A capital lease is a financial agreement where the lessee assumes many risks and benefits of ownership for an asset, often recorded as both an asset and liability on the balance sheet. This type of lease impacts your company's financial statements and tax considerations differently compared to operating leases. Explore the detailed implications of capital leases throughout the rest of this article.

Table of Comparison

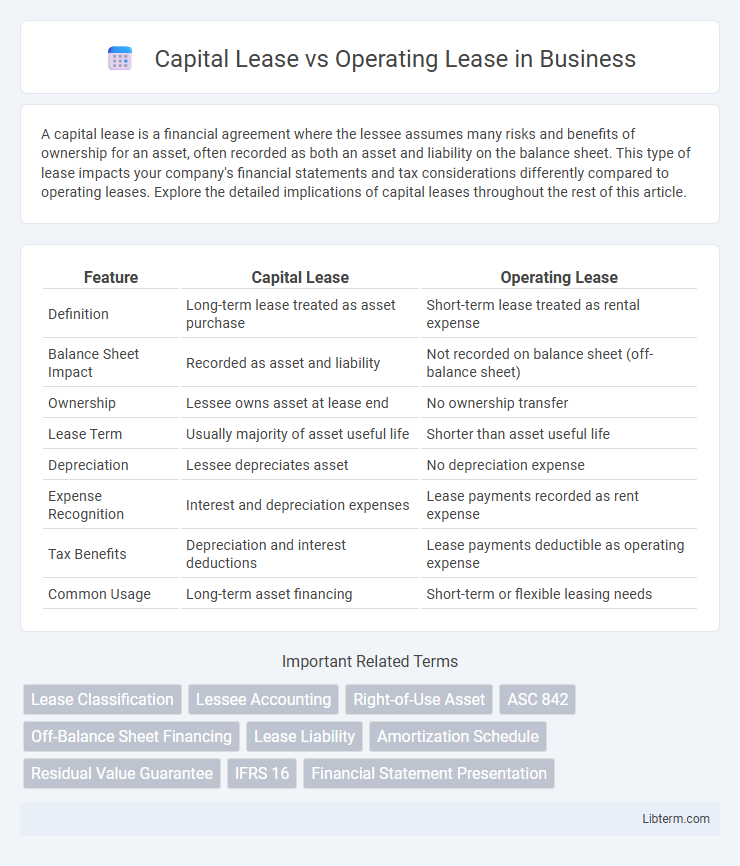

| Feature | Capital Lease | Operating Lease |

|---|---|---|

| Definition | Long-term lease treated as asset purchase | Short-term lease treated as rental expense |

| Balance Sheet Impact | Recorded as asset and liability | Not recorded on balance sheet (off-balance sheet) |

| Ownership | Lessee owns asset at lease end | No ownership transfer |

| Lease Term | Usually majority of asset useful life | Shorter than asset useful life |

| Depreciation | Lessee depreciates asset | No depreciation expense |

| Expense Recognition | Interest and depreciation expenses | Lease payments recorded as rent expense |

| Tax Benefits | Depreciation and interest deductions | Lease payments deductible as operating expense |

| Common Usage | Long-term asset financing | Short-term or flexible leasing needs |

Introduction to Capital Lease vs Operating Lease

Capital leases transfer ownership rights and risks of the asset to the lessee, often recorded as both an asset and a liability on the balance sheet. Operating leases are short-term rental agreements where the lessee uses the asset without ownership, typically expensed on a straight-line basis over the lease term. Understanding the distinction influences financial statements, tax treatment, and lease accounting under standards like ASC 842 and IFRS 16.

Key Differences Between Capital and Operating Leases

Capital leases transfer ownership rights and risks to the lessee, capitalizing the asset and recording both asset and liability on the balance sheet, while operating leases are treated as rental expenses without asset recognition. Capital leases typically have longer terms, often covering most of the asset's useful life, whereas operating leases are shorter and more flexible. The accounting standards, such as ASC 842 and IFRS 16, require capitalization of most leases, but key differences remain in how lease expenses and liabilities are recognized and measured.

Definition and Characteristics of Capital Lease

A capital lease, also known as a finance lease, is an agreement in which the lessee assumes the risks and rewards of ownership, with the leased asset recorded as an asset and liability on the balance sheet. Characteristics of a capital lease include long-term lease periods, transfer of ownership at the end of the lease term, bargain purchase options, and lease payments covering the asset's fair value. This lease type impacts financial statements through asset depreciation and interest expense recognition, distinguishing it from operating leases that are treated as rental expenses.

Definition and Characteristics of Operating Lease

An operating lease is a rental agreement where the lessee uses an asset for a specific period without obtaining ownership rights, typically shorter than the asset's economic life. Characteristics include off-balance-sheet treatment for lessees, lower monthly payments, and less responsibility for maintenance and residual value risk. Operating leases are commonly used for equipment or property that a company needs temporarily or for flexibility without capitalizing the asset.

Accounting Treatment for Capital and Operating Leases

Capital leases are recorded as both an asset and a liability on the balance sheet, reflecting ownership with depreciation expense and interest expense recognized on the income statement. Operating leases are treated as off-balance-sheet items, with lease payments recorded as a single operating expense over the lease term. Under ASC 842, lessees must recognize right-of-use assets and lease liabilities for both types, but operating lease expenses remain straight-lined on the income statement.

Impact on Balance Sheet and Income Statement

Capital leases result in the recognition of both an asset and a corresponding liability on the balance sheet, reflecting ownership of the leased property, which increases total assets and liabilities. On the income statement, capital leases record depreciation expense on the leased asset and interest expense on the lease liability, impacting net income over the lease term. Operating leases, under current accounting standards, also appear on the balance sheet as right-of-use assets and lease liabilities but are expensed on the income statement primarily as a single lease expense, resulting in a more consistent impact on net income throughout the lease period.

Tax Implications of Capital vs Operating Leases

Capital leases are treated as asset acquisitions, allowing depreciation expense deductions and interest expense on lease liabilities, which can reduce taxable income over the lease term. Operating leases are treated as rental expenses, fully deductible in the period incurred, providing immediate tax benefits without affecting asset or liability reporting on the balance sheet. The choice between capital and operating leases impacts tax planning strategies by influencing timing and recognition of deductible expenses, affecting cash flow and overall tax liability.

Advantages and Disadvantages of Capital Lease

A capital lease provides the advantage of asset ownership benefits, including depreciation tax deductions and balance sheet capitalization, enhancing financial leverage and long-term investment value. However, it entails higher upfront costs and less flexibility due to fixed term obligations, making it less suitable for rapidly changing asset needs or short-term use. The obligation to record the leased asset and liability impacts financial ratios such as debt-to-equity, potentially affecting borrowing capacity and investor perception.

Advantages and Disadvantages of Operating Lease

Operating leases provide businesses with flexibility and off-balance-sheet financing, preserving capital and improving financial ratios by recording lease payments as operating expenses. This type of lease reduces maintenance responsibilities and allows easy asset upgrades at the end of lease terms. However, operating leases may result in higher long-term costs and lack asset ownership, limiting potential tax benefits associated with depreciation and interest deductions.

Choosing the Right Lease: Factors to Consider

Choosing the right lease involves analyzing key factors such as lease term, asset control, and financial reporting impacts. Capital leases typically require long-term commitments with asset ownership and balance sheet recognition, benefiting companies seeking fixed asset acquisition. Operating leases offer flexibility with off-balance-sheet treatment, ideal for short-term usage or assets subject to rapid obsolescence.

Capital Lease Infographic

libterm.com

libterm.com