Debentures serve as a common form of long-term debt instrument used by companies to raise capital without diluting ownership. These unsecured bonds rely solely on the issuer's creditworthiness, making it essential for investors to evaluate the risk carefully. Explore the rest of the article to understand how debentures impact your investment strategy and financial decisions.

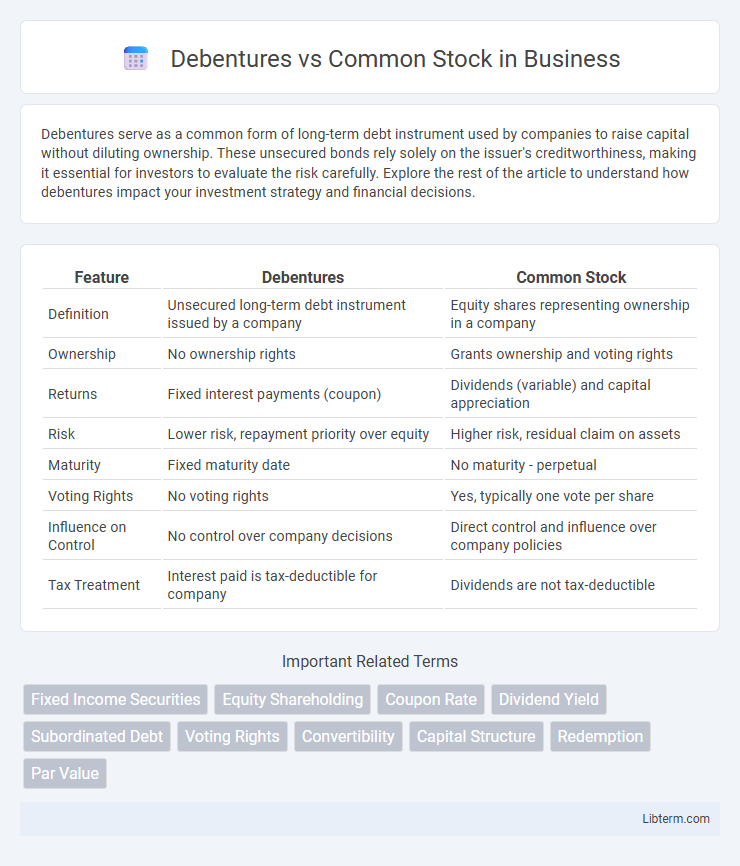

Table of Comparison

| Feature | Debentures | Common Stock |

|---|---|---|

| Definition | Unsecured long-term debt instrument issued by a company | Equity shares representing ownership in a company |

| Ownership | No ownership rights | Grants ownership and voting rights |

| Returns | Fixed interest payments (coupon) | Dividends (variable) and capital appreciation |

| Risk | Lower risk, repayment priority over equity | Higher risk, residual claim on assets |

| Maturity | Fixed maturity date | No maturity - perpetual |

| Voting Rights | No voting rights | Yes, typically one vote per share |

| Influence on Control | No control over company decisions | Direct control and influence over company policies |

| Tax Treatment | Interest paid is tax-deductible for company | Dividends are not tax-deductible |

Introduction to Debentures and Common Stock

Debentures are long-term debt instruments issued by corporations to raise capital, promising fixed interest payments and return of principal at maturity without granting ownership rights. Common stock represents equity ownership in a company, entitling shareholders to voting rights and potential dividends based on company performance. Investors typically choose debentures for stable income and lower risk, while common stock offers growth potential with higher risk and rewards.

Definition of Debentures

Debentures are long-term debt instruments issued by companies to borrow money at a fixed interest rate, representing a loan made by investors rather than ownership. Unlike common stock, debentures do not confer voting rights or ownership claims but guarantee regular interest payments and principal repayment upon maturity. Issuers prefer debentures to raise capital without diluting shareholder control, while investors benefit from predictable income and higher priority in case of liquidation.

Definition of Common Stock

Common stock represents ownership shares in a corporation, granting shareholders voting rights and potential dividends based on company profits. Unlike debentures, which are debt instruments promising fixed interest payments, common stockholders assume greater risk but also benefit from capital appreciation if the company's value increases. This equity stake reflects partial ownership, aligning shareholder interests with the company's growth and performance.

Key Features of Debentures

Debentures are long-term debt instruments issued by companies to raise capital, featuring fixed interest payments and a maturity date at which the principal is repaid. Unlike common stock, debenture holders do not have ownership rights or voting power in the company, but they have priority over shareholders in case of liquidation. Debentures can be secured or unsecured and typically offer lower risk compared to equity, making them attractive to conservative investors seeking steady income.

Key Features of Common Stock

Common stock represents ownership in a corporation, granting shareholders voting rights and potential dividends based on company profits. Unlike debentures, common stockholders assume higher risk but benefit from capital appreciation if the company grows. Common stockholders have residual claims on assets during liquidation, ranking below debenture holders in priority.

Differences in Ownership and Control

Debentures represent debt instruments where holders are creditors without ownership or voting rights, while common stockholders are equity owners with voting power in corporate decisions. Common stockholders participate in profit sharing through dividends and have a residual claim on assets during liquidation, whereas debenture holders receive fixed interest payments and have priority over equity in asset claims. The control of the company lies primarily with common stockholders due to their voting rights, making debentures a non-controlling investment option.

Risk and Returns: Debentures vs Common Stock

Debentures offer fixed interest payments and priority in asset claims, resulting in lower risk but limited returns compared to common stock. Common stockholders face higher risk due to market volatility and subordination in bankruptcy but benefit from potential capital gains and dividends. Investors seeking steady income typically prefer debentures, while those aiming for growth opt for common stock despite its increased risk.

Rights and Privileges of Investors

Debenture holders possess a fixed income through interest payments and have priority over common stockholders in asset claims during liquidation, but lack voting rights in company decisions. Common stock investors enjoy voting privileges that influence corporate policy and potential for dividends, although these dividends are variable and not guaranteed. Debentures are secured by company assets or creditworthiness, providing lower risk, whereas common stock represents ownership with higher risk and potential for growth.

Suitability for Different Types of Investors

Debentures suit conservative investors seeking fixed income with lower risk and priority in company assets during liquidation, while common stock appeals to growth-oriented investors willing to accept higher volatility for potential capital gains and dividends. Income-focused investors typically prefer debentures due to predictable interest payments, whereas common stockholders benefit from voting rights and the possibility of significant appreciation. Risk tolerance and investment goals determine the optimal choice between these securities.

Conclusion: Choosing Between Debentures and Common Stock

Choosing between debentures and common stock depends on an investor's risk tolerance, income needs, and control preferences. Debentures offer fixed interest income with lower risk, while common stock provides potential for capital appreciation and voting rights, albeit with higher volatility. Assessing financial goals and market conditions helps determine the optimal balance between debt and equity investments.

Debentures Infographic

libterm.com

libterm.com