Greenmail involves purchasing a significant stake in a company to pressure its management into buying back the shares at a premium, often to prevent a hostile takeover. This tactic forces the target company to pay a hefty price to the greenmailer, benefiting the latter at the company's expense. Discover how greenmail impacts your investments and the broader market in the rest of this article.

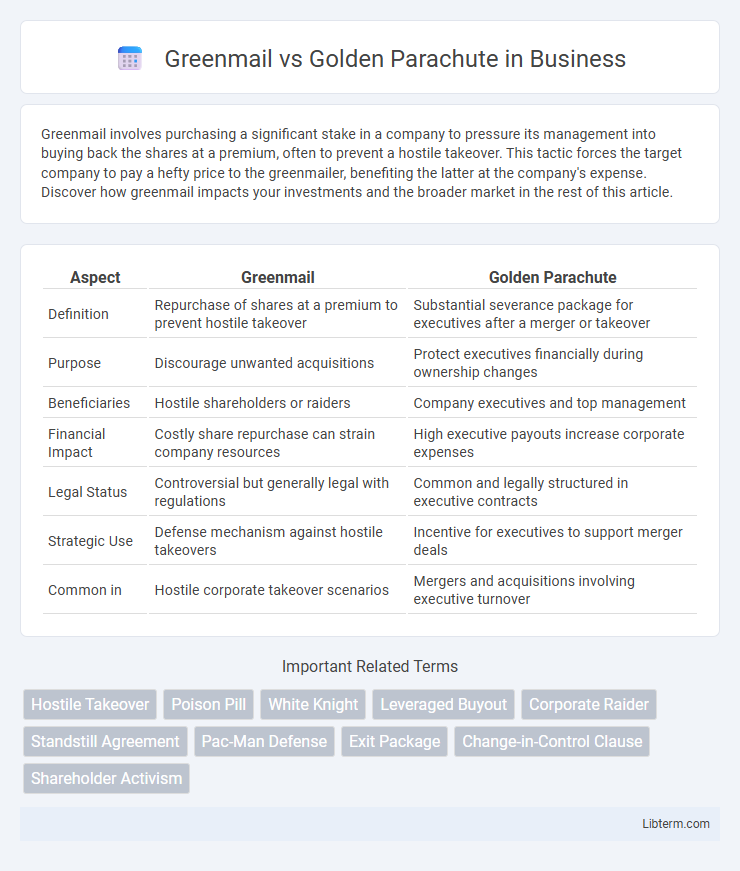

Table of Comparison

| Aspect | Greenmail | Golden Parachute |

|---|---|---|

| Definition | Repurchase of shares at a premium to prevent hostile takeover | Substantial severance package for executives after a merger or takeover |

| Purpose | Discourage unwanted acquisitions | Protect executives financially during ownership changes |

| Beneficiaries | Hostile shareholders or raiders | Company executives and top management |

| Financial Impact | Costly share repurchase can strain company resources | High executive payouts increase corporate expenses |

| Legal Status | Controversial but generally legal with regulations | Common and legally structured in executive contracts |

| Strategic Use | Defense mechanism against hostile takeovers | Incentive for executives to support merger deals |

| Common in | Hostile corporate takeover scenarios | Mergers and acquisitions involving executive turnover |

Understanding Greenmail: Definition and Mechanism

Greenmail refers to a corporate takeover tactic where a potential acquirer buys a substantial block of a company's shares and threatens a hostile takeover, prompting the target company to repurchase the shares at a premium to avoid the takeover. This mechanism forces the target company to pay a significant premium above the market price to the greenmailer, effectively acting as a financial shield. The strategy benefits the greenmailer with a profitable exit while protecting the company from an unwanted acquisition.

Golden Parachute Explained: Key Features

Golden parachutes are lucrative contracts that provide executives with significant severance packages in case of a merger or takeover. Key features include pre-negotiated payments, stock options, bonuses, and benefits designed to protect top management financially during corporate transitions. These agreements aim to retain executive talent and minimize resistance to ownership changes while aligning management's interests with shareholder value.

Historical Context of Greenmail and Golden Parachute

Greenmail emerged prominently in the 1980s as a corporate defense tactic where a company repurchases its stock at a premium from hostile raiders to prevent a takeover, marking a controversial period in merger and acquisition history. The Golden Parachute gained traction during the same era, providing executives with lucrative severance packages to protect leadership during hostile takeovers, influencing corporate governance and executive compensation practices. Both mechanisms played pivotal roles in shaping modern defense strategies against hostile acquisitions in the evolving corporate landscape.

Motivations Behind Greenmail Strategies

Greenmail strategies are primarily motivated by the desire of a target company's management to prevent hostile takeovers by buying back shares at a premium from potential raiders. This preemptive financial maneuver aims to protect existing leadership and maintain control, often at a significant cost to shareholders. Investors engaging in greenmail seek quick profits by threatening a takeover, anticipating management's willingness to pay to avoid disruption.

How Golden Parachutes Protect Executives

Golden parachutes protect executives by guaranteeing substantial financial compensation if they are terminated following a merger or acquisition, ensuring job security and financial stability. These agreements typically include severance pay, bonuses, and stock options, which incentivize executives to support corporate transactions without fear of personal loss. By providing a safety net, golden parachutes help retain top management talent during periods of corporate restructuring and hostile takeovers.

Differences in Legal and Regulatory Perspectives

Greenmail involves the purchase of a substantial block of shares by an investor to threaten a takeover, prompting the target company to repurchase the shares at a premium, often raising legal scrutiny under anti-takeover laws. Golden parachutes are contractual agreements that guarantee substantial benefits to executives if they lose their jobs due to mergers or takeovers, typically regulated to ensure shareholder interests and executive compensation transparency. Regulatory bodies like the SEC closely monitor greenmail for potential market manipulation, while golden parachutes face governance guidelines aimed at preventing excessive payouts and conflicts of interest.

Financial Impacts on Shareholders and Companies

Greenmail imposes significant financial strain on companies by forcing them to repurchase shares at a premium, which drains corporate resources and negatively impacts shareholder value through potential stock price decline. Golden parachutes, while costly due to large executive payouts upon mergers or acquisitions, can stabilize leadership and facilitate smoother transitions, potentially preserving or enhancing shareholder value. Both mechanisms influence corporate governance and capital allocation, with greenmail often viewed as detrimental financial manipulation and golden parachutes as strategic executive risk management.

Criticisms and Ethical Concerns

Greenmail faces criticism for encouraging hostile corporate takeovers by allowing target companies to buy back stock at a premium, often resulting in financial losses for shareholders and promoting short-term profits over long-term stability. Ethical concerns arise from greenmail's potential to reward corporate raiders who exploit loopholes for personal gain, undermining shareholder trust and corporate governance. Golden parachutes attract scrutiny for potentially rewarding executives excessively during company distress or leadership changes, raising questions about fairness and alignment with shareholder interests.

Recent Examples in Corporate America

Greenmail involves a company repurchasing its stock at a premium from a hostile bidder to prevent a takeover, as seen in recent cases like Dell's 2013 buyout attempt by Michael Dell and Silver Lake Partners. Golden parachutes are lucrative severance packages awarded to executives during mergers or acquisitions, highlighted by Uber's $258 million payout to CEO Travis Kalanick after SoftBank's involvement in 2017. Both mechanisms reflect strategic corporate defense and executive compensation trends in contemporary mergers and acquisitions within Corporate America.

Future Trends: Evolving Tactics and Regulations

Future trends in greenmail and golden parachutes indicate a shift towards stricter regulations and enhanced corporate governance to curb excessive executive compensation and hostile takeover defenses. Emerging tactics include increased shareholder activism and the adoption of performance-based incentive structures that align executive rewards with long-term company value. Regulatory bodies are expected to implement more transparent disclosure requirements and robust oversight mechanisms to balance stakeholder interests and prevent abuses in takeover scenarios.

Greenmail Infographic

libterm.com

libterm.com