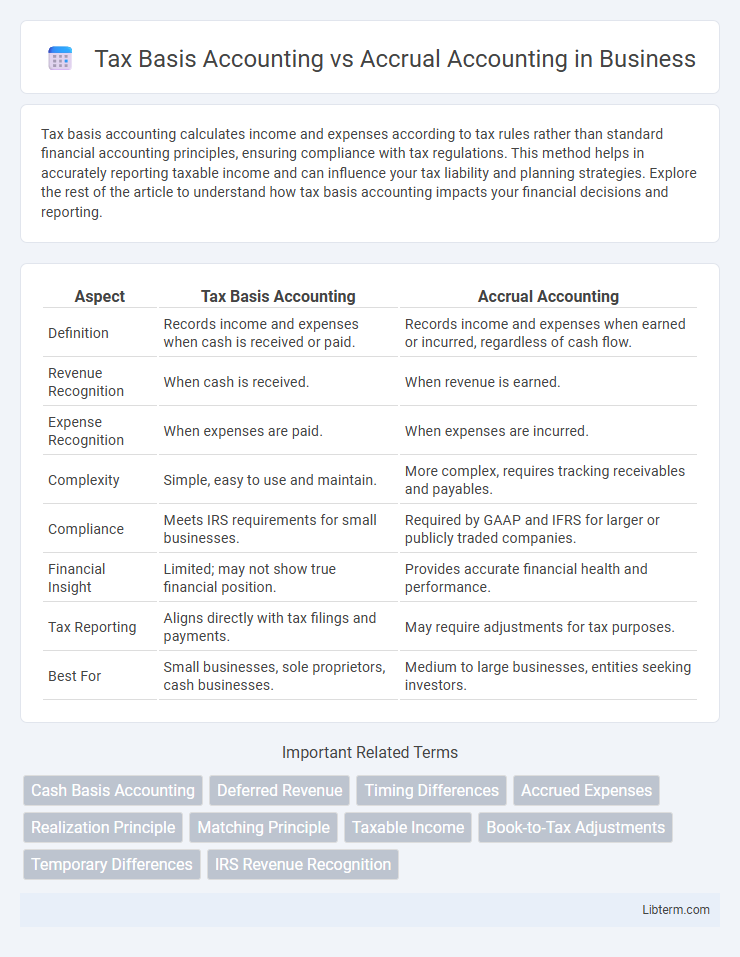

Tax basis accounting calculates income and expenses according to tax rules rather than standard financial accounting principles, ensuring compliance with tax regulations. This method helps in accurately reporting taxable income and can influence your tax liability and planning strategies. Explore the rest of the article to understand how tax basis accounting impacts your financial decisions and reporting.

Table of Comparison

| Aspect | Tax Basis Accounting | Accrual Accounting |

|---|---|---|

| Definition | Records income and expenses when cash is received or paid. | Records income and expenses when earned or incurred, regardless of cash flow. |

| Revenue Recognition | When cash is received. | When revenue is earned. |

| Expense Recognition | When expenses are paid. | When expenses are incurred. |

| Complexity | Simple, easy to use and maintain. | More complex, requires tracking receivables and payables. |

| Compliance | Meets IRS requirements for small businesses. | Required by GAAP and IFRS for larger or publicly traded companies. |

| Financial Insight | Limited; may not show true financial position. | Provides accurate financial health and performance. |

| Tax Reporting | Aligns directly with tax filings and payments. | May require adjustments for tax purposes. |

| Best For | Small businesses, sole proprietors, cash businesses. | Medium to large businesses, entities seeking investors. |

Understanding Tax Basis Accounting

Tax basis accounting records income and expenses when they are recognized for tax purposes, aligning financial reporting with IRS rules and regulations. This method simplifies tax preparation by focusing on taxable income and deductible expenses, often leading to differences from financial statements prepared under accrual accounting. Understanding tax basis accounting is crucial for businesses aiming to optimize tax planning and ensure compliance with tax authorities.

Key Principles of Accrual Accounting

Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of cash flow, ensuring a more accurate financial picture. Key principles include the matching principle, which aligns expenses with related revenues in the same period, and revenue recognition, which records income when earned rather than received. This method offers better insight into an organization's financial health compared to tax basis accounting, which focuses on cash transactions.

Major Differences Between Tax Basis and Accrual Accounting

Tax basis accounting records income and expenses only when cash is received or paid, providing a straightforward view of cash flow but potentially delaying income recognition. Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of cash movement, offering a more accurate picture of financial performance. Key differences include timing of income and expense recognition, complexity of record-keeping, and compliance requirements with GAAP and IRS regulations.

Advantages of Tax Basis Accounting

Tax basis accounting offers the advantage of simplicity by recording income and expenses only when cash is received or paid, which makes it easier for small businesses to manage their finances and comply with tax regulations. This method often results in lower administrative costs and reduced need for complex accounting systems compared to accrual accounting. Tax basis accounting also provides a clearer picture of actual cash flow, helping businesses maintain liquidity and avoid cash shortages.

Benefits of Accrual Accounting Methods

Accrual accounting provides a more accurate financial picture by recognizing revenues and expenses when they are incurred, regardless of cash flow, which enhances decision-making and financial planning. This method allows businesses to track receivables and payables efficiently, improving cash management and forecasting. It also ensures compliance with Generally Accepted Accounting Principles (GAAP), making financial statements more reliable for investors and creditors.

Compliance Requirements for Each Approach

Tax basis accounting requires adherence to IRS regulations, focusing on recognizing income and expenses when cash transactions occur, which simplifies tax compliance for small businesses and sole proprietors. Accrual accounting mandates compliance with Generally Accepted Accounting Principles (GAAP) and matching revenue with expenses when earned or incurred, providing a more accurate financial picture critical for publicly traded companies and entities seeking external financing. Regulatory bodies like the IRS and the Financial Accounting Standards Board (FASB) enforce these standards to ensure transparent and consistent financial reporting across different business types.

Impact on Financial Statements

Tax basis accounting recognizes income and expenses only when cash is exchanged, resulting in financial statements that reflect actual cash flow but may not present a complete picture of a company's long-term financial health. Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash movement, providing a more accurate representation of financial position and performance over time. This difference significantly impacts the timing and comparability of financial statements, influencing decision-making for investors, creditors, and management.

Suitability for Different Business Types

Tax basis accounting is ideal for small businesses and sole proprietorships due to its simplicity and focus on cash flow, recognizing income and expenses only when cash changes hands. Accrual accounting suits larger businesses and companies with complex transactions, as it records revenues and expenses when they are earned or incurred, providing a more accurate financial picture. Businesses dealing with inventory, long-term contracts, or seeking external financing often prefer accrual accounting for better compliance and financial analysis.

Tax Implications and Planning Strategies

Tax basis accounting records income and expenses based on the timing of taxable events, directly aligning with IRS requirements, making it simpler for tax reporting but potentially deferring expense recognition. Accrual accounting recognizes income and expenses when they are earned or incurred, offering a more accurate financial picture but possibly triggering tax liabilities before cash is received or paid. Strategic tax planning involves choosing tax basis accounting for cash flow management and tax deferral benefits, while accrual accounting supports detailed financial analysis and compliance for businesses required to report GAAP financials.

Choosing the Right Accounting Method for Your Organization

Choosing the right accounting method--tax basis or accrual accounting--depends on your organization's size, financial complexity, and reporting needs. Tax basis accounting aligns with IRS regulations, simplifying tax preparation for small businesses but may lack detailed financial insights. Accrual accounting provides a comprehensive view of financial health by recording revenues and expenses when earned or incurred, ideal for organizations seeking precise financial reporting and long-term planning.

Tax Basis Accounting Infographic

libterm.com

libterm.com