Cash dividends represent a portion of a company's earnings distributed directly to shareholders in the form of cash, providing an immediate return on investment. This payment approach reflects company profitability and can impact stock prices and investor sentiment. Explore the rest of the article to understand how cash dividends influence your investment strategy and financial growth.

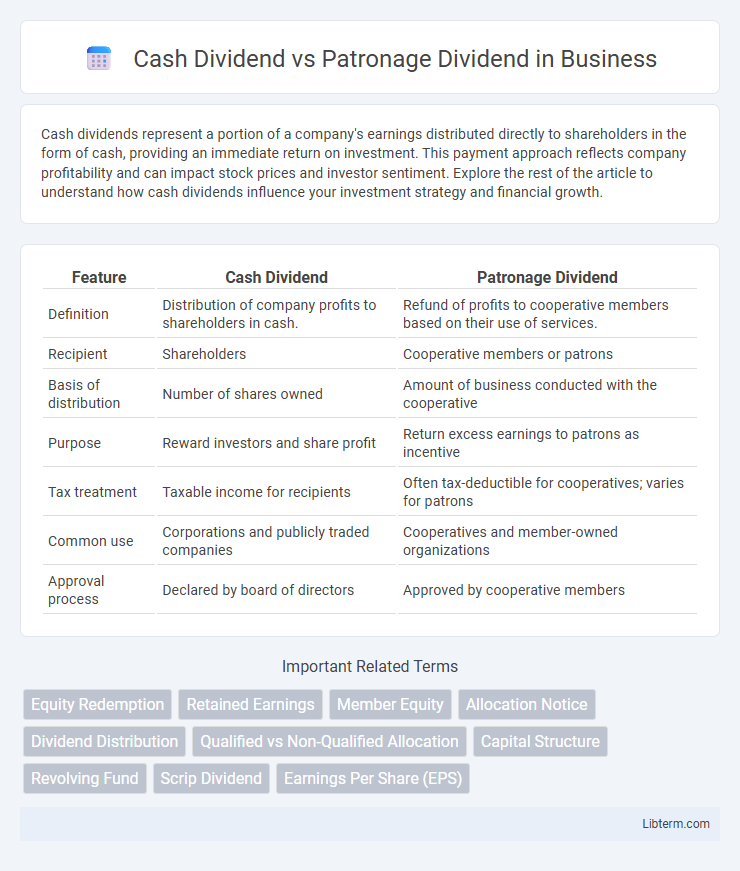

Table of Comparison

| Feature | Cash Dividend | Patronage Dividend |

|---|---|---|

| Definition | Distribution of company profits to shareholders in cash. | Refund of profits to cooperative members based on their use of services. |

| Recipient | Shareholders | Cooperative members or patrons |

| Basis of distribution | Number of shares owned | Amount of business conducted with the cooperative |

| Purpose | Reward investors and share profit | Return excess earnings to patrons as incentive |

| Tax treatment | Taxable income for recipients | Often tax-deductible for cooperatives; varies for patrons |

| Common use | Corporations and publicly traded companies | Cooperatives and member-owned organizations |

| Approval process | Declared by board of directors | Approved by cooperative members |

Introduction to Cash and Patronage Dividends

Cash dividends are direct payments made to shareholders from a corporation's profits, typically distributed in regular intervals, reflecting the company's financial health and profitability. Patronage dividends are profit distributions issued by cooperatives to their members based on the volume of business conducted with the cooperative, emphasizing member participation rather than capital investment. Both dividends serve as a mechanism to return earnings to stakeholders, with cash dividends appealing primarily to investors and patronage dividends reinforcing member loyalty and cooperative principles.

Definition of Cash Dividend

Cash dividends refer to the distribution of a company's earnings directly to shareholders in the form of cash, typically paid on a per-share basis. This type of dividend represents a portion of the company's profits allocated to investors as a return on their investment. Unlike patronage dividends, which are distributed based on member participation or transactions within cooperative organizations, cash dividends are standard in publicly traded corporations and prioritize shareholder equity.

Definition of Patronage Dividend

A patronage dividend is a payment made by cooperatives to their members based on the amount of business each member conducts with the cooperative, reflecting their share of the cooperative's profits. Unlike a cash dividend, which is distributed to shareholders according to the number of shares owned, patronage dividends reward members proportionally to their patronage or usage of the cooperative's services. This profit-sharing approach aligns with cooperative principles, emphasizing member benefits rather than capital investment returns.

Key Differences Between Cash and Patronage Dividends

Cash dividends represent direct payments of a company's profits to shareholders in monetary form, typically based on the number of shares owned. Patronage dividends are distributions provided by cooperatives to members based on their patronage or usage, reflecting the cooperative's earnings proportionate to each member's engagement. Unlike cash dividends, which reward investment, patronage dividends emphasize member participation and are often reinvested or allocated as credits for future cooperative services.

How Cash Dividends Work in Practice

Cash dividends are payments made by corporations directly to shareholders from their earnings, typically distributed on a per-share basis as a fixed amount. Companies declare a dividend amount, set a record date to identify eligible shareholders, and pay out cash on the payment date, providing immediate income to investors. Unlike patronage dividends, which are allocated based on members' transactions with a cooperative, cash dividends represent a straightforward return on investment proportional to stock ownership.

How Patronage Dividends Work in Practice

Patronage dividends work by returning profits to cooperative members based on their level of participation or transactions with the cooperative, rather than distributing earnings as a fixed cash amount. These dividends are often calculated as a percentage of each member's purchases or sales and may be paid in cash, credits, or allocated back to the cooperative as retained earnings. The practice incentivizes member loyalty and aligns the cooperative's financial success with member engagement, differing fundamentally from cash dividends issued by traditional corporations based on stock ownership.

Advantages of Cash Dividends

Cash dividends provide immediate liquidity to shareholders, allowing them to reinvest or use the funds at their discretion without waiting for future distributions. They offer transparent and straightforward returns, reflecting a company's profitability and financial health, which can enhance investor confidence. Unlike patronage dividends, cash dividends are often more predictable and consistent, making them attractive for income-focused investors seeking steady cash flow.

Advantages of Patronage Dividends

Patronage dividends offer advantages by directly returning earnings to cooperative members based on their level of participation, fostering member loyalty and reinforcing cooperative principles. Unlike cash dividends, patronage dividends align member interests with the cooperative's performance, encouraging active involvement and support. This approach enhances financial transparency and promotes equitable distribution of profits within the cooperative community.

Tax Implications of Cash vs. Patronage Dividends

Cash dividends are typically taxed as ordinary income or qualified dividends for shareholders, depending on the holding period and tax regulations, subject to federal and state income taxes. Patronage dividends, often issued by cooperatives, may be considered a return of capital or patronage refund, potentially reducing taxable income if allocated as a credit for patronage-based business. Understanding the distinct tax treatments is crucial for effective tax planning, as cash dividends increase taxable income while patronage dividends might provide beneficial tax deferral or deduction opportunities.

Choosing Between Cash and Patronage Dividends

Choosing between cash dividends and patronage dividends depends on the cooperative's financial strategy and member preferences. Cash dividends provide immediate liquidity and straightforward value to members, making them preferable for those seeking direct income. Patronage dividends, typically allocated based on member transactions with the cooperative, align with principles of cooperative equity and reinvestment, benefiting members who prioritize long-term growth and cooperative sustainability.

Cash Dividend Infographic

libterm.com

libterm.com