Direct listing offers an alternative method for companies to go public by allowing existing shares to be sold directly on the stock exchange without issuing new shares or raising capital. This approach provides greater liquidity for shareholders and avoids the dilution of ownership common in traditional IPOs. Discover how direct listing could impact your investment strategy and the broader market by exploring the rest of this article.

Table of Comparison

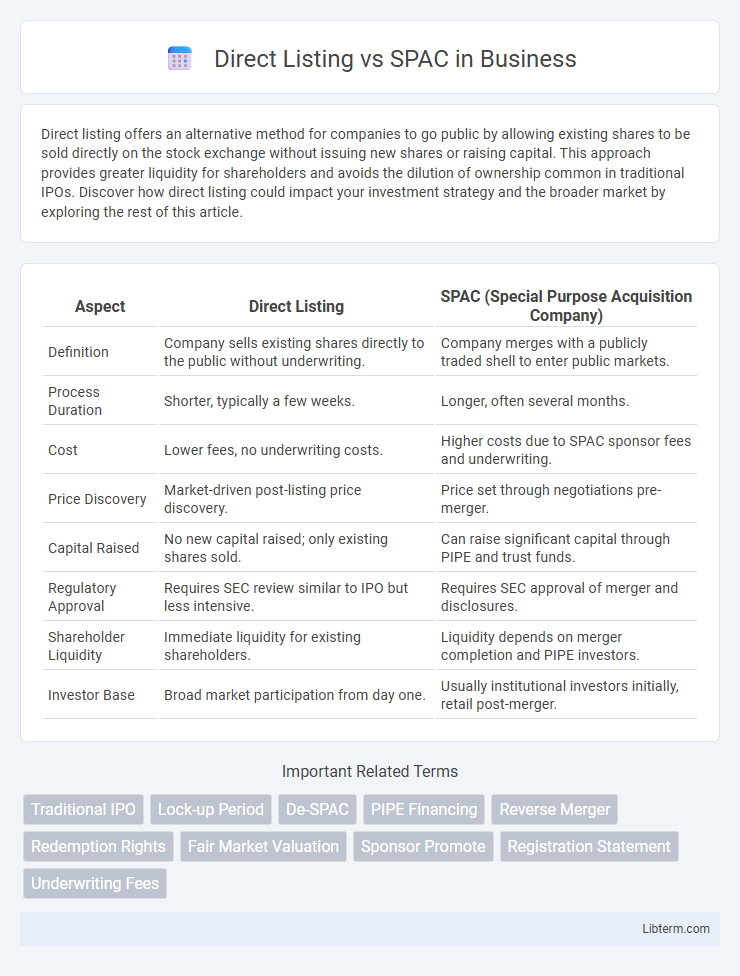

| Aspect | Direct Listing | SPAC (Special Purpose Acquisition Company) |

|---|---|---|

| Definition | Company sells existing shares directly to the public without underwriting. | Company merges with a publicly traded shell to enter public markets. |

| Process Duration | Shorter, typically a few weeks. | Longer, often several months. |

| Cost | Lower fees, no underwriting costs. | Higher costs due to SPAC sponsor fees and underwriting. |

| Price Discovery | Market-driven post-listing price discovery. | Price set through negotiations pre-merger. |

| Capital Raised | No new capital raised; only existing shares sold. | Can raise significant capital through PIPE and trust funds. |

| Regulatory Approval | Requires SEC review similar to IPO but less intensive. | Requires SEC approval of merger and disclosures. |

| Shareholder Liquidity | Immediate liquidity for existing shareholders. | Liquidity depends on merger completion and PIPE investors. |

| Investor Base | Broad market participation from day one. | Usually institutional investors initially, retail post-merger. |

Introduction to Direct Listing and SPAC

Direct listings enable companies to go public by selling existing shares directly on the stock exchange, bypassing traditional underwriters and initial public offerings (IPOs). Special Purpose Acquisition Companies (SPACs) are shell companies that raise capital through an IPO with the intention of merging with a private company, allowing the private firm to become public without the conventional IPO process. Both methods offer alternative routes to public markets, with direct listings emphasizing transparency and liquidity, while SPACs provide speed and reduced regulatory scrutiny.

Understanding the Direct Listing Process

The direct listing process involves a company offering existing shares directly to the public without issuing new shares or raising capital, enabling immediate liquidity for current shareholders. Companies bypass traditional underwriting, which reduces fees and avoids share dilution, while market-driven pricing allows transparent valuation based on supply and demand. Unlike SPAC mergers, direct listings do not involve a sponsored acquisition, making it a streamlined approach suited for firms with strong brand recognition and sufficient capital.

How SPACs Take Companies Public

SPACs take companies public by merging with a private company, allowing it to bypass the traditional initial public offering (IPO) process and gain immediate access to public markets. This method provides faster capital infusion and reduces regulatory scrutiny compared to direct listings. Investors in SPACs gain shares in a newly merged public entity, with the SPAC founders typically receiving a stake as part of the deal structure.

Key Differences Between Direct Listing and SPAC

Direct listings allow companies to sell existing shares directly to the public without issuing new shares or raising capital, whereas SPACs involve merging with a special purpose acquisition company to go public and raise funds simultaneously. Direct listings typically provide immediate liquidity and market-driven pricing, while SPACs offer a private valuation negotiation with subscription agreements and potential PIPE investments. Regulatory scrutiny and disclosure requirements also differ; direct listings follow traditional IPO regulations, while SPAC transactions involve both SEC review of the merger and SPAC-specific rules.

Advantages of Direct Listing

Direct listings enable companies to go public without issuing new shares, allowing existing investors to sell shares directly to the market, thus avoiding dilution. This method reduces underwriting fees significantly compared to traditional IPOs or SPAC mergers, providing cost efficiency. Moreover, direct listings offer greater market-driven price discovery, enhancing transparency and potentially improving shareholder value.

Benefits of Choosing a SPAC

Choosing a SPAC offers companies faster access to public markets compared to traditional IPOs and direct listings, often reducing regulatory hurdles and underwriting costs. SPACs provide confirmed capital through a sponsor, ensuring financial backing and greater certainty for the transaction. This structure also allows private companies to partner with experienced sponsors, benefiting from their market expertise and enhanced valuation negotiations.

Potential Risks and Challenges

Direct listings present risks such as limited capital raise opportunities and less price stability due to the absence of underwriters, increasing volatility during initial trading. SPACs face challenges including potential conflicts of interest, regulatory scrutiny, and the uncertainty of successfully identifying and merging with a viable target company. Both routes carry market perception risks, with direct listings often lacking traditional investor protections and SPACs sometimes criticized for speculative valuations.

Costs: Direct Listing vs SPAC

Direct listings typically incur lower overall costs by avoiding underwriting fees, which can range from 4% to 7% of the capital raised in traditional IPOs. In contrast, SPAC transactions often involve significant expenses, including sponsor promote fees (usually 20% of shares), underwriting fees, and PIPE financing costs, making them generally more expensive. Companies seeking cost efficiency tend to favor direct listings due to reduced intermediary fees and streamlined regulatory requirements.

Case Studies: Notable Companies Going Public

Direct listings showcased by Spotify and Slack demonstrate how established companies can bypass traditional IPOs, enabling existing shareholders to sell shares directly to the public and enhancing liquidity without underwriters. In contrast, SPACs gained prominence with companies like DraftKings and Virgin Galactic, leveraging quicker public entry by merging with a shell company, often with greater price certainty and less regulatory scrutiny. Case studies reveal that direct listings suit firms with strong brand recognition and cash reserves, while SPACs offer faster market access for growth-stage companies seeking flexible capital raising options.

Which Path Is Right for Your Business?

Choosing between a direct listing and a SPAC depends on your company's growth stage, capital needs, and desire for control. Direct listings offer liquidity without diluting ownership or incurring underwriting fees, ideal for established firms seeking transparency and market-driven pricing. SPACs provide faster access to public markets with upfront capital and sponsor expertise, beneficial for high-growth companies aiming for strategic partnerships and flexible deal structures.

Direct Listing Infographic

libterm.com

libterm.com