Operating margin measures a company's profitability by showing the percentage of revenue remaining after covering operating expenses. A higher operating margin indicates efficient management and strong control over costs, directly impacting your business's financial health. Explore the rest of the article to understand how improving operating margin can boost your company's performance.

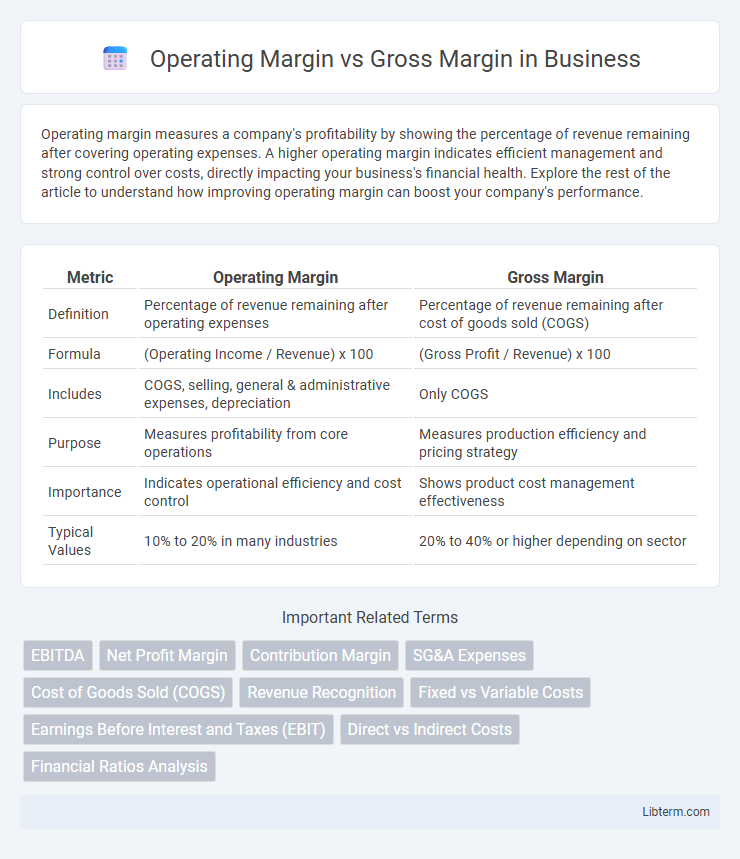

Table of Comparison

| Metric | Operating Margin | Gross Margin |

|---|---|---|

| Definition | Percentage of revenue remaining after operating expenses | Percentage of revenue remaining after cost of goods sold (COGS) |

| Formula | (Operating Income / Revenue) x 100 | (Gross Profit / Revenue) x 100 |

| Includes | COGS, selling, general & administrative expenses, depreciation | Only COGS |

| Purpose | Measures profitability from core operations | Measures production efficiency and pricing strategy |

| Importance | Indicates operational efficiency and cost control | Shows product cost management effectiveness |

| Typical Values | 10% to 20% in many industries | 20% to 40% or higher depending on sector |

Introduction to Operating Margin and Gross Margin

Operating margin measures a company's profitability by comparing operating income to net sales, reflecting how efficiently core business operations generate profit before interest and taxes. Gross margin calculates the percentage of revenue remaining after deducting the cost of goods sold (COGS), highlighting the efficiency of production and pricing strategies. Both margins provide essential insights into financial health, with gross margin focusing on product-level profitability and operating margin encompassing broader operational expenses.

Definition of Gross Margin

Gross margin represents the difference between revenue and the cost of goods sold (COGS), expressed as a percentage of total sales, indicating how efficiently a company produces its products. Operating margin, however, measures the profitability after accounting for operating expenses such as wages, rent, and utilities, reflecting core business performance excluding non-operational factors. Understanding gross margin is crucial for assessing production efficiency before overhead and operating costs affect profitability.

Definition of Operating Margin

Operating Margin represents the percentage of revenue remaining after deducting operating expenses such as wages, depreciation, and cost of goods sold, reflecting a company's core profitability from its primary business operations. It differs from Gross Margin, which only considers revenue minus the cost of goods sold, excluding operating expenses. A higher Operating Margin indicates efficient management and strong operational performance.

Key Differences Between Gross Margin and Operating Margin

Gross margin measures the percentage of revenue remaining after deducting the cost of goods sold (COGS), highlighting production efficiency and direct costs control. Operating margin goes further by accounting for operating expenses such as selling, general, and administrative costs, reflecting overall operational efficiency. While gross margin focuses on core production profitability, operating margin provides a clearer picture of how well a company manages its total operating costs relative to revenue.

Calculating Gross Margin: Formula and Example

Gross Margin is calculated by subtracting the Cost of Goods Sold (COGS) from total revenue, then dividing the result by total revenue, expressed as a percentage ((Revenue - COGS) / Revenue * 100). For example, if a company has $500,000 in revenue and $300,000 in COGS, the gross margin is (($500,000 - $300,000) / $500,000) * 100 = 40%. This metric indicates the efficiency of production and the profitability before operating expenses.

Calculating Operating Margin: Formula and Example

Operating margin is calculated by dividing operating income by net sales and multiplying by 100 to express it as a percentage, representing the efficiency of core business operations. For example, if a company reports $500,000 in operating income and $2,000,000 in net sales, the operating margin is (500,000 / 2,000,000) x 100 = 25%. This metric excludes non-operating expenses and revenues, providing a clearer view of profitability from regular business activities compared to gross margin, which considers only cost of goods sold.

Importance of Gross Margin in Financial Analysis

Gross margin measures the percentage of revenue remaining after deducting the cost of goods sold, highlighting profitability from core production activities and serving as a critical indicator of pricing strategy and cost management effectiveness. Operating margin goes further by accounting for operating expenses, providing insight into overall operational efficiency but is influenced by broader cost structures beyond direct production. Gross margin is essential in financial analysis for benchmarking industry performance, assessing margin sustainability, and identifying potential issues in production costs before they affect operating profitability.

Significance of Operating Margin for Business Health

Operating margin measures a company's profitability after covering operating expenses, reflecting the efficiency and core business performance, while gross margin accounts only for cost of goods sold, highlighting production efficiency. A healthy operating margin indicates strong control over operating costs and pricing strategies, essential for sustaining long-term business growth and financial stability. Investors and managers rely on operating margin as a key metric to assess operational effectiveness and the ability to generate profit from core activities.

When to Use Gross Margin vs Operating Margin

Gross margin is most useful for evaluating the core profitability of a company's production efficiency by measuring revenue minus cost of goods sold, excluding overhead costs. Operating margin provides a broader view of profitability by factoring in operating expenses such as salaries, rent, and utilities, making it ideal for assessing overall operational performance. Use gross margin when analyzing product-level profitability and operating margin when comparing management effectiveness across different companies or industries.

Frequently Asked Questions: Operating Margin vs Gross Margin

Operating Margin measures profitability after operating expenses like salaries and rent, while Gross Margin reflects revenue minus the cost of goods sold (COGS), indicating production efficiency. Frequently asked questions about Operating Margin vs Gross Margin often focus on which metric better represents financial health; Operating Margin provides a clearer picture of overall profitability by including operational costs, whereas Gross Margin highlights core production profitability. Businesses use both margins to assess cost structure and operational efficiency, helping investors and managers make informed decisions.

Operating Margin Infographic

libterm.com

libterm.com