Profitability Index measures the value created per unit of investment, helping investors evaluate the efficiency of their projects. This financial metric prioritizes projects with the highest returns relative to cost, optimizing your investment decisions. Explore the article to understand how Profitability Index can improve your portfolio outcomes.

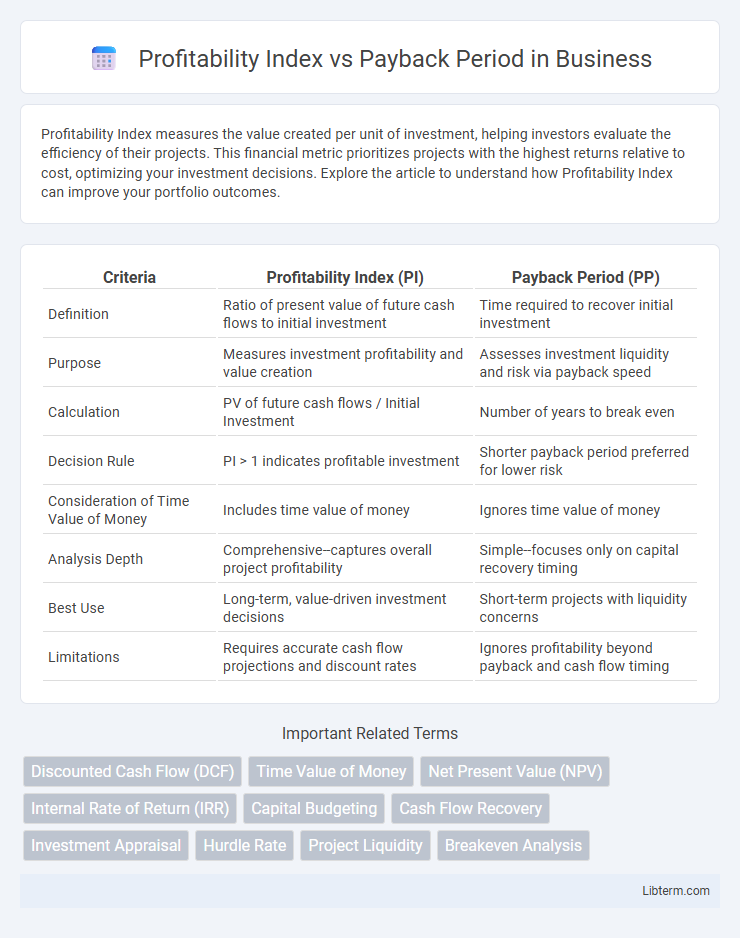

Table of Comparison

| Criteria | Profitability Index (PI) | Payback Period (PP) |

|---|---|---|

| Definition | Ratio of present value of future cash flows to initial investment | Time required to recover initial investment |

| Purpose | Measures investment profitability and value creation | Assesses investment liquidity and risk via payback speed |

| Calculation | PV of future cash flows / Initial Investment | Number of years to break even |

| Decision Rule | PI > 1 indicates profitable investment | Shorter payback period preferred for lower risk |

| Consideration of Time Value of Money | Includes time value of money | Ignores time value of money |

| Analysis Depth | Comprehensive--captures overall project profitability | Simple--focuses only on capital recovery timing |

| Best Use | Long-term, value-driven investment decisions | Short-term projects with liquidity concerns |

| Limitations | Requires accurate cash flow projections and discount rates | Ignores profitability beyond payback and cash flow timing |

Introduction to Investment Appraisal Techniques

Profitability Index (PI) measures the value created per unit of investment by dividing the present value of future cash flows by the initial investment, highlighting project efficiency. Payback Period calculates the time needed to recover the initial investment, emphasizing liquidity and risk assessment. Both techniques are essential in investment appraisal for evaluating project viability and financial feasibility.

Understanding Profitability Index (PI)

Profitability Index (PI) measures the ratio of the present value of future cash flows to the initial investment, indicating project profitability and efficiency. A PI greater than 1 signifies that the project's net present value (NPV) is positive, making it a desirable investment option. Unlike the Payback Period, which assesses liquidity by measuring how quickly initial costs are recovered, PI evaluates overall value creation and risk-adjusted returns.

Defining Payback Period (PP)

Payback Period (PP) measures the time required for an investment to generate cash flows sufficient to recover its initial cost, providing a straightforward assessment of project liquidity risk. Unlike the Profitability Index, which evaluates the ratio of discounted cash inflows to initial investment, PP emphasizes the speed of capital recovery without considering the time value of money. PP serves as a critical metric for firms prioritizing quick recoupment of funds, especially in environments with high uncertainty or limited capital availability.

Calculation Methods: PI vs Payback Period

The Profitability Index (PI) is calculated by dividing the present value of future cash inflows by the initial investment, reflecting the value created per unit of investment. The Payback Period determines how long it takes for cash inflows to recover the initial investment, focusing solely on the time to breakeven without considering the time value of money. While PI incorporates discounted cash flows, providing a measure of investment efficiency, the Payback Period offers a simpler, time-based metric for project evaluation.

Key Advantages of Profitability Index

The Profitability Index (PI) offers a clear advantage over the Payback Period by incorporating the time value of money, providing a more accurate measure of an investment's profitability. Unlike the Payback Period, which only assesses the time needed to recover initial costs without considering cash flows beyond that point, the PI evaluates the present value of all future cash inflows relative to the initial investment. This makes the Profitability Index especially useful for comparing projects of different scales and cash flow timings, ensuring better capital budgeting decisions.

Main Benefits of Payback Period

Payback Period offers a straightforward and quick assessment of how long it takes for an investment to recover its initial cost, making it easy for businesses to evaluate risk and liquidity. This metric is particularly beneficial for companies with limited capital or those prioritizing short-term financial stability. Unlike Profitability Index, Payback Period emphasizes cash flow timing without relying on discount rates, providing clear insight into investment recovery speed.

Limitations of Profitability Index

The Profitability Index (PI) can be misleading for projects with unconventional cash flows or mutually exclusive investments, as it does not account for scale differences or project size. It assumes reinvestment at the project's internal rate of return, which may not be realistic, potentially overstating the attractiveness of projects. The Payback Period, while simpler, provides a clearer measure of liquidity risk and project breakeven time, highlighting PI's limitation in cash flow timing sensitivity.

Drawbacks of Payback Period

The Payback Period method ignores the time value of money and cash flows beyond the cutoff, leading to potentially misleading investment decisions. It fails to measure overall profitability or risk, unlike the Profitability Index, which evaluates the present value of future cash flows relative to initial investment. This limitation causes the Payback Period to undervalue long-term projects with higher returns.

Comparative Analysis: PI vs Payback Period

Profitability Index (PI) measures the value created per unit of investment by dividing the present value of future cash flows by the initial investment, emphasizing long-term profitability, while Payback Period calculates the time needed to recover the initial investment, focusing on liquidity and risk reduction. PI incorporates the time value of money and provides a ratio for easy project ranking, whereas Payback Period ignores discounted cash flows and does not account for profitability beyond the payback horizon. For investment decisions, PI offers a comprehensive assessment of project viability, while Payback Period serves as a simple tool for evaluating investment risk and cash flow timing.

Final Verdict: Choosing the Right Capital Budgeting Tool

The Profitability Index (PI) offers a precise measure of value creation by comparing the present value of future cash flows to initial investment, making it ideal for ranking projects when capital is limited. The Payback Period focuses on liquidity and risk by calculating how quickly invested capital can be recovered but ignores cash flows beyond the cutoff point and the time value of money. Selecting the right capital budgeting tool depends on project goals: use PI for maximizing shareholder value and optimal resource allocation, while Payback Period suits firms prioritizing rapid capital recovery and risk mitigation.

Profitability Index Infographic

libterm.com

libterm.com