Effective financial analysis evaluates your company's performance by examining key metrics such as profitability, liquidity, and solvency to inform strategic decisions. Utilizing financial ratios and trend analysis provides insights into operational efficiency and potential risks. Explore the rest of this article to master techniques that enhance your financial decision-making.

Table of Comparison

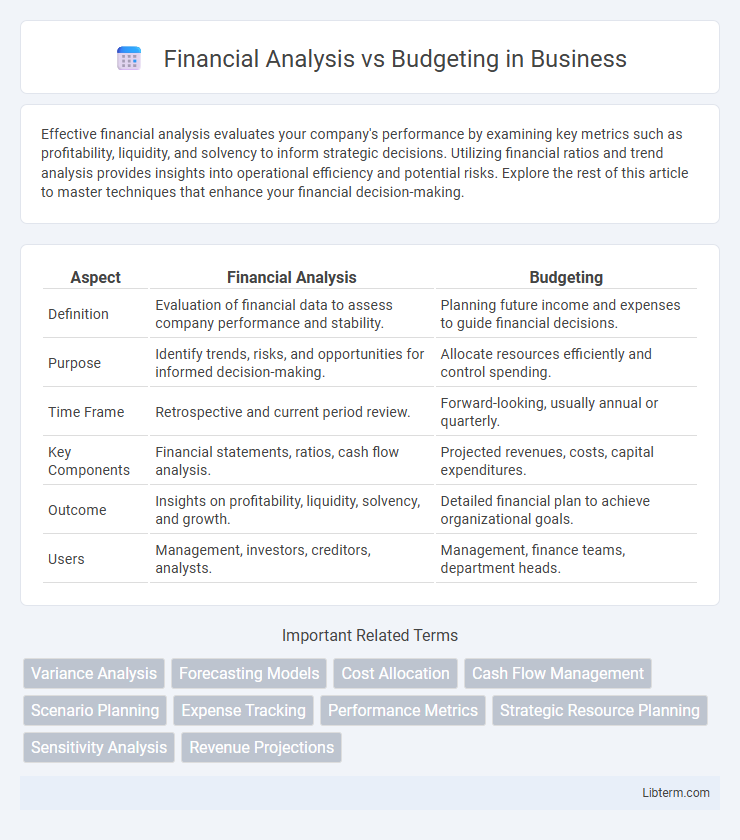

| Aspect | Financial Analysis | Budgeting |

|---|---|---|

| Definition | Evaluation of financial data to assess company performance and stability. | Planning future income and expenses to guide financial decisions. |

| Purpose | Identify trends, risks, and opportunities for informed decision-making. | Allocate resources efficiently and control spending. |

| Time Frame | Retrospective and current period review. | Forward-looking, usually annual or quarterly. |

| Key Components | Financial statements, ratios, cash flow analysis. | Projected revenues, costs, capital expenditures. |

| Outcome | Insights on profitability, liquidity, solvency, and growth. | Detailed financial plan to achieve organizational goals. |

| Users | Management, investors, creditors, analysts. | Management, finance teams, department heads. |

Introduction to Financial Analysis and Budgeting

Financial analysis involves evaluating financial data to assess a company's performance, profitability, and risk, using tools like ratio analysis, trend analysis, and financial statement review. Budgeting is the process of creating a financial plan that estimates revenue, expenses, and resource allocation over a specific period to guide business operations and control costs. Both financial analysis and budgeting are essential for informed decision-making, enabling businesses to forecast financial outcomes and maintain fiscal discipline.

Defining Financial Analysis

Financial analysis involves evaluating historical and current financial data to assess a company's performance, identify trends, and support strategic decision-making. It includes analyzing financial statements, ratios, and cash flow to provide insights into profitability, liquidity, and solvency. Budgeting, in contrast, focuses on forecasting future revenues and expenses to create financial plans that guide resource allocation and control costs.

Understanding Budgeting

Understanding budgeting involves creating a detailed financial plan that outlines expected income and expenses over a specific period. It helps organizations allocate resources efficiently, control costs, and set financial goals to ensure liquidity and profitability. Budgeting serves as a critical tool for measuring performance against financial objectives and supports strategic decision-making processes.

Key Differences Between Financial Analysis and Budgeting

Financial analysis involves evaluating historical and current financial data to assess a company's performance and make informed decisions, while budgeting is the process of planning future financial activities by setting revenue and expenditure targets. Financial analysis emphasizes data interpretation, trend identification, and performance measurement, whereas budgeting focuses on resource allocation and financial control. The key difference lies in financial analysis being retrospective and diagnostic, whereas budgeting is prospective and strategic.

Objectives of Financial Analysis

Financial analysis aims to evaluate an organization's financial health by examining income statements, balance sheets, and cash flow reports to inform strategic decision-making and investment opportunities. It focuses on assessing profitability, liquidity, solvency, and operational efficiency to identify financial strengths and weaknesses. Accurate financial analysis supports risk management, resource allocation, and long-term planning, distinguishing it from budgeting's emphasis on forecasting and controlling future expenditures.

Goals of Budgeting

The primary goals of budgeting include forecasting income and expenses to ensure financial stability, allocating resources efficiently to meet organizational objectives, and providing a benchmark for performance evaluation. Budgeting facilitates cost control by identifying potential overspending areas and enabling timely corrective actions. It also supports strategic planning by aligning financial activities with long-term business goals.

Tools and Techniques Used

Financial analysis relies heavily on tools such as ratio analysis, variance analysis, and cash flow analysis to evaluate a company's financial health, utilizing software like Excel, QuickBooks, and advanced analytics platforms like Tableau or Power BI. Budgeting employs techniques including zero-based budgeting, incremental budgeting, and rolling forecasts, often supported by specialized budgeting tools such as Adaptive Insights and Planful for effective resource allocation and financial planning. Both practices integrate data visualization and scenario modeling to enhance decision-making accuracy and strategic financial management.

Impact on Business Decision-Making

Financial analysis provides detailed insights into past and current financial performance, enabling businesses to identify trends, assess risks, and evaluate profitability. Budgeting establishes a financial framework by setting future revenue and expense targets, guiding resource allocation and operational planning. Together, these processes influence business decision-making by combining empirical data with strategic forecasting to optimize financial outcomes and support sustainable growth.

Common Challenges and Pitfalls

Financial analysis and budgeting both face challenges such as inaccurate data inputs, which can lead to flawed forecasts and misinformed decisions. Common pitfalls include underestimating expenses and overestimating revenues in budgeting, while financial analysis often struggles with interpreting complex datasets and predicting market volatility. Effective integration of real-time financial metrics and continuous monitoring can mitigate risks associated with these challenges.

Integrating Financial Analysis and Budgeting for Success

Integrating financial analysis and budgeting enhances business decision-making by aligning budget forecasts with real-time financial performance data. Utilizing key financial metrics such as variance analysis, cash flow projections, and ROI ensures budgets are both realistic and flexible, supporting strategic goals. This synergy enables organizations to optimize resource allocation, reduce financial risks, and improve overall fiscal responsibility.

Financial Analysis Infographic

libterm.com

libterm.com