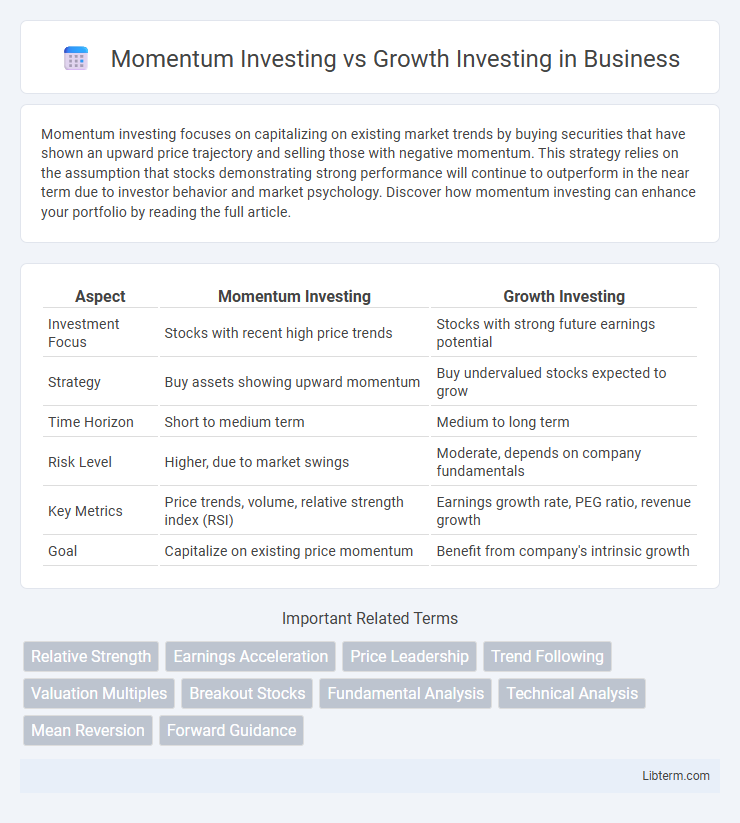

Momentum investing focuses on capitalizing on existing market trends by buying securities that have shown an upward price trajectory and selling those with negative momentum. This strategy relies on the assumption that stocks demonstrating strong performance will continue to outperform in the near term due to investor behavior and market psychology. Discover how momentum investing can enhance your portfolio by reading the full article.

Table of Comparison

| Aspect | Momentum Investing | Growth Investing |

|---|---|---|

| Investment Focus | Stocks with recent high price trends | Stocks with strong future earnings potential |

| Strategy | Buy assets showing upward momentum | Buy undervalued stocks expected to grow |

| Time Horizon | Short to medium term | Medium to long term |

| Risk Level | Higher, due to market swings | Moderate, depends on company fundamentals |

| Key Metrics | Price trends, volume, relative strength index (RSI) | Earnings growth rate, PEG ratio, revenue growth |

| Goal | Capitalize on existing price momentum | Benefit from company's intrinsic growth |

Introduction to Momentum Investing and Growth Investing

Momentum investing capitalizes on the continuation of existing market trends by purchasing stocks exhibiting strong recent performance, driven by investor sentiment and behavioral biases. Growth investing targets companies with high potential for future earnings expansion, emphasizing innovation, market share gains, and reinvestment strategies. Both strategies differ in risk profiles and time horizons, with momentum seeking short-term price acceleration and growth focusing on long-term capital appreciation.

Core Principles of Momentum Investing

Momentum investing relies on the principle that stocks exhibiting strong recent performance will continue to outperform in the near term due to investor behavior and market trends. This strategy capitalizes on the persistence of price trends driven by factors such as investor herding, overreaction, and underreaction to information. Core principles include identifying securities with upward price momentum, timing entry and exit points effectively, and managing risks associated with trend reversals.

Defining Growth Investing Strategies

Growth investing strategies focus on targeting companies with above-average revenue and earnings growth potential, often in emerging or rapidly expanding industries. Investors prioritize firms demonstrating strong financial performance indicators, such as high return on equity (ROE) and robust cash flow projections. This approach emphasizes capital appreciation by selecting stocks expected to outperform the broader market due to innovative products, market expansion, or competitive advantages.

Key Differences Between Momentum and Growth Investing

Momentum investing focuses on capitalizing on existing market trends by purchasing assets showing upward price momentum, relying heavily on recent performance data indicators. Growth investing targets companies with strong potential for long-term earnings expansion, emphasizing fundamental analysis of financial metrics such as revenue growth and profit margins. The key difference lies in momentum investing's trend-following strategy based on price action, while growth investing centers on intrinsic value derived from future growth prospects.

Risk Factors: Momentum vs Growth Approaches

Momentum investing carries higher risk due to its reliance on stock price trends, making it vulnerable to sudden market reversals and volatility spikes. Growth investing involves investing in companies with strong earnings potential but faces risks related to overvaluation and slower-than-expected revenue growth. Both strategies demand careful risk management, yet momentum often experiences sharper drawdowns, whereas growth investing risks stem more from fundamental business performance and market sentiment shifts.

Performance Potential: Momentum vs Growth Stocks

Momentum investing targets stocks exhibiting strong recent price trends, often delivering rapid gains by capitalizing on market sentiment and momentum indicators, while growth investing concentrates on companies with robust earnings growth potential, aiming for long-term value appreciation. Historically, momentum stocks can outperform growth stocks in bullish markets due to their ability to exploit short-term market inefficiencies and investor behavior. However, growth stocks typically offer higher performance potential over extended periods driven by fundamental factors such as revenue expansion, innovative product launches, and scalable business models.

Time Horizon and Suitability for Investors

Momentum investing targets short- to medium-term gains by capitalizing on recent price trends, making it suitable for investors with higher risk tolerance and active trading styles. Growth investing focuses on long-term capital appreciation by investing in companies with strong earnings potential, fitting investors with longer time horizons and willingness to endure market volatility. Choosing between momentum and growth investing depends on an investor's risk profile, time commitment, and financial goals.

Market Conditions Favoring Each Strategy

Momentum investing thrives in trending markets where stock prices exhibit persistent movement, capitalizing on recent performance to predict future gains. Growth investing performs best in expanding economies with favorable interest rates, as companies with strong earnings potential attract long-term investors. Volatile or sideways markets challenge momentum strategies, while growth investing may struggle during economic downturns or rising interest rates.

Popular Metrics Used in Momentum and Growth Investing

Momentum investing relies heavily on metrics like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and price rate of change to identify stocks exhibiting strong price trends. Growth investing focuses on fundamental indicators such as earnings growth rate, price-to-earnings (P/E) ratio, and revenue growth to evaluate companies with high potential for future expansion. Both strategies utilize distinct quantitative tools to balance risk and reward based on market behavior and company performance.

Which Strategy Fits Your Investment Goals?

Momentum investing targets stocks with strong recent performance, aiming for short- to medium-term gains by capitalizing on market trends, whereas growth investing focuses on companies with high potential for long-term earnings expansion and capital appreciation. Momentum suits investors seeking quicker returns and willing to accept higher volatility, while growth investing aligns with those prioritizing sustained growth and long-term wealth accumulation. Assessing your risk tolerance, investment horizon, and income needs determines which strategy best fits your financial goals.

Momentum Investing Infographic

libterm.com

libterm.com