Venture debt offers startups a strategic financing option that complements equity funding by providing growth capital without significant ownership dilution. This form of debt is often secured by assets or future receivables and can extend your runway to achieve milestones before the next funding round. Explore the rest of the article to understand how venture debt can be a powerful tool for scaling your business.

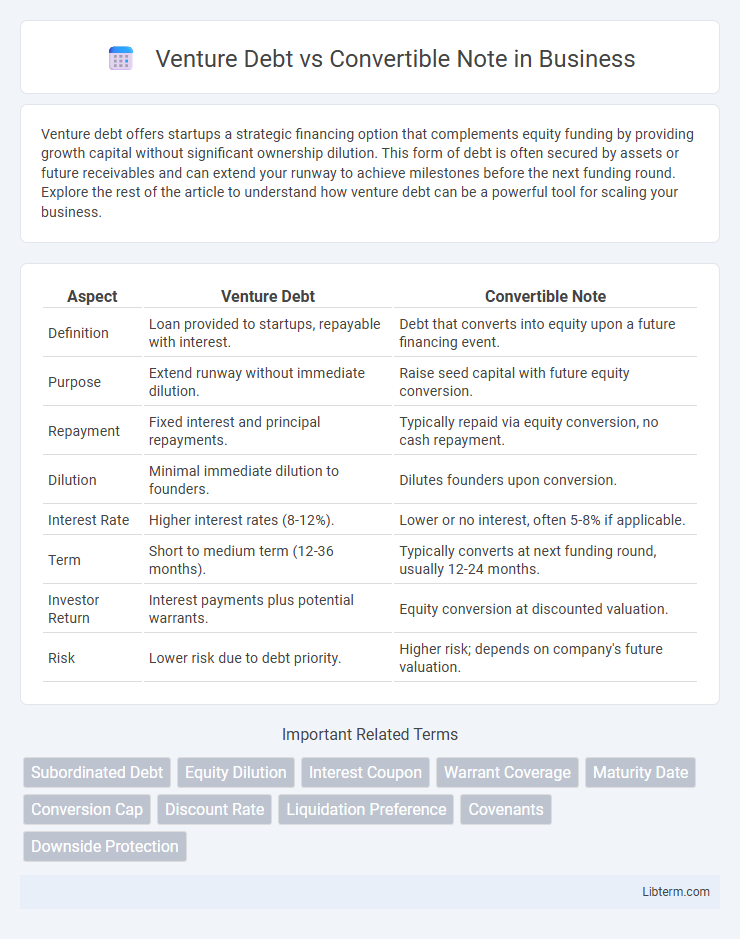

Table of Comparison

| Aspect | Venture Debt | Convertible Note |

|---|---|---|

| Definition | Loan provided to startups, repayable with interest. | Debt that converts into equity upon a future financing event. |

| Purpose | Extend runway without immediate dilution. | Raise seed capital with future equity conversion. |

| Repayment | Fixed interest and principal repayments. | Typically repaid via equity conversion, no cash repayment. |

| Dilution | Minimal immediate dilution to founders. | Dilutes founders upon conversion. |

| Interest Rate | Higher interest rates (8-12%). | Lower or no interest, often 5-8% if applicable. |

| Term | Short to medium term (12-36 months). | Typically converts at next funding round, usually 12-24 months. |

| Investor Return | Interest payments plus potential warrants. | Equity conversion at discounted valuation. |

| Risk | Lower risk due to debt priority. | Higher risk; depends on company's future valuation. |

Understanding Venture Debt

Venture debt is a form of financing that provides growth capital to startups without diluting equity, typically structured as a loan with warrants or rights to purchase equity. It complements venture capital by extending runway while preserving ownership, making it ideal for companies with predictable revenue but limited equity to offer. Unlike convertible notes, venture debt requires regular repayments and may impose financial covenants, impacting cash flow and operational flexibility.

What is a Convertible Note?

A convertible note is a type of short-term debt instrument used by startups to raise capital, which automatically converts into equity during a future financing round. It typically includes a valuation cap and a discount rate, providing early investors with equity at a favorable price compared to later investors. Convertible notes are popular because they delay valuation discussions and offer a streamlined path from debt to equity.

Key Differences Between Venture Debt and Convertible Notes

Venture debt provides non-dilutive financing primarily used to extend runway and optimize capital efficiency, while convertible notes are debt instruments designed to convert into equity during a future funding round. Venture debt typically includes interest payments and warrants, offering lenders downside protection with defined repayment terms, whereas convertible notes function as hybrid instruments with conversion discounts and valuation caps incentivizing early investors. The choice between these options depends on a startup's need for cash flow flexibility versus strategic equity financing, impacting dilution, cost of capital, and control considerations.

Advantages of Venture Debt Financing

Venture debt financing provides startups with non-dilutive capital, allowing founders to retain greater equity and control compared to convertible notes. It offers predictable repayment terms and structured interest, reducing uncertainty around future dilution and valuation cap complexities common in convertible notes. This form of financing often complements venture capital by extending the runway and supporting growth without triggering immediate ownership conversion or significant valuation adjustments.

Benefits of Using Convertible Notes

Convertible notes offer startups flexible funding by deferring valuation discussions until a future financing round, reducing early negotiation complexities. They provide investors with potential upside through conversion discounts and valuation caps, aligning interests while minimizing immediate equity dilution. This instrument simplifies fundraising with quicker execution and lower legal costs compared to traditional equity rounds.

Risks and Drawbacks: Venture Debt vs Convertible Note

Venture debt carries the risk of immediate repayment obligations, which can strain a startup's cash flow and potentially lead to default if revenue targets are not met. Convertible notes may dilute founder ownership upon conversion and introduce valuation uncertainties during subsequent funding rounds. Both financing options expose startups to financial risks, but venture debt emphasizes repayment pressure while convertible notes focus on future equity dilution and investor control.

Ideal Scenarios for Venture Debt

Venture debt is ideal for startups with consistent revenue growth and existing venture capital backing, seeking capital to extend runway without diluting ownership. It suits companies aiming to finance equipment purchases, working capital, or market expansion while preserving equity for future funding rounds. This option benefits firms with predictable cash flows and a clear path to profitability, mitigating dilution compared to convertible notes.

When to Choose a Convertible Note

Choose a convertible note when early-stage startups seek flexible, quick financing without immediate valuation pressure, allowing investors to convert debt into equity during subsequent funding rounds. This instrument is ideal for companies anticipating rapid growth and future equity financing, providing founders with less dilution upfront. Convertible notes align well with uncertain valuations and evolving business models, offering a streamlined path to secure capital before setting a formal valuation.

Impact on Startup Equity and Ownership

Venture debt provides startups with capital without immediate equity dilution, preserving ownership but often requiring warrants as a form of equity participation. Convertible notes delay equity impact by converting debt into shares during future financing rounds, which can cause dilution based on valuation caps and discount rates. Startups should weigh venture debt's fixed repayment obligations against the potential ownership dilution from convertible notes when managing their capital structure.

Decision Factors: Choosing the Right Funding Option

Choosing between venture debt and a convertible note depends on several decision factors such as the company's stage, cash flow stability, and growth potential. Venture debt suits startups with predictable revenue seeking non-dilutive capital, while convertible notes appeal to early-stage companies aiming for equity financing with deferred valuation. Consideration of repayment terms, interest rates, dilution risks, and fundraising timelines is crucial in selecting the optimal funding option.

Venture Debt Infographic

libterm.com

libterm.com