Gross profit represents the difference between your total revenue and the cost of goods sold, indicating the core profitability of your business operations. It highlights how efficiently your company produces and sells products before accounting for other expenses like marketing and administrative costs. Explore the rest of the article to understand strategies for improving your gross profit and boosting overall business performance.

Table of Comparison

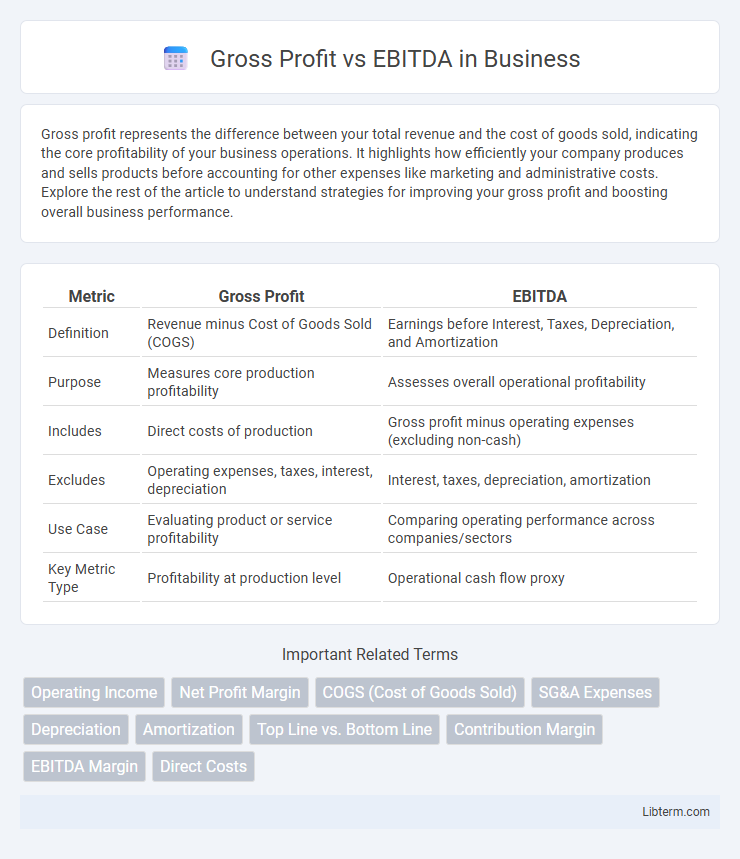

| Metric | Gross Profit | EBITDA |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Earnings before Interest, Taxes, Depreciation, and Amortization |

| Purpose | Measures core production profitability | Assesses overall operational profitability |

| Includes | Direct costs of production | Gross profit minus operating expenses (excluding non-cash) |

| Excludes | Operating expenses, taxes, interest, depreciation | Interest, taxes, depreciation, amortization |

| Use Case | Evaluating product or service profitability | Comparing operating performance across companies/sectors |

| Key Metric Type | Profitability at production level | Operational cash flow proxy |

Introduction to Gross Profit and EBITDA

Gross Profit represents a company's revenue minus the cost of goods sold (COGS), reflecting the efficiency of production and core operations. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures profitability by excluding non-operational expenses and non-cash charges, providing insight into operational cash flow. Both metrics are essential for assessing financial health but serve different analytical purposes in evaluating business performance.

Definitions: Gross Profit and EBITDA Explained

Gross Profit represents the difference between total revenue and the cost of goods sold (COGS), reflecting the core profitability of a company's primary activities without accounting for operating expenses. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures overall operational performance by excluding non-operational costs, providing insight into cash flow and profitability before financial and accounting deductions. Both metrics are crucial for assessing different aspects of a company's financial health, with Gross Profit focusing on production efficiency and EBITDA highlighting operational profitability.

Calculating Gross Profit: Key Components

Calculating Gross Profit involves subtracting the Cost of Goods Sold (COGS) from total revenue, emphasizing direct production costs such as raw materials, labor, and manufacturing overhead. This metric isolates profitability related to core operations before accounting for operating expenses, interest, and taxes. Understanding Gross Profit is essential for evaluating pricing strategies and production efficiency, distinct from EBITDA which incorporates operating expenses but excludes depreciation and amortization.

Calculating EBITDA: Key Components

Calculating EBITDA involves adding back interest, taxes, depreciation, and amortization to net income, providing a clear measure of a company's operational profitability. Unlike gross profit, which subtracts only the cost of goods sold from revenue, EBITDA offers insight by excluding non-operational expenses and accounting charges. This metric is essential for comparing companies within capital-intensive industries because it highlights cash flow potential before financing and accounting decisions.

Major Differences Between Gross Profit and EBITDA

Gross Profit represents the revenue remaining after deducting the cost of goods sold (COGS), highlighting the efficiency of production and direct costs management. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) expands on gross profit by subtracting operating expenses, excluding non-cash charges and financing costs, providing a clearer picture of operating performance. Major differences include Gross Profit's focus on production cost efficiency, whereas EBITDA reflects overall operational profitability before accounting for financial and accounting decisions.

Importance in Financial Analysis

Gross Profit measures a company's revenue minus the cost of goods sold, highlighting core production efficiency, while EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides insight into operating profitability by excluding non-operational expenses. Financial analysts prioritize EBITDA for evaluating a firm's operational cash flow and comparing profitability across companies with different capital structures. Both metrics are essential: Gross Profit reveals product-level profitability, and EBITDA aids in assessing overall operational performance and financial health.

Advantages and Limitations of Gross Profit

Gross Profit highlights the core profitability by subtracting direct costs of goods sold from revenue, providing clear insight into production efficiency and pricing strategy. It excludes operating expenses and non-operational items, which limits its use in assessing overall business performance and cash flow. Unlike EBITDA, Gross Profit does not account for overhead costs, depreciation, or interest, restricting its utility for comprehensive financial analysis.

Advantages and Limitations of EBITDA

EBITDA offers advantages by highlighting operational profitability, excluding non-cash expenses like depreciation and amortization, which provides clearer insight into cash flow and business performance. Its limitation lies in ignoring capital expenditures, working capital changes, and debt costs, potentially overstating financial health and cash generation. Gross profit, while useful for assessing product-level profitability, does not reflect operating expenses, making EBITDA a broader measure for operational efficiency evaluation.

Use Cases: When to Use Gross Profit vs EBITDA

Gross profit is ideal for assessing a company's core production efficiency by focusing solely on revenue minus the cost of goods sold, making it essential for pricing strategies and evaluating product profitability. EBITDA, which includes operating expenses but excludes interest, taxes, depreciation, and amortization, is used to measure overall operational performance and cash flow potential, aiding in debt management and investor analysis. Businesses prioritize gross profit when analyzing direct cost control, while EBITDA is preferred for benchmarking profitability across companies with varying capital structures.

Conclusion: Choosing the Right Metric

Gross Profit highlights a company's core profitability by subtracting production costs from revenue, offering insight into product efficiency, while EBITDA provides a broader view of operational performance by excluding non-operating expenses like interest, taxes, depreciation, and amortization. Choosing the right metric depends on the analysis focus: Gross Profit is ideal for evaluating product cost management, whereas EBITDA is better suited for assessing overall operational profitability and cash flow potential. Financial analysts often use both metrics complementary to gain a comprehensive understanding of a company's financial health.

Gross Profit Infographic

libterm.com

libterm.com