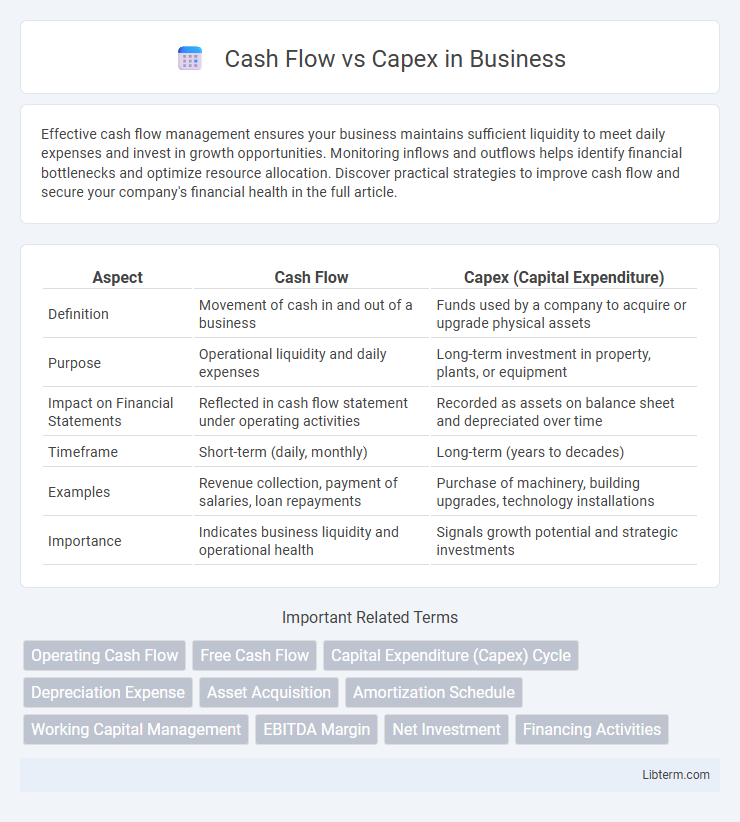

Effective cash flow management ensures your business maintains sufficient liquidity to meet daily expenses and invest in growth opportunities. Monitoring inflows and outflows helps identify financial bottlenecks and optimize resource allocation. Discover practical strategies to improve cash flow and secure your company's financial health in the full article.

Table of Comparison

| Aspect | Cash Flow | Capex (Capital Expenditure) |

|---|---|---|

| Definition | Movement of cash in and out of a business | Funds used by a company to acquire or upgrade physical assets |

| Purpose | Operational liquidity and daily expenses | Long-term investment in property, plants, or equipment |

| Impact on Financial Statements | Reflected in cash flow statement under operating activities | Recorded as assets on balance sheet and depreciated over time |

| Timeframe | Short-term (daily, monthly) | Long-term (years to decades) |

| Examples | Revenue collection, payment of salaries, loan repayments | Purchase of machinery, building upgrades, technology installations |

| Importance | Indicates business liquidity and operational health | Signals growth potential and strategic investments |

Understanding Cash Flow: Definition and Importance

Cash flow represents the net amount of cash and cash equivalents moving into and out of a business, reflecting liquidity available for operations. It is crucial for assessing a company's ability to cover expenses, invest, and meet financial obligations without raising external capital. Understanding cash flow enables better financial planning and highlights how capital expenditures (Capex) impact available operational funds and long-term asset growth.

What is Capex? Capital Expenditure Explained

Capex, or Capital Expenditure, refers to funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, or equipment. This type of spending is essential for long-term investments and impacts the company's balance sheet rather than its income statement immediately. Unlike operating expenses, Capex is capitalized and depreciated over time, reflecting the asset's useful life in financial statements.

Key Differences Between Cash Flow and Capex

Cash flow represents the total amount of cash generated or used by a business during a specific period, encompassing operating, investing, and financing activities. Capex, or capital expenditures, specifically refers to funds used by a company to acquire, upgrade, or maintain physical assets such as property, equipment, or technology. Unlike cash flow, which indicates overall liquidity and operational efficiency, Capex is a long-term investment reflected on the balance sheet and impacts depreciation and future cash flows.

How Capex Impacts Cash Flow

Capital Expenditures (Capex) directly reduce cash flow as these outlays represent substantial investments in long-term assets, which are reported as cash outflows in the investing activities section of the cash flow statement. High Capex can strain operational cash flow by diverting funds away from daily business activities, impacting liquidity and possibly necessitating external financing. Monitoring Capex is crucial for maintaining a healthy balance between asset growth and cash flow stability, ensuring sustained business operations and financial flexibility.

Managing Cash Flow While Planning Capex

Effective management of cash flow while planning capital expenditures (Capex) ensures business liquidity and sustainable growth. Analyzing cash flow projections helps align Capex timing with operational cash availability, reducing financing risks and maintaining working capital. Strategic scheduling of Capex investments optimized through detailed cash flow forecasts supports long-term asset acquisition without compromising daily financial stability.

Analyzing Cash Flow Statements for Capex Insights

Analyzing cash flow statements reveals crucial insights into a company's capital expenditures (Capex), highlighting how much cash is spent on acquiring or maintaining fixed assets like property, plants, and equipment. The investing activities section explicitly outlines Capex, allowing investors to assess the company's growth initiatives and asset investments. Understanding the relationship between operating cash flow and Capex helps determine if a business generates sufficient cash internally to fund its long-term investments without relying on external financing.

Short-Term vs Long-Term Financial Planning

Cash flow management prioritizes short-term liquidity, ensuring sufficient funds for operating expenses and immediate obligations, whereas Capex involves long-term investments in assets that support future growth and operational capacity. Effective financial planning balances maintaining positive cash flow for day-to-day activities with strategic allocation towards capital expenditures that drive sustained business expansion and competitive advantage. Firms analyze cash flow cycles alongside depreciation schedules and ROI projections to optimize both short-term solvency and long-term financial health.

Common Mistakes in Balancing Cash Flow and Capex

Common mistakes in balancing cash flow and capex include underestimating capital expenditure requirements, leading to cash shortages that hamper daily operations. Overcommitting to large capex projects without adequate cash flow forecasting can result in liquidity crises and jeopardize financial stability. Failing to align capex timing with cash inflows often causes disruptions, emphasizing the need for precise budgeting and dynamic cash management.

Best Practices for Optimizing Cash Flow During Capital Investments

Optimizing cash flow during capital expenditures involves closely monitoring Capex budgets to avoid overspending and aligning investments with projected revenue streams to ensure liquidity. Implementing phased capital investments allows businesses to spread out expenses, maintaining steady cash flow without compromising operational capacity. Utilizing accurate forecasting tools and negotiating favorable payment terms with vendors further enhances cash flow stability during major capital projects.

Cash Flow vs Capex: Strategic Decision-Making for Businesses

Cash flow represents the liquidity available for daily operations, while Capex (Capital Expenditures) refers to funds invested in long-term assets essential for growth. Analyzing cash flow versus Capex enables businesses to balance operational efficiency with strategic investments, ensuring sustainable financial health. Effective decision-making involves evaluating cash flow forecasts, Capex requirements, and ROI projections to optimize capital allocation and support expansion goals.

Cash Flow Infographic

libterm.com

libterm.com