Fee-for-service revenue is the income generated by businesses or professionals charging clients based on individual services rendered, rather than through a fixed fee or subscription model. This pricing strategy allows providers to directly correlate income with the quantity and complexity of services delivered, making it common in healthcare, legal, and consulting industries. Explore the rest of the article to understand how fee-for-service revenue impacts your business strategy and financial growth.

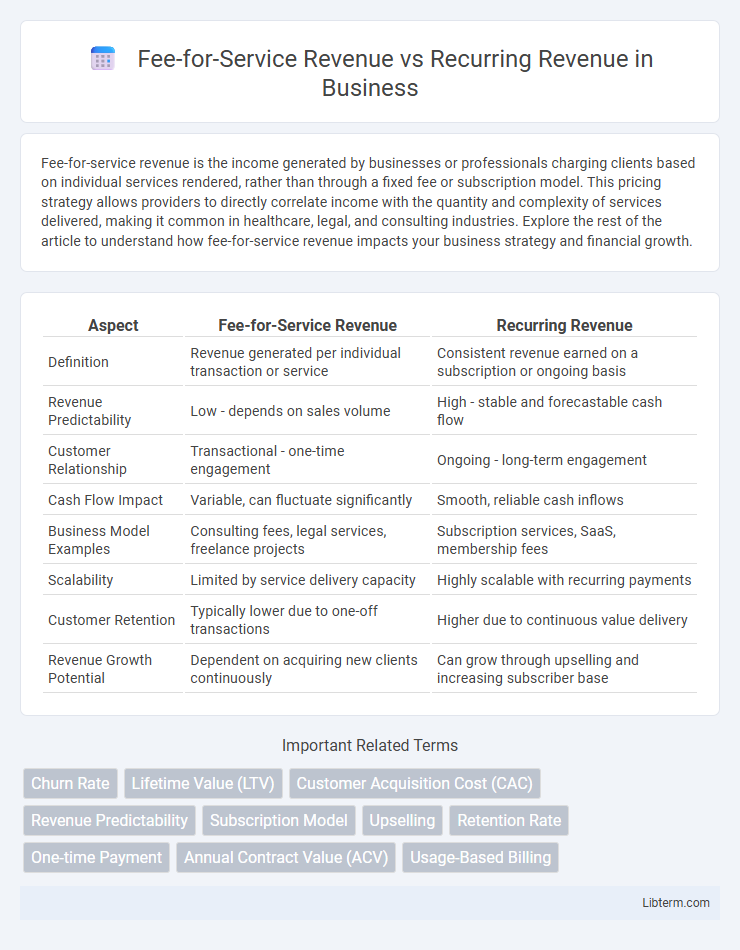

Table of Comparison

| Aspect | Fee-for-Service Revenue | Recurring Revenue |

|---|---|---|

| Definition | Revenue generated per individual transaction or service | Consistent revenue earned on a subscription or ongoing basis |

| Revenue Predictability | Low - depends on sales volume | High - stable and forecastable cash flow |

| Customer Relationship | Transactional - one-time engagement | Ongoing - long-term engagement |

| Cash Flow Impact | Variable, can fluctuate significantly | Smooth, reliable cash inflows |

| Business Model Examples | Consulting fees, legal services, freelance projects | Subscription services, SaaS, membership fees |

| Scalability | Limited by service delivery capacity | Highly scalable with recurring payments |

| Customer Retention | Typically lower due to one-off transactions | Higher due to continuous value delivery |

| Revenue Growth Potential | Dependent on acquiring new clients continuously | Can grow through upselling and increasing subscriber base |

Introduction to Revenue Models

Fee-for-service revenue models generate income based on individual sales or transactions, providing immediate cash flow but often lacking predictability. Recurring revenue models, such as subscriptions or memberships, ensure consistent, predictable income streams by charging customers regularly over time. Businesses leveraging recurring revenue typically experience higher customer lifetime value and improved financial stability compared to fee-for-service structures.

Understanding Fee-for-Service Revenue

Fee-for-service revenue is generated when businesses charge customers for individual products or services rendered, creating a direct transaction-based income model. This revenue stream is highly variable, dependent on the volume and frequency of customer purchases, making it less predictable compared to recurring revenue. Understanding fee-for-service revenue is crucial for businesses aiming to manage cash flow and resource allocation effectively while balancing client demand fluctuations.

What is Recurring Revenue?

Recurring revenue refers to the consistent and predictable income generated from customers on a regular basis, typically through subscription models, memberships, or ongoing service contracts. It provides businesses with financial stability and growth potential by ensuring a steady cash flow over time, in contrast to the one-time payments characteristic of fee-for-service revenue. Companies leveraging recurring revenue models benefit from higher customer lifetime value and improved forecasting accuracy.

Key Differences Between Fee-for-Service and Recurring Revenue

Fee-for-Service revenue generates income based on individual transactions or services rendered, resulting in fluctuating cash flow tied directly to customer demand. Recurring Revenue offers predictable, consistent income through subscription models or ongoing contracts, enhancing financial stability and long-term business valuation. Key differences include revenue predictability, customer retention focus, and scalability, with Fee-for-Service emphasizing volume and Recurring Revenue prioritizing long-term customer relationships.

Advantages of Fee-for-Service Revenue

Fee-for-service revenue provides immediate cash flow by charging customers for each individual transaction, enhancing liquidity and operational flexibility for businesses. This model allows precise tracking of revenue per service, facilitating detailed financial analysis and cost management. It also reduces dependency on long-term contracts, enabling quicker adjustments to market demand and customer preferences.

Benefits of Recurring Revenue

Recurring revenue provides businesses with predictable and stable cash flow, enabling better financial planning and resource allocation. It enhances customer lifetime value through ongoing relationships and reduces dependency on one-time sales, fostering long-term business growth. Companies with recurring revenue models often experience higher valuation multiples due to consistent income streams and lower churn rates.

Challenges in Fee-for-Service Models

Fee-for-Service revenue models face challenges such as unpredictable cash flow and difficulty in forecasting income due to dependence on individual transactions and client demand fluctuations. This model often results in increased administrative burdens and higher operational costs as providers must manage billing and service delivery for each separate service. Maintaining consistent client engagement is harder, leading to potential revenue volatility compared to the stability offered by recurring revenue models.

Obstacles with Recurring Revenue streams

Establishing consistent recurring revenue streams faces obstacles such as customer churn, which disrupts stable cash flow, and high initial acquisition costs that delay profitability. Additionally, businesses must invest in continuous value delivery and customer support to maintain subscriptions, increasing operational complexity compared to fee-for-service models. Managing fluctuating subscription pricing and adapting to market demands also challenge long-term revenue predictability in recurring models.

Choosing the Right Revenue Model for Your Business

Fee-for-service revenue provides immediate cash flow by charging customers per transaction, ideal for businesses with variable or project-based offerings. Recurring revenue offers predictable, steady income through subscriptions or contracts, enhancing financial stability and customer retention. Assess your business's service type, customer preferences, and cash flow needs to select a revenue model that balances growth potential with operational sustainability.

Future Trends in Revenue Models

The shift from traditional Fee-for-Service Revenue to Recurring Revenue models is accelerating across industries, driven by the growing demand for predictable cash flow and enhanced customer retention. Subscription services, Software as a Service (SaaS), and membership platforms are fueling this transformation, emphasizing continuous value delivery over one-time transactions. Future trends suggest increased adoption of hybrid models combining one-time fees with recurring charges, leveraging AI-driven analytics to optimize customer lifetime value and personalize offerings.

Fee-for-Service Revenue Infographic

libterm.com

libterm.com