A down payment is an initial upfront cash payment made when purchasing expensive assets like a house or car, reducing the overall loan amount. This payment plays a crucial role in determining your financing terms and monthly installments. Explore the rest of the article to understand how a down payment impacts your financial planning and loan approval.

Table of Comparison

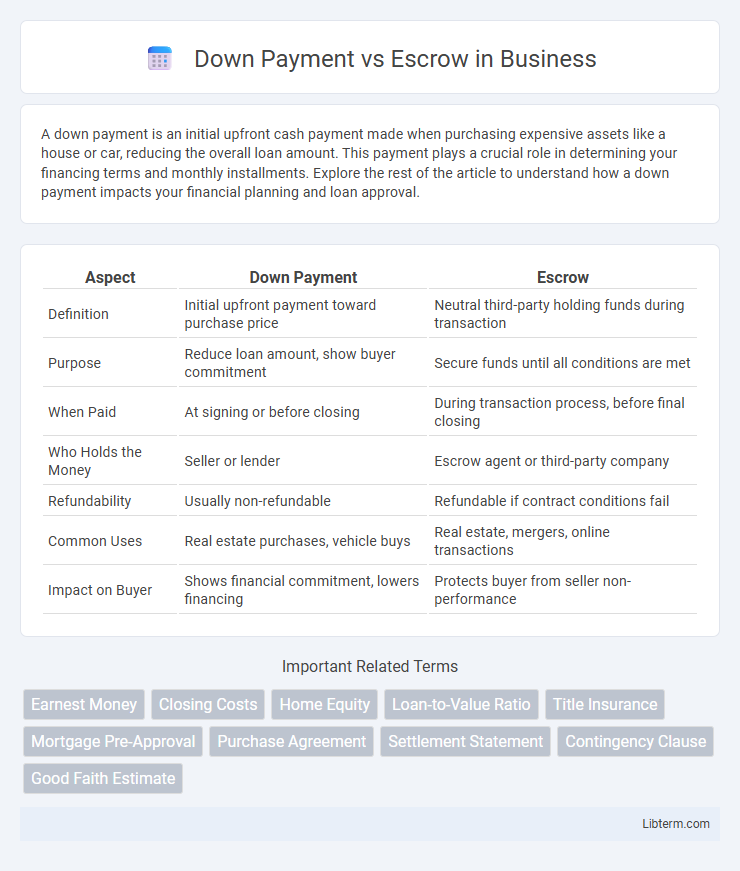

| Aspect | Down Payment | Escrow |

|---|---|---|

| Definition | Initial upfront payment toward purchase price | Neutral third-party holding funds during transaction |

| Purpose | Reduce loan amount, show buyer commitment | Secure funds until all conditions are met |

| When Paid | At signing or before closing | During transaction process, before final closing |

| Who Holds the Money | Seller or lender | Escrow agent or third-party company |

| Refundability | Usually non-refundable | Refundable if contract conditions fail |

| Common Uses | Real estate purchases, vehicle buys | Real estate, mergers, online transactions |

| Impact on Buyer | Shows financial commitment, lowers financing | Protects buyer from seller non-performance |

Understanding Down Payment: Definition and Purpose

A down payment is an initial, upfront partial payment made by a buyer when purchasing a property, typically representing a percentage of the total purchase price. This payment demonstrates the buyer's financial commitment and reduces the lender's risk by lowering the loan amount. Down payments vary by loan type but generally range from 3% to 20%, impacting mortgage terms and interest rates.

What is Escrow? Key Functions Explained

Escrow is a financial arrangement in real estate where a neutral third party holds funds or documents until all conditions of a transaction are met, ensuring a secure exchange between buyer and seller. Key functions of escrow include safeguarding the buyer's down payment, managing the disbursement of funds upon contract fulfillment, and holding important documents like titles to prevent fraud. This process protects both parties by ensuring that neither funds nor property change hands until all contractual obligations are satisfied.

Differences Between Down Payment and Escrow

A down payment is an upfront partial payment made by a buyer toward the purchase price of a property, typically representing a percentage of the total cost. Escrow, on the other hand, is a financial arrangement where a neutral third party holds funds or documents until contractual conditions are met during a real estate transaction. The primary difference is that the down payment directly reduces the purchase price, while escrow funds are held temporarily to ensure all obligations, such as inspections and loan approvals, are satisfied before the sale is finalized.

How Down Payment Works in Real Estate Transactions

A down payment in real estate transactions is an upfront sum paid by the buyer to secure the property, typically ranging from 3% to 20% of the purchase price. This payment reduces the loan amount required and demonstrates the buyer's financial commitment to the lender and seller. Unlike escrow funds held by a third party to cover future expenses, the down payment is directly applied toward the property's purchase cost at closing.

The Role of Escrow in Home Buying

Escrow acts as a secure intermediary during home buying, holding funds such as the down payment until all contract conditions are met. This ensures both the buyer and seller fulfill their obligations, preventing premature fund transfers and reducing transaction risks. The escrow process provides a transparent, neutral environment that protects all parties until closing, facilitating a smooth and trustworthy real estate transaction.

Financial Implications: Down Payment vs. Escrow

Down payment represents the initial equity invested by the buyer, directly reducing the loan amount and impacting monthly mortgage payments and interest over the loan term. Escrow, by contrast, functions as a financial safeguard account managed by a third party, collecting funds for property taxes and insurance, preventing large lump-sum payments and ensuring timely obligations. Understanding the distinct financial roles of down payment and escrow helps buyers assess upfront costs versus ongoing fiscal responsibilities in real estate transactions.

Common Misconceptions About Down Payment and Escrow

Many buyers mistakenly believe a down payment and escrow are the same, but the down payment is the portion of the home's price paid upfront, while escrow is a neutral third party holding funds and documents during the transaction. Another misconception is that escrow funds only involve the down payment; they also include property taxes, insurance, and other closing costs. Understanding these distinctions helps prevent confusion during home buying and ensures accurate financial planning.

Step-by-Step Process: From Down Payment to Escrow Closing

The step-by-step process begins with the down payment, where the buyer provides an initial sum to demonstrate financial commitment, typically ranging from 3% to 20% of the home price. Following the down payment, the transaction moves into the escrow phase, during which a neutral third party holds funds and documents while all closing conditions, such as inspections and title searches, are completed. Escrow closes once all contingencies are met, leading to the transfer of ownership and the release of funds to the seller.

Tips for Managing Down Payments and Escrow Accounts

Effectively managing down payments and escrow accounts requires clear communication with your lender and careful budgeting to ensure funds are available when needed. Keep organized records of all transactions related to your down payment and escrow account to avoid discrepancies and facilitate smooth closing processes. Regularly review your escrow statements to monitor adjustments for property taxes and insurance, enabling better financial planning throughout the homeownership period.

Frequently Asked Questions: Down Payment vs. Escrow

Down payment refers to the initial upfront amount paid by a buyer towards purchasing a property, typically representing a percentage of the total home price, while escrow is a neutral third-party account that holds funds such as down payment, property taxes, and insurance until the transaction conditions are met. Frequently asked questions often clarify that the down payment directly reduces the loan amount, whereas escrow funds safeguard the buyer and seller by ensuring all contractual obligations are fulfilled before closing. Understanding the distinction helps buyers manage financial responsibilities and avoid confusion during the home buying process.

Down Payment Infographic

libterm.com

libterm.com