An Employee Stock Ownership Plan (ESOP) allows employees to acquire ownership stakes in the company, aligning their interests with organizational success and enhancing motivation. This tax-qualified, defined contribution benefit plan can improve employee retention while offering significant financial advantages upon retirement or sale of the company. Discover how an ESOP can transform your workplace culture and financial future by reading the full article.

Table of Comparison

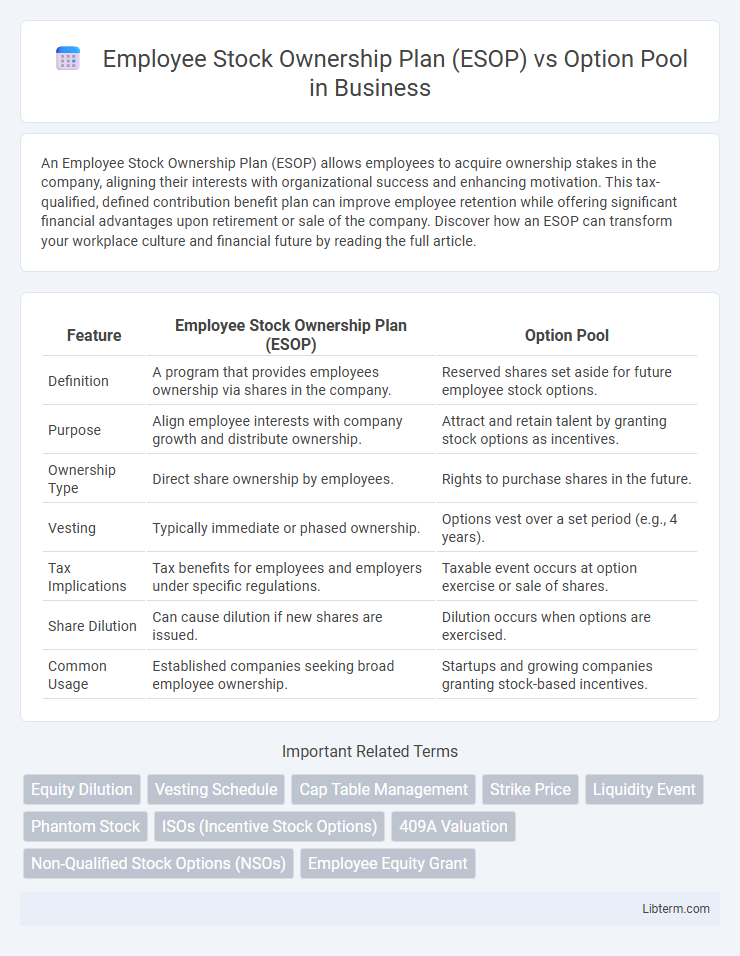

| Feature | Employee Stock Ownership Plan (ESOP) | Option Pool |

|---|---|---|

| Definition | A program that provides employees ownership via shares in the company. | Reserved shares set aside for future employee stock options. |

| Purpose | Align employee interests with company growth and distribute ownership. | Attract and retain talent by granting stock options as incentives. |

| Ownership Type | Direct share ownership by employees. | Rights to purchase shares in the future. |

| Vesting | Typically immediate or phased ownership. | Options vest over a set period (e.g., 4 years). |

| Tax Implications | Tax benefits for employees and employers under specific regulations. | Taxable event occurs at option exercise or sale of shares. |

| Share Dilution | Can cause dilution if new shares are issued. | Dilution occurs when options are exercised. |

| Common Usage | Established companies seeking broad employee ownership. | Startups and growing companies granting stock-based incentives. |

Understanding Employee Stock Ownership Plans (ESOPs)

Employee Stock Ownership Plans (ESOPs) offer employees a direct ownership stake by allocating shares of the company, fostering a sense of commitment and long-term investment. Unlike option pools, which grant options to purchase stock at a future date, ESOPs provide actual shares, often with tax advantages and shareholder voting rights. This structure aligns employee and company interests by promoting shared financial success and driving motivation.

What is an Option Pool?

An option pool is a reserved percentage of a company's shares set aside specifically for future issuance to employees, advisors, and consultants as part of equity compensation plans, designed to attract and retain talent. Unlike Employee Stock Ownership Plans (ESOPs), which are formal trust-based plans offering employees ownership in the company, option pools represent unissued shares allocated for stock options but do not guarantee ownership until exercised. Typical option pools range from 10% to 20% of the total equity, impacting dilution and valuation during fundraising rounds.

Key Differences Between ESOPs and Option Pools

Employee Stock Ownership Plans (ESOPs) are employee benefit plans granting workers actual ownership stakes, often funded by the company purchasing shares, creating a retirement benefit aligned with company performance. Option pools consist of reserved shares allocated to attract and retain talent by offering stock options, which provide employees the right to purchase shares at a set price after vesting periods. Key differences include ESOPs offering immediate ownership and retirement benefits, while option pools focus on incentivizing employees through potential future equity appreciation without initial ownership.

Eligibility Criteria for ESOPs vs Option Pools

Employee Stock Ownership Plans (ESOPs) typically require participants to be full-time employees who meet specific tenure or performance criteria set by the company, ensuring ownership benefits are aligned with long-term commitment. Option pools, however, often have broader eligibility, potentially including new hires, contractors, and advisors to incentivize a wider range of contributors. The stricter eligibility for ESOPs helps maintain a dedicated employee ownership culture, while option pools provide flexibility to attract and retain diverse talent.

Legal and Regulatory Framework

Employee Stock Ownership Plans (ESOPs) operate under strict regulatory frameworks including the Employee Retirement Income Security Act (ERISA), ensuring fiduciary responsibilities and tax advantages for retirement savings. Option pools, commonly used in startups, are governed by corporate securities laws such as the Securities Act of 1933 and state-specific regulations, requiring careful compliance with stock issuance and investor rights. Legal distinctions impact dilution, valuation, and disclosure requirements, influencing how companies structure equity compensation within regulatory boundaries.

Impact on Employee Motivation and Retention

Employee Stock Ownership Plans (ESOPs) provide employees with actual ownership stakes, fostering a strong sense of commitment and long-term motivation through direct equity participation, which often leads to higher retention rates. In contrast, Option Pools offer employees potential future equity contingent on company performance and vesting schedules, which can incentivize short-term efforts but may result in lower immediate engagement compared to ESOPs. Studies show that ESOPs enhance employee loyalty by aligning interests closely with company growth, while option pools require effective communication and performance milestones to maintain sustained motivation.

Dilution and Ownership Structure Considerations

Employee Stock Ownership Plans (ESOPs) create an ownership structure where employees hold actual shares, resulting in direct equity participation and potential voting rights, which can lead to gradual dilution of existing shareholders over time. In contrast, option pools allocate rights to purchase shares in the future, causing dilution primarily when options are exercised, impacting ownership percentages more abruptly. Evaluating ESOPs versus option pools requires analyzing the timing and extent of dilution, employee incentives, and how each structure aligns with long-term corporate governance and shareholder value objectives.

Tax Implications for Employees and Companies

Employee Stock Ownership Plans (ESOPs) offer tax advantages to employees by allowing deferred taxation until shares are sold, while companies benefit from tax deductions on contributions. In contrast, Option Pools grant employees stock options taxed as ordinary income upon exercise, potentially leading to immediate tax liabilities. Companies creating Option Pools do not receive the same tax deduction benefits as ESOP contributions, influencing overall tax efficiency and compensation strategy decisions.

Pros and Cons of ESOPs and Option Pools

Employee Stock Ownership Plans (ESOPs) provide employees with actual ownership in the company, enhancing motivation and long-term commitment by aligning employee and shareholder interests, but they require complex administration and potential dilution of existing equity. Option Pools reserve shares specifically for future employees or executives, offering flexibility in incentivizing talent without immediate ownership transfer, though they can create uncertainty over valuation and dilute shareholder equity upon exercise. ESOPs promote stronger employee engagement through ownership benefits but involve higher costs and regulatory compliance; option pools simplify initial allocation but may lead to misaligned incentives if options are viewed as speculative.

Choosing the Right Equity Plan for Your Business

Selecting the right equity plan hinges on your company's growth stage and employee incentives strategy, where Employee Stock Ownership Plans (ESOPs) offer broad-based ownership and long-term retirement benefits, while Option Pools primarily motivate key employees through potential future equity value. ESOPs are regulated retirement plans providing employees with shares, aligning interests with company performance and fostering retention, whereas Option Pools grant stock options that vest over time, suitable for startups seeking to conserve cash. Evaluating factors such as tax implications, dilution impact, and administrative complexity will help determine whether an ESOP or Option Pool better supports your business goals and talent acquisition strategy.

Employee Stock Ownership Plan (ESOP) Infographic

libterm.com

libterm.com