Restricted Stock Units (RSUs) are company shares granted to employees as part of their compensation, subject to a vesting schedule that aligns with performance or tenure. These units convert to actual stock ownership once vesting conditions are met, offering potential financial growth tied to company success. Explore the full article to understand how RSUs can impact Your compensation strategy and long-term financial planning.

Table of Comparison

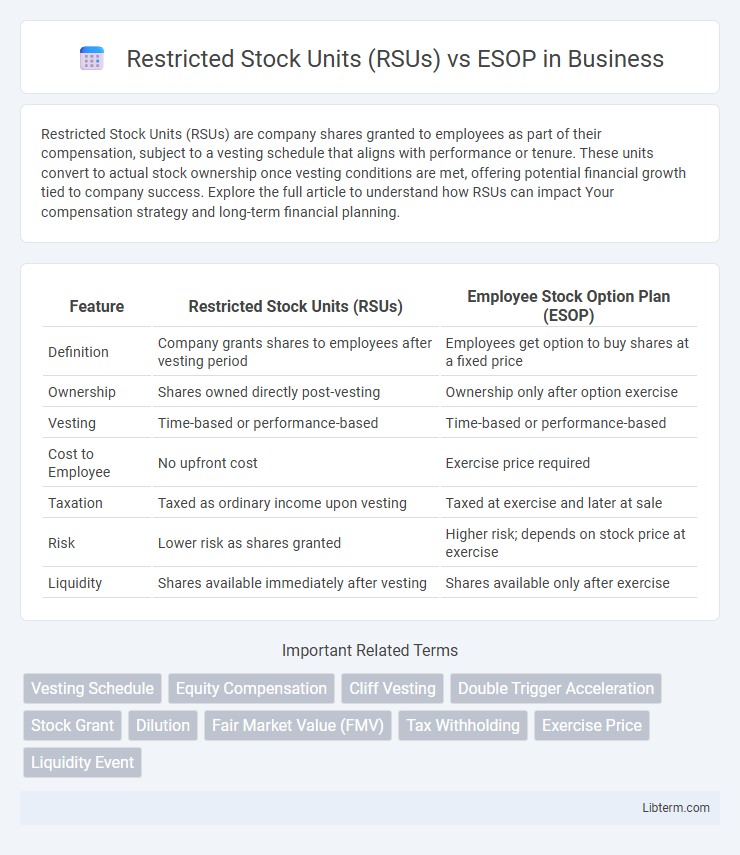

| Feature | Restricted Stock Units (RSUs) | Employee Stock Option Plan (ESOP) |

|---|---|---|

| Definition | Company grants shares to employees after vesting period | Employees get option to buy shares at a fixed price |

| Ownership | Shares owned directly post-vesting | Ownership only after option exercise |

| Vesting | Time-based or performance-based | Time-based or performance-based |

| Cost to Employee | No upfront cost | Exercise price required |

| Taxation | Taxed as ordinary income upon vesting | Taxed at exercise and later at sale |

| Risk | Lower risk as shares granted | Higher risk; depends on stock price at exercise |

| Liquidity | Shares available immediately after vesting | Shares available only after exercise |

Introduction to Restricted Stock Units (RSUs) and ESOP

Restricted Stock Units (RSUs) represent company shares granted to employees as part of their compensation, typically vesting over time to incentivize long-term commitment. Employee Stock Ownership Plans (ESOPs) are retirement plans that provide employees with an ownership interest in the company through allocated shares held in a trust. While RSUs are direct equity awards subject to vesting schedules, ESOPs function as broader employee benefit plans aimed at fostering company ownership and retirement savings.

Key Definitions: RSUs and ESOP Explained

Restricted Stock Units (RSUs) represent company shares granted to employees with conditions such as vesting periods before ownership and transfer rights apply, typically used to align employee interests with company performance. Employee Stock Ownership Plans (ESOPs) are retirement benefit plans that provide employees with ownership stakes through allocated shares in the company, often serving as a long-term investment and incentive tool. RSUs function as deferred compensation with explicit vesting schedules, while ESOPs operate as employee benefit trusts designed to promote broad-based employee ownership and retirement savings.

How RSUs Work: Granting, Vesting, and Taxation

Restricted Stock Units (RSUs) are granted to employees as company shares that vest over a specified period, typically tied to tenure or performance milestones. Vesting schedules determine when employees gain full ownership, triggering taxation as ordinary income on the fair market value of vested shares at that time. Unlike ESOPs, RSUs do not require employees to purchase shares, simplifying the process and providing immediate ownership once vested, with tax implications occurring upon vesting rather than exercise.

How ESOPs Operate: Structure, Allocation, and Tax Treatment

Employee Stock Ownership Plans (ESOPs) operate by establishing a trust that holds company shares allocated to employees based on factors like salary and tenure, creating a retirement benefit aligned with corporate growth. ESOP shares are often allocated annually, vested over a period, and can be sold back to the company or on the open market upon retirement or exit. Tax treatment favors ESOP participants through deferred taxation until shares are sold, with potential capital gains rates, while companies benefit from tax deductions on contributions to the ESOP trust.

Major Differences Between RSUs and ESOP

Restricted Stock Units (RSUs) represent company shares granted to employees subject to vesting conditions, while Employee Stock Ownership Plans (ESOPs) are retirement plans that allocate company stock to employees' accounts. RSUs typically have specific vesting schedules and are taxed as ordinary income upon vesting, whereas ESOPs provide broader ownership benefits and often focus on long-term retirement savings with tax advantages. The key differences lie in their purpose, tax treatment, and the way employees gain ownership and value from the shares.

Advantages and Disadvantages of RSUs

Restricted Stock Units (RSUs) offer employees direct ownership of company stock without upfront cost, providing clear value once vested and reducing risk compared to stock options that may expire worthless. RSUs align employee interests with company performance, encouraging retention through vesting schedules and straightforward tax treatment upon vesting as ordinary income. However, RSUs lack flexibility in purchase timing, can lead to significant tax liabilities at vesting regardless of stock sale, and may dilute existing shareholders if shares are newly issued.

Pros and Cons of ESOP for Employees

Employee Stock Ownership Plans (ESOPs) offer employees potential wealth accumulation through stock ownership and align their interests with company performance, fostering motivation and long-term commitment. However, ESOPs carry risks such as lack of diversification since employees' financial well-being is tied closely to company stock, and stock value fluctuations can impact retirement security. Administrative complexity and potential dilution of existing shareholders can also affect overall employee benefit outcomes.

RSUs vs ESOP: Optimal Scenarios for Each

Restricted Stock Units (RSUs) are most effective for companies seeking to retain employees with a guaranteed form of equity compensation that vests over time, providing predictable tax treatment upon vesting. Employee Stock Ownership Plans (ESOPs) are ideal for businesses aiming to foster broad employee ownership and align workforce incentives with company performance through shares held in a retirement plan. RSUs suit startups and tech firms with high growth potential and limited cash flow, while ESOPs benefit established companies focusing on succession planning and long-term employee wealth accumulation.

Impact on Employee Motivation and Retention

Restricted Stock Units (RSUs) deliver direct equity ownership with clear financial value upon vesting, strongly incentivizing employees by aligning their interests with company performance and boosting long-term retention. Employee Stock Ownership Plans (ESOPs) foster a broader sense of ownership through profit-sharing mechanisms, which enhance motivation by promoting collective success and loyalty over time. RSUs often have a more immediate perceived value, making them more effective for retaining high-performing talent, while ESOPs contribute to sustained employee engagement and a deeper cultural commitment.

Choosing Between RSUs and ESOP: Factors to Consider

Choosing between Restricted Stock Units (RSUs) and Employee Stock Ownership Plans (ESOPs) depends on factors such as vesting schedules, tax implications, and company goals. RSUs offer a straightforward grant of company shares with defined vesting periods and taxable events upon vesting, making them attractive for immediate equity incentives. ESOPs function as retirement plans that allow employees to accumulate ownership over time, often with tax benefits and a longer-term wealth accumulation focus.

Restricted Stock Units (RSUs) Infographic

libterm.com

libterm.com