Retained earnings represent the cumulative net income a company has reinvested rather than distributed as dividends, serving as a key indicator of financial health and growth potential. This figure is crucial for understanding how effectively a business manages profits to fuel expansion, pay down debt, or invest in new projects. Explore the rest of the article to discover how retained earnings impact your company's future strategy and financial stability.

Table of Comparison

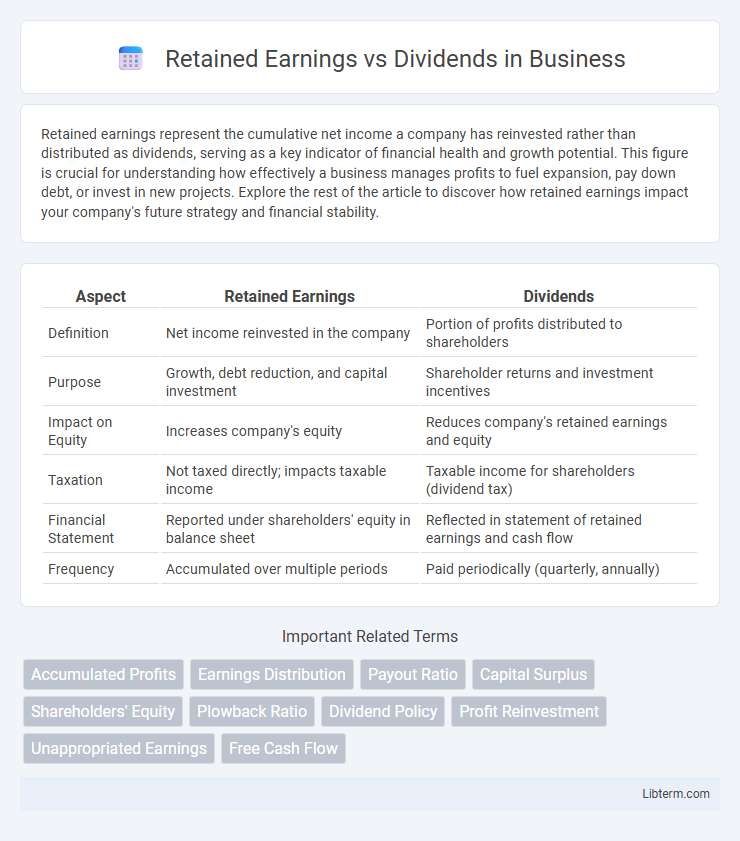

| Aspect | Retained Earnings | Dividends |

|---|---|---|

| Definition | Net income reinvested in the company | Portion of profits distributed to shareholders |

| Purpose | Growth, debt reduction, and capital investment | Shareholder returns and investment incentives |

| Impact on Equity | Increases company's equity | Reduces company's retained earnings and equity |

| Taxation | Not taxed directly; impacts taxable income | Taxable income for shareholders (dividend tax) |

| Financial Statement | Reported under shareholders' equity in balance sheet | Reflected in statement of retained earnings and cash flow |

| Frequency | Accumulated over multiple periods | Paid periodically (quarterly, annually) |

Understanding Retained Earnings

Retained earnings represent the cumulative net income a company has reinvested in its operations rather than distributing as dividends to shareholders. These earnings fund business growth, debt reduction, and other strategic investments, directly impacting the company's equity and long-term financial stability. Understanding retained earnings provides insight into a company's ability to sustain expansion and generate shareholder value without relying solely on external financing.

What Are Dividends?

Dividends are payments made by a corporation to its shareholders, typically derived from the company's retained earnings to distribute profits. These distributions can be issued in cash, additional shares, or other assets, representing a direct return on investment for shareholders. Understanding dividends is crucial for evaluating a company's profitability and financial health compared to the accumulation of retained earnings used for reinvestment.

Key Differences Between Retained Earnings and Dividends

Retained earnings represent the cumulative net income that a company reinvests into its operations instead of distributing to shareholders, serving as a critical indicator of financial health and growth potential. Dividends are the portion of earnings paid out to shareholders as a return on investment, directly impacting shareholder wealth and reflecting a company's dividend policy. The key difference lies in retained earnings being an internal source of funding, while dividends represent a cash outflow to investors, affecting the company's liquidity and capital structure.

How Retained Earnings Impact Business Growth

Retained earnings represent the portion of net income that a company reinvests into its operations, fueling business expansion and innovation. By allocating retained earnings toward research and development, capital expenditures, or debt reduction, businesses enhance their competitive edge and long-term profitability. In contrast, dividends distribute profits to shareholders, reducing the funds available for growth initiatives.

The Role of Dividends in Attracting Investors

Dividends serve as a tangible return on investment, making a company more attractive to income-focused investors seeking regular cash flow. While retained earnings are reinvested to fuel growth and increase long-term shareholder value, dividends provide immediate income that signals financial health and stability. Companies that balance retained earnings with consistent dividend payments often attract a broader investor base, enhancing market confidence and stock demand.

Factors Influencing Retained Earnings Decisions

Factors influencing retained earnings decisions include a company's profitability, growth opportunities, and cash flow requirements. Management evaluates reinvestment potential to finance expansion or debt reduction against shareholder demands for dividend payouts. Regulatory constraints and tax considerations also play critical roles in balancing retained earnings and dividends.

Factors Affecting Dividend Policy

Factors affecting dividend policy include company profitability, cash flow stability, and future investment opportunities, which influence the balance between retained earnings and dividend payouts. Firms with strong retained earnings often choose to reinvest profits to fuel growth rather than distribute large dividends to shareholders. Market conditions, tax considerations, and shareholder preferences also play critical roles in shaping a company's approach to dividend payments.

Pros and Cons of Retaining Earnings vs. Distributing Dividends

Retaining earnings allows a company to reinvest profits for growth, debt reduction, and increased financial stability, fostering long-term value creation, but it may disappoint shareholders seeking immediate returns. Distributing dividends provides investors with regular income and can enhance stock attractiveness; however, it reduces funds available for reinvestment, potentially limiting future expansion. Balancing retained earnings and dividends depends on the company's growth prospects, cash flow needs, and shareholder expectations.

Retained Earnings and Dividends in Financial Statements

Retained earnings represent the accumulated net income a company retains for reinvestment or debt reduction, reflected in the equity section of the balance sheet. Dividends are distributions of earnings to shareholders, reducing retained earnings and appearing as a liability on the balance sheet when declared. In financial statements, retained earnings indicate company growth potential, while dividends provide insight into shareholder returns.

Choosing Between Retained Earnings and Dividends for Long-Term Success

Choosing between retained earnings and dividends is critical for long-term business success, as retaining earnings fuels reinvestment in growth opportunities, strengthens the company's financial stability, and improves shareholder value over time. Paying dividends satisfies investors seeking immediate income but may limit funds available for expansion, research, and debt reduction. A balanced approach aligned with the company's strategic goals and market conditions ensures sustainable growth while maintaining investor confidence.

Retained Earnings Infographic

libterm.com

libterm.com