovery, allowing investors to buy and sell shares easily, but it is subject to market volatility and price fluctuations that can affect investment value. The primary market provides companies with direct access to capital through initial public offerings (IPOs), enabling fundraising without prior market trading, yet it typically involves higher costs, regulatory scrutiny, and longer timelines. Both markets play crucial roles in financial ecosystems, with the equity market facilitating ongoing trade and price formation, while the primary market focuses on capital generation and company growth.

Impact on Investors and Companies

The equity market provides investors with liquidity and opportunities to buy and sell existing shares, offering price discovery and risk diversification. The primary market enables companies to raise capital directly by issuing new shares, fueling business expansion and innovation. Investors in the primary market often benefit from purchasing shares at the initial offering price, while companies gain crucial funding to support growth strategies.

Conclusion: Choosing Between Equity Market and Primary Market

Choosing between the equity market and the primary market depends on investment goals and risk tolerance. The equity market offers liquidity and the opportunity to trade existing securities, while the primary market provides access to new issuances and potential early gains. Investors seeking immediate ownership of new shares might prefer the primary market, whereas those prioritizing flexibility and diversification often favor the equity market.

Equity Market Infographic

libterm.com

libterm.com