Treasury bills are short-term government securities issued at a discount and mature within one year, offering a secure investment with predictable returns. They are highly liquid, low-risk instruments favored by investors seeking to preserve capital while earning interest. Explore this article to understand how treasury bills can fit into your investment strategy and financial goals.

Table of Comparison

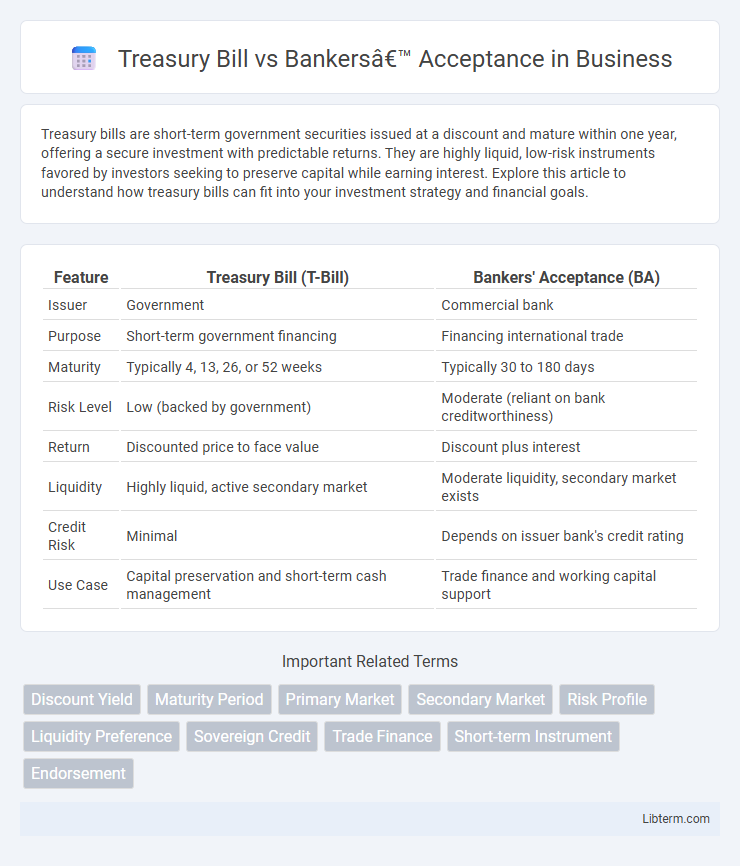

| Feature | Treasury Bill (T-Bill) | Bankers' Acceptance (BA) |

|---|---|---|

| Issuer | Government | Commercial bank |

| Purpose | Short-term government financing | Financing international trade |

| Maturity | Typically 4, 13, 26, or 52 weeks | Typically 30 to 180 days |

| Risk Level | Low (backed by government) | Moderate (reliant on bank creditworthiness) |

| Return | Discounted price to face value | Discount plus interest |

| Liquidity | Highly liquid, active secondary market | Moderate liquidity, secondary market exists |

| Credit Risk | Minimal | Depends on issuer bank's credit rating |

| Use Case | Capital preservation and short-term cash management | Trade finance and working capital support |

Introduction to Treasury Bills and Bankers’ Acceptances

Treasury Bills (T-Bills) are short-term government securities issued at a discount and mature at face value, providing a low-risk investment option with high liquidity. Bankers' Acceptances (BAs) are time drafts guaranteed by a bank, commonly used in international trade to finance receivables and provide short-term credit. Both instruments offer secure, short-term financing solutions but differ in issuer, purpose, and risk profile.

Key Features of Treasury Bills

Treasury Bills (T-Bills) are short-term government securities issued at a discount and mature at face value, providing a secure and liquid investment option with maturities ranging from a few days to one year. Unlike Bankers' Acceptances, which are time drafts guaranteed by a bank used primarily in trade finance, T-Bills have zero default risk due to government backing and are highly favored for cash management and risk-averse portfolios. Key features include their discount issuance method, exemption from state and local taxes, and active secondary market liquidity.

Key Features of Bankers’ Acceptances

Bankers' Acceptances are short-term debt instruments guaranteed by a bank, typically used in international trade to finance imports and exports, with maturities ranging from 30 to 180 days. Unlike Treasury Bills, which are government-issued and considered risk-free, Bankers' Acceptances carry a higher credit risk due to bank backing but offer higher returns. Key features include bank creditworthiness, negotiability in secondary markets, fixed maturity dates, and their role as a secure financing tool for commercial transactions.

Comparison of Issuers and Backing

Treasury bills are issued by the government and backed by the full faith and credit of the issuing country, ensuring minimal credit risk for investors. Bankers' acceptances are issued by banks to guarantee payments on international trade transactions, carrying credit risk primarily tied to the issuing bank's financial stability. While Treasury bills represent sovereign debt instruments, bankers' acceptances function as short-term credit instruments supported by bank guarantees.

Maturity Periods and Liquidity

Treasury Bills typically have short maturity periods ranging from a few days up to one year, offering high liquidity due to their active trading in secondary markets and government backing. Bankers' Acceptances generally have maturity periods of 30 to 180 days and are also highly liquid, especially in international trade finance where they serve as guaranteed payment instruments. The shorter and government-sponsored Treasury Bills often provide more immediate liquidity compared to Bankers' Acceptances, which depend on the creditworthiness of the accepting bank and the specific trade transaction.

Risk Factors and Security

Treasury Bills (T-Bills) are government-issued securities with negligible credit risk due to sovereign backing, making them one of the safest short-term investments. Bankers' Acceptances (BAs) carry moderate credit risk since they depend on the acceptance and creditworthiness of the issuing bank, which can vary significantly. While T-Bills guarantee principal and interest through government assurance, BAs offer security through bank guarantees but expose investors to potential default risk in case of issuer insolvency.

Yield and Returns Analysis

Treasury Bills typically offer lower yields due to their high credit quality and government backing, making them a safer investment with predictable returns. Bankers' Acceptances generally provide higher yields reflecting their slightly elevated credit risk and shorter maturity periods tied to international trade finance. Investors seeking stable returns with minimal risk often prefer Treasury Bills, whereas those aiming for enhanced yields might consider Bankers' Acceptances despite the marginally higher risk.

Market Accessibility and Trading

Treasury Bills (T-Bills) offer high market accessibility due to their active secondary market and direct issuance by governments, making them easily tradable with low risk. Bankers' Acceptances (BAs) are traded primarily in interbank and corporate markets with less liquidity and accessibility for individual investors, as their trading depends heavily on creditworthiness and bank guarantees. The T-Bill market benefits from transparent pricing and standardized maturities, while BAs require more specialized knowledge and connections for effective trading.

Suitability for Different Investors

Treasury bills offer a low-risk option suitable for conservative investors seeking short-term liquidity and government-backed security, making them ideal for risk-averse individuals and institutional portfolios prioritizing capital preservation. Bankers' acceptances appeal to investors comfortable with moderate risk, as they provide higher yields by leveraging the creditworthiness of banks in trade finance, fitting well with corporate treasuries and investors focused on yield enhancement. The choice between Treasury bills and Bankers' acceptances depends on the investor's risk tolerance, investment horizon, and income requirements, with Treasury bills favoring safety and liquidity while Bankers' acceptances emphasize yield and credit risk.

Conclusion: Choosing Between Treasury Bills and Bankers’ Acceptances

Treasury Bills offer government-backed security with lower risk and higher liquidity, making them ideal for conservative investors seeking short-term investments. Bankers' Acceptances provide higher yields with moderate credit risk, suitable for corporate financing and investors willing to accept less liquidity for potential returns. Selecting between these instruments depends on the investor's risk tolerance, investment horizon, and need for liquidity.

Treasury Bill Infographic

libterm.com

libterm.com