Venture capitalists invest in early-stage startups with high growth potential in exchange for equity, providing not only funding but strategic guidance to accelerate success. They evaluate business models, market opportunities, and management teams to identify ventures that align with their investment criteria. Discover how understanding the role of venture capitalists can help your startup secure crucial funding and mentorship by exploring the rest of this article.

Table of Comparison

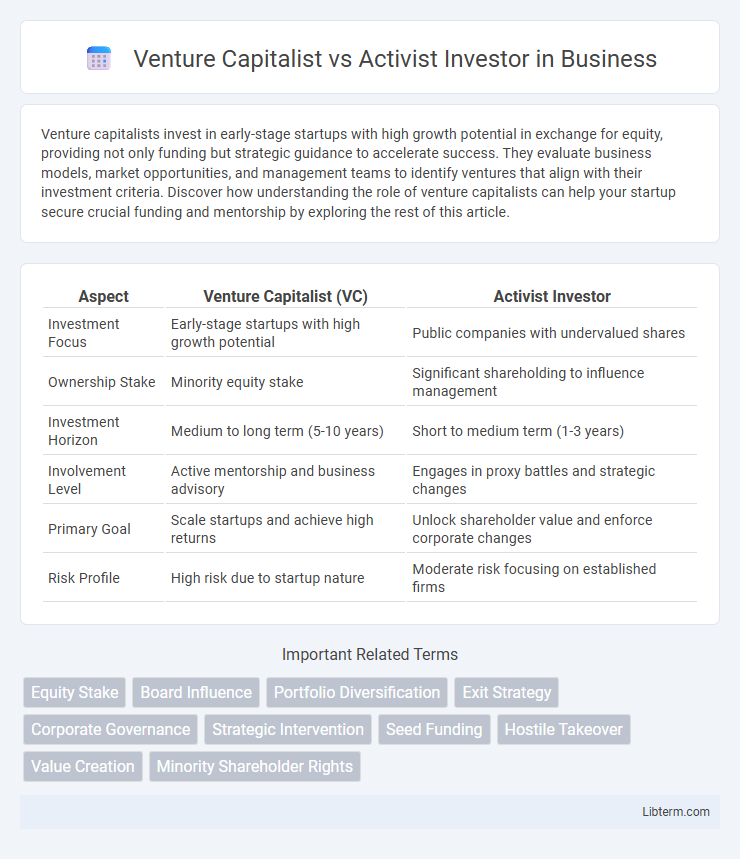

| Aspect | Venture Capitalist (VC) | Activist Investor |

|---|---|---|

| Investment Focus | Early-stage startups with high growth potential | Public companies with undervalued shares |

| Ownership Stake | Minority equity stake | Significant shareholding to influence management |

| Investment Horizon | Medium to long term (5-10 years) | Short to medium term (1-3 years) |

| Involvement Level | Active mentorship and business advisory | Engages in proxy battles and strategic changes |

| Primary Goal | Scale startups and achieve high returns | Unlock shareholder value and enforce corporate changes |

| Risk Profile | High risk due to startup nature | Moderate risk focusing on established firms |

Understanding Venture Capitalists and Activist Investors

Venture capitalists provide early-stage funding to high-growth startups in exchange for equity, playing a critical role in innovation and market disruption. Activist investors acquire substantial stakes in public companies to influence management decisions, aiming to increase shareholder value through strategic changes. Understanding the distinct goals and methods of venture capitalists versus activist investors highlights their unique impacts on company growth and governance.

Core Strategies: Funding vs. Influence

Venture capitalists primarily focus on providing early-stage funding to high-growth startups, seeking equity stakes and long-term capital appreciation. Activist investors target established companies by acquiring significant shares to influence management decisions and corporate policies for value creation. The core strategy of venture capitalists revolves around financial support and scalability, while activist investors leverage ownership positions to drive strategic changes.

Key Objectives and Goals

Venture capitalists primarily focus on funding early-stage startups with high growth potential to achieve significant returns through equity appreciation during exit events like IPOs or acquisitions. Activist investors aim to influence management decisions and strategic direction in established companies to unlock shareholder value, often by pushing for operational improvements, governance changes, or restructuring. Both pursue maximizing financial returns, but venture capitalists target innovation-driven growth, while activist investors concentrate on value creation through corporate governance and performance enhancements.

Investment Timeline and Approach

Venture capitalists typically invest in early-stage startups with a long-term horizon, often holding investments for 5 to 10 years to support growth and scalability before exit. In contrast, activist investors target publicly traded companies, seeking to influence management decisions and unlock shareholder value within a shorter timeframe, often 1 to 3 years. These distinct investment approaches reflect the venture capitalist's focus on innovation and market disruption versus the activist investor's emphasis on corporate governance and operational improvements.

Target Companies and Industries

Venture capitalists primarily target early-stage startups in high-growth industries such as technology, biotech, and clean energy, seeking innovative companies with scalable business models. Activist investors focus on established companies across diverse sectors like consumer goods, industrials, and finance, aiming to influence management and strategic direction for improved shareholder value. Both investor types play distinct roles in the investment ecosystem, with venture capitalists fueling innovation and activists driving operational enhancements.

Influence on Corporate Governance

Venture capitalists typically influence corporate governance by securing board seats and actively guiding startup growth to ensure strategic alignment and scalability. Activist investors often push for significant changes in corporate policies or leadership to enhance shareholder value, frequently challenging existing governance structures. Both exert control through board engagement, but venture capitalists prioritize long-term development while activists focus on immediate value extraction.

Risk Tolerance and Return Expectations

Venture capitalists typically exhibit high risk tolerance due to their investment in early-stage startups with uncertain outcomes, aiming for substantial returns often exceeding 20-30% annually. Activist investors, conversely, engage with established companies, balancing moderate risk by influencing management decisions to unlock shareholder value, targeting consistent returns around 10-15%. The fundamental difference lies in venture capitalists pursuing high-growth opportunities with variable outcomes, whereas activist investors prioritize strategic interventions to drive steady financial performance.

Impact on Company Management

Venture capitalists typically collaborate closely with company management to provide strategic guidance and support for scaling operations, often taking board seats to influence long-term growth. Activist investors exert pressure on management to implement changes that boost short-term shareholder value, which can include restructuring leadership or altering business strategies. This distinction results in venture capitalists fostering partnership and innovation, while activist investors prioritize accountability and rapid performance improvements.

Notable Success Stories and Case Studies

Venture capitalists achieved notable success with early investments in companies like Google and Airbnb, driving exponential growth through funding and strategic guidance during startup phases. Activist investors like Carl Icahn and Bill Ackman influenced major corporations such as Apple and Valeant Pharmaceuticals by pushing for operational and governance changes that unlocked shareholder value. Case studies highlight how venture capital accelerates innovation, while activist investing reshapes established firms for enhanced profitability and market performance.

Choosing the Right Partner for Business Growth

Selecting the right partner for business growth hinges on understanding the distinct roles of venture capitalists and activist investors. Venture capitalists provide essential early-stage funding and strategic guidance to fuel innovation and scalable growth, often taking a hands-off approach to management. Activist investors seek impactful changes in governance or operations to enhance long-term value, bringing active involvement that can drive significant restructuring or strategic shifts.

Venture Capitalist Infographic

libterm.com

libterm.com