An invoice is a detailed document issued by a seller to a buyer, outlining purchased goods or services along with their prices, quantities, and payment terms. It plays a crucial role in maintaining accurate financial records and ensuring timely payments in business transactions. Discover how proper invoice management can streamline Your accounts and enhance cash flow by reading the rest of this article.

Table of Comparison

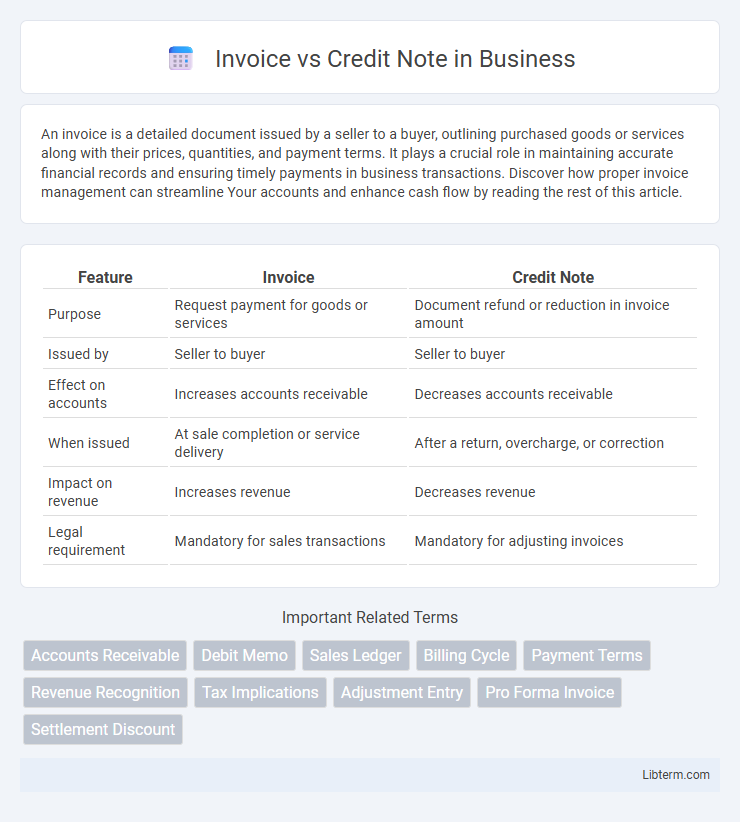

| Feature | Invoice | Credit Note |

|---|---|---|

| Purpose | Request payment for goods or services | Document refund or reduction in invoice amount |

| Issued by | Seller to buyer | Seller to buyer |

| Effect on accounts | Increases accounts receivable | Decreases accounts receivable |

| When issued | At sale completion or service delivery | After a return, overcharge, or correction |

| Impact on revenue | Increases revenue | Decreases revenue |

| Legal requirement | Mandatory for sales transactions | Mandatory for adjusting invoices |

Understanding Invoices and Credit Notes

Invoices serve as formal requests for payment, detailing goods or services provided along with prices, quantities, and payment terms, essential for accurate financial records and cash flow management. Credit notes function as official documents issued to correct or cancel previously issued invoices, reflecting returns, discounts, or billing errors that reduce the amount owed by the customer. Understanding invoices and credit notes ensures proper accounting practices, compliance with tax regulations, and streamlined dispute resolution between buyers and sellers.

Definition of an Invoice

An invoice is a commercial document issued by a seller to a buyer that specifies the products or services provided, their quantities, prices, and total amount due. It serves as a formal request for payment and includes essential details such as invoice number, date, payment terms, and seller contact information. In contrast, a credit note is issued to correct or refund an amount on a previously issued invoice.

Definition of a Credit Note

A credit note is a financial document issued by a seller to a buyer, indicating a reduction in the amount owed due to returned goods, pricing errors, or other adjustments. It acts as proof that the seller has credited the buyer's account, effectively decreasing the outstanding invoice balance. Unlike an invoice, which requests payment, a credit note serves to rectify or cancel part of an invoice, ensuring accurate accounting records for both parties.

Key Differences Between Invoices and Credit Notes

Invoices represent a request for payment issued by a seller to a buyer, detailing products or services provided, quantities, prices, and payment terms. Credit notes are issued to correct or cancel part or all of an invoice, indicating a reduction in the amount owed due to returns, discounts, or errors. Key differences include their purpose--an invoice demands payment, while a credit note adjusts or nullifies a previous invoice--and their impact on accounting records, where invoices increase accounts receivable and credit notes reduce it.

Purpose and Use Cases for Invoices

Invoices serve as formal requests for payment issued by sellers to buyers, detailing products or services provided, quantities, prices, and payment terms. They are essential for recording sales transactions, managing accounts receivable, and ensuring timely payment in business operations. Common use cases for invoices include billing customers after order fulfillment, tracking revenue streams, and supporting financial auditing processes.

Purpose and Use Cases for Credit Notes

Credit notes serve as official documents issued by sellers to buyers to correct errors in invoices or to acknowledge returns, refunds, or discounts. They are used primarily to adjust billing amounts without creating a new invoice, ensuring accurate accounting records and customer satisfaction. Common use cases include product returns, price adjustments, and cancellation of services or orders.

Legal Requirements for Invoices vs Credit Notes

Invoices must comply with strict legal requirements, including unique invoice numbers, issue dates, seller and buyer details, description of goods or services, quantity, price, tax rates, and total amounts payable, ensuring clear evidence of a transaction for tax and accounting purposes. Credit notes, governed by tax regulations, must reference the original invoice, state the reason for issuance, include buyer and seller details, and detail the corrected amounts, facilitating adjustments to previous sales and ensuring accurate VAT reporting and compliance. Both documents are essential for maintaining transparent financial records and must adhere to jurisdiction-specific tax laws, such as VAT directives under the EU or IRS guidelines in the USA.

How to Issue an Invoice and a Credit Note

To issue an invoice, include detailed information such as the seller's and buyer's contact details, unique invoice number, description of goods or services provided, quantities, unit prices, total amount due, payment terms, and issue date. For issuing a credit note, reference the original invoice number, specify the reason for the credit, list the corrected quantities or amounts, and include the credit note date and a unique credit note number. Proper documentation and clear communication are essential in both cases to ensure accurate financial records and facilitate smooth accounting processes.

Common Mistakes with Invoices and Credit Notes

Common mistakes with invoices include incorrect billing amounts, missing invoice numbers, and inaccurate customer details, which can delay payment processing. For credit notes, errors often involve applying incorrect credit amounts or failing to reference the original invoice properly, causing accounting discrepancies. Proper verification and alignment between invoices and credit notes ensure accurate financial records and smooth transaction reconciliation.

Best Practices for Managing Invoices and Credit Notes

Effective management of invoices and credit notes involves accurate documentation and timely reconciliation to maintain clear financial records and minimize errors. Implementing automated accounting software ensures consistency in issuing, tracking, and storing both documents, enhancing audit readiness and cash flow management. Establishing standardized approval workflows and regular reconciliation practices helps promptly address discrepancies, improving vendor relationships and financial transparency.

Invoice Infographic

libterm.com

libterm.com