Strategic acquisition involves the targeted purchase of a company or its assets to enhance competitive advantage, expand market presence, or acquire new capabilities. This approach requires careful analysis of financials, market positioning, and cultural fit to ensure long-term success. Explore the rest of the article to understand how strategic acquisition can elevate your business strategy.

Table of Comparison

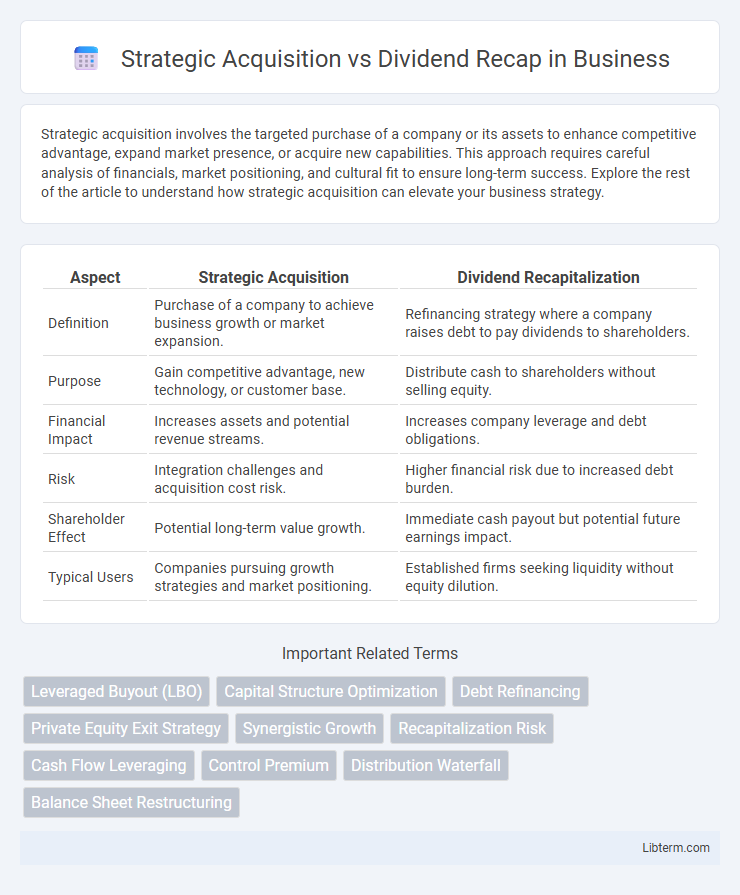

| Aspect | Strategic Acquisition | Dividend Recapitalization |

|---|---|---|

| Definition | Purchase of a company to achieve business growth or market expansion. | Refinancing strategy where a company raises debt to pay dividends to shareholders. |

| Purpose | Gain competitive advantage, new technology, or customer base. | Distribute cash to shareholders without selling equity. |

| Financial Impact | Increases assets and potential revenue streams. | Increases company leverage and debt obligations. |

| Risk | Integration challenges and acquisition cost risk. | Higher financial risk due to increased debt burden. |

| Shareholder Effect | Potential long-term value growth. | Immediate cash payout but potential future earnings impact. |

| Typical Users | Companies pursuing growth strategies and market positioning. | Established firms seeking liquidity without equity dilution. |

Understanding Strategic Acquisition: Definition and Purpose

Strategic acquisition involves a company purchasing another business to enhance its market position, expand product lines, or acquire new technologies, focusing on long-term growth and competitive advantage. This approach typically includes thorough due diligence and aims to create synergies that increase overall company value. Understanding its purpose helps businesses make informed decisions about resource allocation and market expansion strategies.

What is a Dividend Recapitalization?

A dividend recapitalization is a financial strategy where a company incurs new debt to pay a special dividend to shareholders, allowing investors to extract cash without selling equity. This approach contrasts with strategic acquisitions, which involve purchasing target companies to achieve growth or synergies rather than returning capital. Dividend recaps can optimize capital structure but may increase leverage and risk profiles for the business.

Key Differences Between Strategic Acquisition and Dividend Recap

Strategic acquisition involves purchasing another company to achieve long-term growth, market expansion, or competitive advantage, while dividend recapitalization refers to a company taking on new debt to pay dividends to shareholders, enhancing short-term returns. Key differences include the purpose: strategic acquisitions focus on value creation through operational synergies, whereas dividend recaps prioritize immediate shareholder cash flow without necessarily adding operational value. Financial impact varies as acquisitions usually involve significant capital investment and integration risk, while dividend recaps increase leverage and financial risk without asset acquisition.

Benefits of Strategic Acquisition for Business Growth

Strategic acquisitions drive business growth by enabling companies to expand market share, diversify product offerings, and access new customer bases efficiently. They facilitate synergies that improve operational efficiencies and enhance competitive advantage in target industries. Long-term value creation through strategic acquisitions often surpasses the short-term financial gains offered by dividend recapitalizations.

Advantages and Risks of Dividend Recapitalization

Dividend recapitalization provides companies with immediate liquidity by leveraging debt to pay shareholders without diluting equity ownership, enhancing shareholder value in the short term. However, increased leverage raises financial risk, potentially compromising credit ratings and limiting future borrowing capacity during economic downturns. The aggressive debt structure may also pressure cash flow management, leading to potential solvency challenges and reduced operational flexibility.

Financial Impact: Strategic Acquisition vs Dividend Recap

Strategic acquisitions typically involve significant upfront capital outlay and integration costs but often lead to long-term revenue growth and market expansion, enhancing overall company valuation. Dividend recapitalizations provide immediate liquidity to shareholders by increasing leverage without asset acquisition, which can improve short-term financial metrics but may elevate debt risk and strain cash flow. The financial impact of strategic acquisitions centers on value creation through synergy realization, whereas dividend recaps prioritize shareholder returns with potential trade-offs in balance sheet stability.

When to Choose Strategic Acquisition Over Dividend Recap

Choose a strategic acquisition over a dividend recap when aiming for long-term growth, market expansion, or acquiring valuable assets and capabilities that enhance competitive advantage. Strategic acquisitions provide opportunities to integrate complementary businesses, increase market share, and unlock synergies that dividend recaps cannot deliver. Dividend recaps suit companies needing immediate cash returns without altering control, but strategic acquisitions prioritize sustained value creation and business transformation.

Risk Factors in Strategic Acquisition and Dividend Recap

Strategic acquisitions involve integrating new businesses, which carries risks such as overpaying for assets, cultural misalignment, and unforeseen liabilities that can erode expected synergies and financial performance. Dividend recapitalizations increase leverage by refinancing debt to pay dividends, exposing companies to heightened credit risk, reduced financial flexibility, and vulnerability during economic downturns. Both strategies demand rigorous due diligence and risk assessment to mitigate potential impacts on cash flow stability and long-term value creation.

Real-World Examples: Strategic Acquisition vs Dividend Recap

Strategic acquisitions often involve companies like Disney acquiring 21st Century Fox to enhance market share and diversify assets, driving long-term growth. Dividend recapitalizations, as seen in private equity firms such as KKR with portfolio companies, prioritize immediate shareholder value by leveraging debt to pay dividends without selling the business. These real-world examples highlight the trade-offs between growth through strategic asset integration versus short-term liquidity for investors.

How to Decide: Strategic Acquisition or Dividend Recap for Your Business

Deciding between a strategic acquisition and a dividend recap depends on your business goals and financial health. Strategic acquisitions enhance growth potential by expanding market share, product lines, or capabilities, whereas dividend recaps focus on returning capital to shareholders without altering operational control. Evaluate factors such as current debt capacity, market conditions, growth strategy, and shareholder priorities to determine which option aligns best with your company's long-term vision and liquidity needs.

Strategic Acquisition Infographic

libterm.com

libterm.com