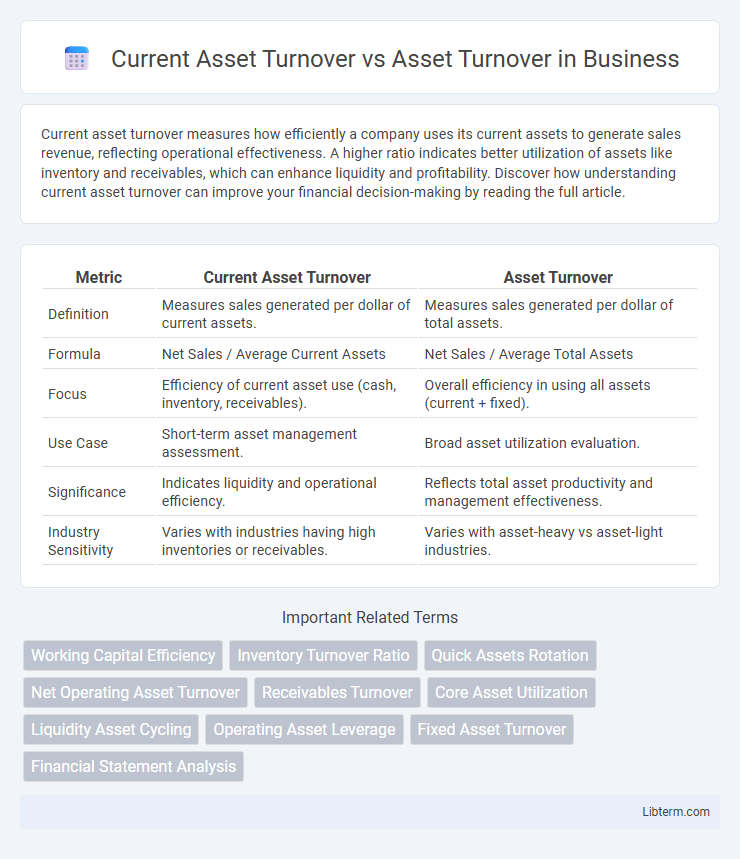

Current asset turnover measures how efficiently a company uses its current assets to generate sales revenue, reflecting operational effectiveness. A higher ratio indicates better utilization of assets like inventory and receivables, which can enhance liquidity and profitability. Discover how understanding current asset turnover can improve your financial decision-making by reading the full article.

Table of Comparison

| Metric | Current Asset Turnover | Asset Turnover |

|---|---|---|

| Definition | Measures sales generated per dollar of current assets. | Measures sales generated per dollar of total assets. |

| Formula | Net Sales / Average Current Assets | Net Sales / Average Total Assets |

| Focus | Efficiency of current asset use (cash, inventory, receivables). | Overall efficiency in using all assets (current + fixed). |

| Use Case | Short-term asset management assessment. | Broad asset utilization evaluation. |

| Significance | Indicates liquidity and operational efficiency. | Reflects total asset productivity and management effectiveness. |

| Industry Sensitivity | Varies with industries having high inventories or receivables. | Varies with asset-heavy vs asset-light industries. |

Introduction to Asset Turnover Ratios

Current Asset Turnover measures how efficiently a company uses its current assets to generate sales, highlighting short-term asset management effectiveness. Asset Turnover ratio, on the other hand, evaluates the overall efficiency of a company in using all its assets, both current and fixed, to produce revenue. These ratios provide critical insights into operational performance and asset utilization, essential for financial analysis and decision-making.

Defining Current Asset Turnover

Current Asset Turnover measures how efficiently a company uses its current assets, such as cash, inventory, and receivables, to generate sales revenue within a specific period. Unlike Asset Turnover, which considers total assets including fixed assets like property and equipment, Current Asset Turnover focuses solely on short-term assets that are expected to be converted into cash within a year. This ratio provides insights into a company's operational efficiency in managing liquid assets to support day-to-day business activities.

What is Total Asset Turnover?

Total Asset Turnover measures a company's efficiency in generating sales from its total assets, calculated by dividing net sales by average total assets. It reflects how well a firm utilizes both current and non-current assets to produce revenue, unlike Current Asset Turnover, which focuses solely on current assets. A higher Total Asset Turnover ratio indicates more effective asset management and operational performance across the entire asset base.

Key Differences Between Current and Total Asset Turnover

Current asset turnover measures how efficiently a company uses its current assets, such as cash, inventory, and receivables, to generate sales, highlighting short-term asset management effectiveness. Total asset turnover evaluates how well a company utilizes all its assets, including both current and fixed assets like property and equipment, to drive revenue, reflecting overall asset productivity. The key difference lies in the scope of assets analyzed: current asset turnover focuses on liquid assets impacting operational cycle, while total asset turnover provides a broader efficiency ratio encompassing the entire asset base.

Calculating Current Asset Turnover

Current Asset Turnover measures a company's efficiency in using its current assets to generate sales, calculated by dividing net sales by average current assets. Asset Turnover, by contrast, evaluates overall asset utilization by dividing net sales by average total assets. Calculating Current Asset Turnover helps businesses analyze how effectively inventory, receivables, and cash are contributing to revenue generation.

Calculating Total Asset Turnover Ratio

Total Asset Turnover Ratio measures a company's efficiency in using all its assets to generate sales by dividing net sales by average total assets, including both current and fixed assets. Current Asset Turnover, in contrast, specifically evaluates how well a company uses its current assets, such as inventory, receivables, and cash, by dividing net sales by average current assets. Calculating Total Asset Turnover provides a comprehensive view of asset utilization across the entire asset base, making it essential for assessing overall operational efficiency.

Interpreting Asset Turnover Metrics

Current Asset Turnover measures how efficiently a company uses its current assets to generate sales, highlighting short-term operational effectiveness, whereas Asset Turnover evaluates the overall efficiency of all assets in producing revenue. Higher Current Asset Turnover indicates strong management of inventory, receivables, and cash, which supports liquidity and operational agility. Comparing these ratios helps investors and analysts identify asset utilization patterns and make informed decisions about a company's operational performance and asset management strategies.

Industry Benchmarks for Asset Turnover

Current Asset Turnover measures how efficiently a company uses its current assets to generate sales, while Asset Turnover evaluates overall asset efficiency, including both current and fixed assets. Industry benchmarks for Asset Turnover vary significantly, with retail sectors often exhibiting higher ratios around 3.0 due to quick inventory turnover, whereas capital-intensive industries like utilities may have lower benchmarks near 0.5 to 1.0. Comparing these ratios against industry standards helps identify operational efficiency and asset utilization strengths or weaknesses specific to the business sector.

Importance of Current vs Total Asset Turnover in Financial Analysis

Current Asset Turnover measures how efficiently a company uses its current assets to generate sales, highlighting short-term asset management. In contrast, Asset Turnover evaluates overall asset utilization, encompassing both current and long-term assets, reflecting a company's total asset productivity. Analysts prioritize Current Asset Turnover for assessing liquidity and operational efficiency, while Total Asset Turnover is crucial for understanding broad capital investment effectiveness and long-term asset utilization.

Improving Asset Efficiency: Best Practices

Current Asset Turnover measures how efficiently a company utilizes its current assets to generate sales, while Asset Turnover evaluates overall asset efficiency by including both current and non-current assets. Improving asset efficiency involves optimizing inventory management, accelerating receivables collection, and enhancing fixed asset utilization through regular maintenance and strategic investments. Implementing advanced analytics and automated tracking systems helps identify underperforming assets, enabling companies to maximize return on total assets and boost operational performance.

Current Asset Turnover Infographic

libterm.com

libterm.com