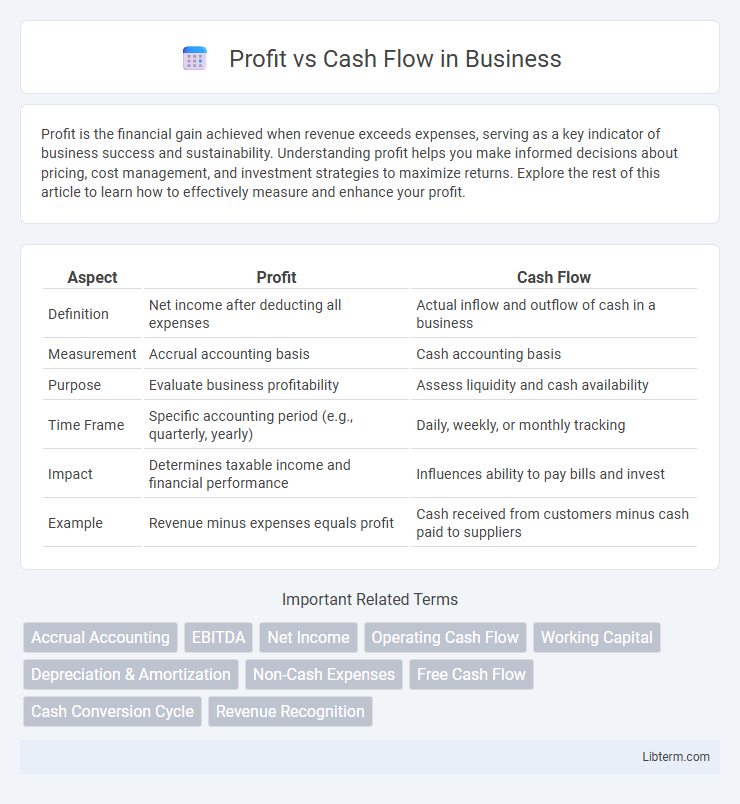

Profit is the financial gain achieved when revenue exceeds expenses, serving as a key indicator of business success and sustainability. Understanding profit helps you make informed decisions about pricing, cost management, and investment strategies to maximize returns. Explore the rest of this article to learn how to effectively measure and enhance your profit.

Table of Comparison

| Aspect | Profit | Cash Flow |

|---|---|---|

| Definition | Net income after deducting all expenses | Actual inflow and outflow of cash in a business |

| Measurement | Accrual accounting basis | Cash accounting basis |

| Purpose | Evaluate business profitability | Assess liquidity and cash availability |

| Time Frame | Specific accounting period (e.g., quarterly, yearly) | Daily, weekly, or monthly tracking |

| Impact | Determines taxable income and financial performance | Influences ability to pay bills and invest |

| Example | Revenue minus expenses equals profit | Cash received from customers minus cash paid to suppliers |

Understanding Profit and Cash Flow: Key Differences

Profit represents the financial gain after deducting all expenses from total revenue within a specific period, reflecting a company's overall profitability. Cash flow measures the actual inflow and outflow of cash, indicating liquidity and the ability to cover immediate obligations. Understanding these differences is crucial for accurate financial analysis, as profit shows long-term viability while cash flow highlights operational efficiency and short-term financial health.

Why Cash Flow Matters More Than Profit

Cash flow represents the actual liquidity available for daily operations, making it crucial for sustaining business activities and meeting financial obligations. Profit indicates overall business success but can be misleading due to non-cash accounting items like depreciation and receivables. Positive cash flow ensures a company can invest, pay debts, and avoid insolvency despite reported profits.

Components of Profit: Gross, Operating, and Net

Gross profit represents revenue minus the cost of goods sold (COGS), reflecting the efficiency of production and pricing strategies. Operating profit, also known as operating income, is derived by subtracting operating expenses such as selling, general, and administrative costs from gross profit, indicating core business profitability. Net profit accounts for all expenses, including taxes and interest, providing a comprehensive measure of the company's financial performance after all costs are considered.

Types of Cash Flow: Operating, Investing, and Financing

Operating cash flow reflects the cash generated from core business operations, indicating the company's ability to sustain day-to-day activities. Investing cash flow involves transactions related to the acquisition or sale of long-term assets, signaling investments in future growth or asset divestitures. Financing cash flow captures the inflow and outflow from issuing or repaying debt, equity, and dividends, revealing how a company funds its operations and returns value to shareholders.

Common Misconceptions About Profit and Cash Flow

Profit represents the accounting earnings of a business after expenses, while cash flow measures the actual inflow and outflow of cash within a specific period. A common misconception is that a profitable company always has positive cash flow, but businesses can show profit on paper while experiencing cash shortages due to delayed receivables or large capital expenditures. Understanding the differences between net profit and cash flow is critical for accurate financial analysis and maintaining operational liquidity.

How Profit and Cash Flow Impact Business Decisions

Profit reflects a company's financial success by showing net income after expenses, directly influencing strategies for expansion and investment. Cash flow reveals actual liquidity, guiding decisions on operational spending, debt management, and immediate financial obligations. Balancing both metrics ensures sustainable growth and effective resource allocation in business planning.

Analyzing Financial Statements: Profit vs Cash Flow

Profit reflects a company's net income after deducting expenses, providing a snapshot of overall financial performance, while cash flow measures the actual inflow and outflow of cash, highlighting liquidity and operational efficiency. Analyzing financial statements requires examining both the income statement for profit figures and the cash flow statement to assess cash generation and usage, revealing potential discrepancies between reported earnings and available cash. Understanding the differences aids in evaluating business sustainability, solvency, and the ability to fund operations or investments.

Strategies to Improve Cash Flow and Profitability

Enhancing cash flow and profitability requires implementing strategies like optimizing accounts receivable by accelerating invoice payments and tightening credit terms to reduce outstanding debts. Controlling operating costs through budgeting and expense monitoring helps maintain sustainable profit margins while preserving liquidity. Leveraging inventory management techniques such as just-in-time ordering minimizes holding costs and frees up cash for reinvestment or debt reduction.

Cash Flow Problems Despite Profitable Operations

Businesses may report strong profits while facing severe cash flow problems due to delayed receivables, excessive inventory, or high operating expenses. Positive net income does not guarantee liquidity if cash inflows are not timely enough to cover short-term obligations like payroll and vendor payments. Effective cash flow management requires monitoring cash conversion cycles and maintaining sufficient working capital to avoid insolvency despite profitability.

Profit vs Cash Flow: Which Drives Business Success?

Profit represents the financial gain after all expenses are deducted from revenue, reflecting the overall business performance. Cash flow measures the actual inflow and outflow of cash, essential for maintaining daily operations and solvency. Successful businesses balance strong profit margins with positive cash flow to sustain growth and avoid liquidity crises.

Profit Infographic

libterm.com

libterm.com