Forming a strategic partnership can accelerate business growth by combining resources and expertise from both parties. Effective partnerships enhance market reach, improve innovation, and share risks, creating a competitive advantage. Discover how to choose the right partner and maximize your collaboration by reading the full article.

Table of Comparison

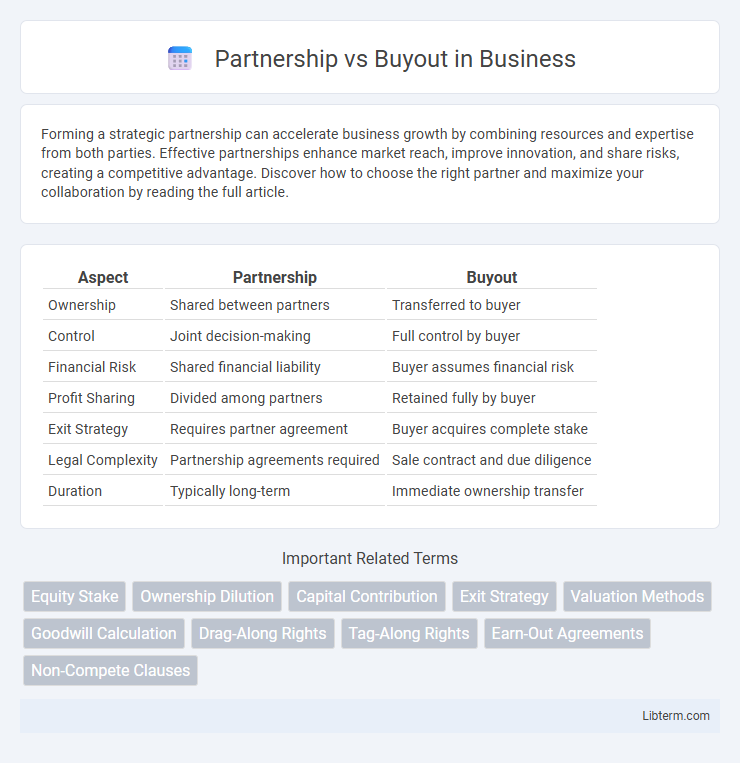

| Aspect | Partnership | Buyout |

|---|---|---|

| Ownership | Shared between partners | Transferred to buyer |

| Control | Joint decision-making | Full control by buyer |

| Financial Risk | Shared financial liability | Buyer assumes financial risk |

| Profit Sharing | Divided among partners | Retained fully by buyer |

| Exit Strategy | Requires partner agreement | Buyer acquires complete stake |

| Legal Complexity | Partnership agreements required | Sale contract and due diligence |

| Duration | Typically long-term | Immediate ownership transfer |

Understanding Partnerships: Definition and Structure

Understanding partnerships involves recognizing them as business arrangements where two or more individuals share ownership, responsibilities, and profits. Key structures include general partnerships, where all partners share equal liability, and limited partnerships, which distinguish between general and limited partners with differing degrees of control and risk. These frameworks impact decision-making, financial contributions, and legal obligations, making the choice critical for business strategy and risk management.

What is a Buyout? Key Concepts Explained

A buyout refers to the acquisition of a controlling interest or the entire ownership stake of a company, often involving a significant purchase of shares or assets by an individual, group, or another company. Key concepts in a buyout include valuation, financing structures such as leveraged buyouts (LBOs), and control transfer, which distinguish it from partnership arrangements where ownership and control are shared. Buyouts enable ownership consolidation, allowing for greater decision-making authority and strategic direction by the acquiring party.

Pros and Cons of Forming a Partnership

Forming a partnership offers shared financial responsibility and combined expertise, enhancing business growth and risk management. However, potential conflicts and divided decision-making authority may hinder progress and create challenges in profit distribution. Legal liability is another significant drawback, as partners are personally liable for business debts and obligations.

Advantages and Disadvantages of a Business Buyout

A business buyout offers full control and decision-making power to the buyer, enabling streamlined strategic direction and operational efficiency. However, it requires significant capital investment and entails higher financial risk, including potential debt burden and loss of shared expertise. The buyout structure also limits collaborative input, which can reduce diverse perspectives and innovation opportunities in the company's growth.

Legal Considerations: Partnership vs. Buyout

Legal considerations in a partnership involve shared liability, joint decision-making, and detailed agreements outlining roles, responsibilities, and profit distribution to prevent disputes. In contrast, a buyout requires clear contractual terms for valuation, transfer of ownership, and indemnities to protect both parties during the acquisition process. Understanding fiduciary duties and compliance with relevant business laws is crucial in both scenarios to ensure legal protection and smooth transitions.

Financial Implications of Each Approach

Partnerships typically involve shared financial risk and reward, allowing for pooled resources and combined expertise, but profits must be split according to the agreement, potentially limiting individual returns. Buyouts require significant upfront capital investment, granting full ownership and control over financial decisions, which can lead to higher returns but also greater exposure to debt and financial liability. Understanding tax implications is crucial, as partnerships often benefit from pass-through taxation while buyouts may trigger capital gains taxes and complex financing costs.

Impact on Business Control and Decision-Making

In a partnership, business control and decision-making are shared equally or based on ownership stakes, requiring consensus among partners, which can slow down the process but allows diverse input and shared responsibility. In a buyout, control shifts to the acquiring party, centralizing decision-making authority and enabling faster, unilateral decisions that align closely with the buyer's strategic vision. The choice between partnership and buyout significantly impacts operational control, governance dynamics, and the agility of business decisions.

Tax Differences Between Partnerships and Buyouts

Partnerships are generally taxed through pass-through taxation, where income is reported on individual partners' tax returns, avoiding double taxation at the entity level. Buyouts, especially when structured as asset purchases, can trigger immediate tax liabilities such as capital gains and depreciation recapture for the selling party. Understanding how partnership distributions are treated versus the tax consequences of asset or stock sales in buyouts is critical for effective tax planning.

Common Scenarios for Partnerships vs Buyouts

Common scenarios for partnerships often involve collaborative ventures where businesses share resources, expertise, and risks to achieve mutual growth, such as co-developing products or entering new markets. Buyouts typically occur when one party seeks full control by acquiring another company's equity, commonly seen in private equity acquisitions, family business succession, or distressed asset purchases. Partnerships are favored for strategic alliances requiring ongoing cooperation, whereas buyouts are preferred for consolidation, streamlining ownership, or executing exit strategies.

Choosing the Right Path: Partnership or Buyout?

Choosing between a partnership and a buyout requires analyzing control preferences, financial capacity, and long-term goals. Partnerships enable shared decision-making and risk, ideal for complementary skills and ongoing collaboration. Buyouts provide full control and potential for greater profits but demand substantial capital and strategic vision for solo business ownership.

Partnership Infographic

libterm.com

libterm.com