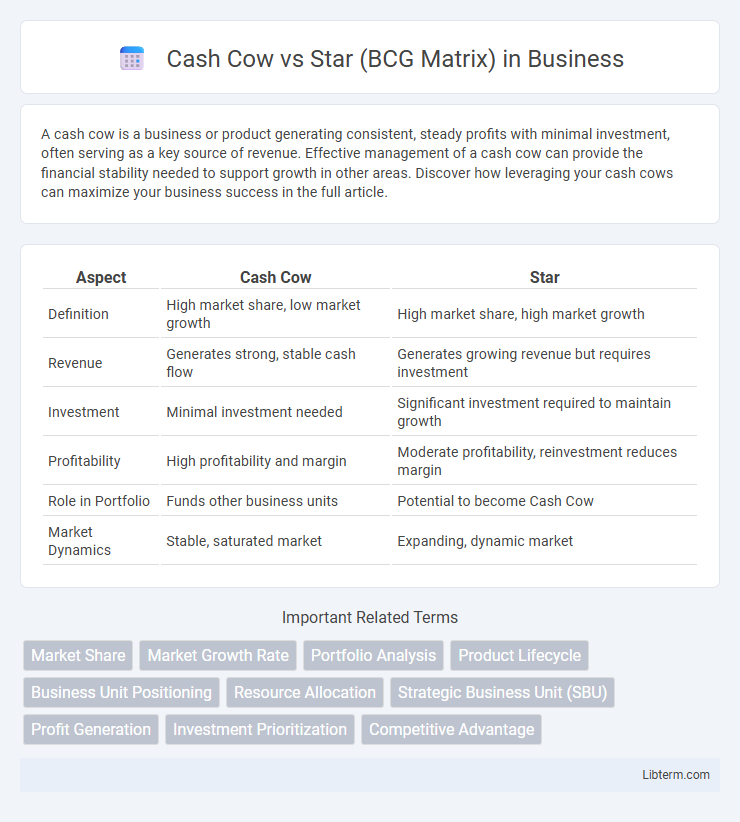

A cash cow is a business or product generating consistent, steady profits with minimal investment, often serving as a key source of revenue. Effective management of a cash cow can provide the financial stability needed to support growth in other areas. Discover how leveraging your cash cows can maximize your business success in the full article.

Table of Comparison

| Aspect | Cash Cow | Star |

|---|---|---|

| Definition | High market share, low market growth | High market share, high market growth |

| Revenue | Generates strong, stable cash flow | Generates growing revenue but requires investment |

| Investment | Minimal investment needed | Significant investment required to maintain growth |

| Profitability | High profitability and margin | Moderate profitability, reinvestment reduces margin |

| Role in Portfolio | Funds other business units | Potential to become Cash Cow |

| Market Dynamics | Stable, saturated market | Expanding, dynamic market |

Introduction to the BCG Matrix

The BCG Matrix, developed by the Boston Consulting Group, categorizes business units into four groups based on market growth and relative market share, including Cash Cows and Stars. Cash Cows represent mature products with high market share but low growth, generating steady cash flow, while Stars are high-growth, high-market-share units requiring investment to sustain growth. This framework helps businesses allocate resources strategically for maximizing long-term profitability.

Defining Cash Cows

Cash Cows represent business units or products with high market share in a mature, low-growth industry, generating steady and substantial cash flow. These units fund other segments, requiring minimal investment due to established market dominance and customer loyalty. The BCG Matrix categorizes Cash Cows as vital for sustaining company operations and fueling growth in other divisions.

Understanding Stars in the BCG Matrix

Stars in the BCG Matrix represent business units or products with high market growth and high market share, indicating strong competitive positions and significant potential for revenue generation. These units require substantial investment to sustain rapid growth and maintain market leadership while eventually evolving into Cash Cows as market growth slows. Understanding Stars is crucial for allocating resources effectively to leverage future profitability and market dominance.

Key Differences: Cash Cow vs Star

Cash Cow products generate consistent, high cash flow with low market growth, serving as a stable source of revenue and funding for other business units. Star products operate in high-growth markets with significant market share, requiring substantial investment to sustain rapid expansion and eventually become Cash Cows. The key difference lies in growth potential and investment needs: Cash Cows have market saturation and steady returns, whereas Stars focus on growth opportunities with higher risk and resource demands.

Financial Performance Comparison

Cash Cows generate steady, high cash flow with low investment needs, delivering consistent profitability and funding other business units. Stars exhibit high market growth and potential but require substantial investment, often resulting in variable profitability during expansion phases. Financial performance of Cash Cows typically shows strong, stable returns, while Stars may incur higher costs and lower short-term margins despite promising future earnings.

Strategic Importance in Business

Cash Cows generate consistent, high cash flow with low market growth, making them critical for funding other business units and maintaining overall financial stability. Stars operate in high-growth markets and require significant investment to sustain rapid expansion but hold the potential to become future Cash Cows. Strategically, balancing Cash Cows and Stars ensures a firm's long-term viability by optimizing resource allocation between mature, profitable products and high-potential growth opportunities.

Investment Strategies for Stars and Cash Cows

Stars demand aggressive investment to sustain rapid growth and capitalize on market leadership, often requiring substantial capital to enhance production capacity and expand market share. Cash Cows generate stable cash flow with minimal investment, allowing firms to allocate surplus funds to fuel Stars and support other business units. Effective resource allocation prioritizes funding innovation and marketing for Stars while optimizing operational efficiency in Cash Cows to maximize profitability.

Challenges in Managing Cash Cows and Stars

Cash Cows generate stable cash flow but face challenges in maintaining market leadership due to market saturation and limited growth potential, requiring careful cost control to sustain profitability. Stars demand significant investment to support rapid growth and market expansion, creating pressure on cash resources and necessitating strategic allocation to avoid cash flow constraints. Managing the balance between investing in Stars and leveraging Cash Cows is crucial for optimizing long-term portfolio performance within the BCG Matrix framework.

Real-World Examples: Cash Cow vs Star

Apple's iPhone represents a Star in the BCG Matrix, showing high market growth and strong market share driven by continuous innovation and consumer demand. Microsoft Office serves as a Cash Cow, maintaining a dominant market share in a mature market with steady revenue and low investment needs. These examples illustrate how companies balance investment in Stars for future growth while leveraging Cash Cows to fund operations and new ventures.

Conclusion: Choosing the Right Strategy

Selecting the appropriate strategy between Cash Cow and Star in the BCG Matrix depends on a company's growth objectives and resource allocation capacity. Cash Cow businesses generate steady revenue with low investment, best suited for funding other segments, while Star units require significant investment to maintain high growth and market leadership. Prioritizing Stars can drive future expansion, but managing Cash Cows ensures financial stability and sustainability.

Cash Cow Infographic

libterm.com

libterm.com