Non-accredited investors typically lack the financial sophistication or net worth required to participate in certain private investment opportunities. These individuals face restrictions designed to protect them from high-risk ventures that may not be suitable for their financial situation. Explore the rest of the article to understand how these regulations impact your investment options and pathways to potential inclusion.

Table of Comparison

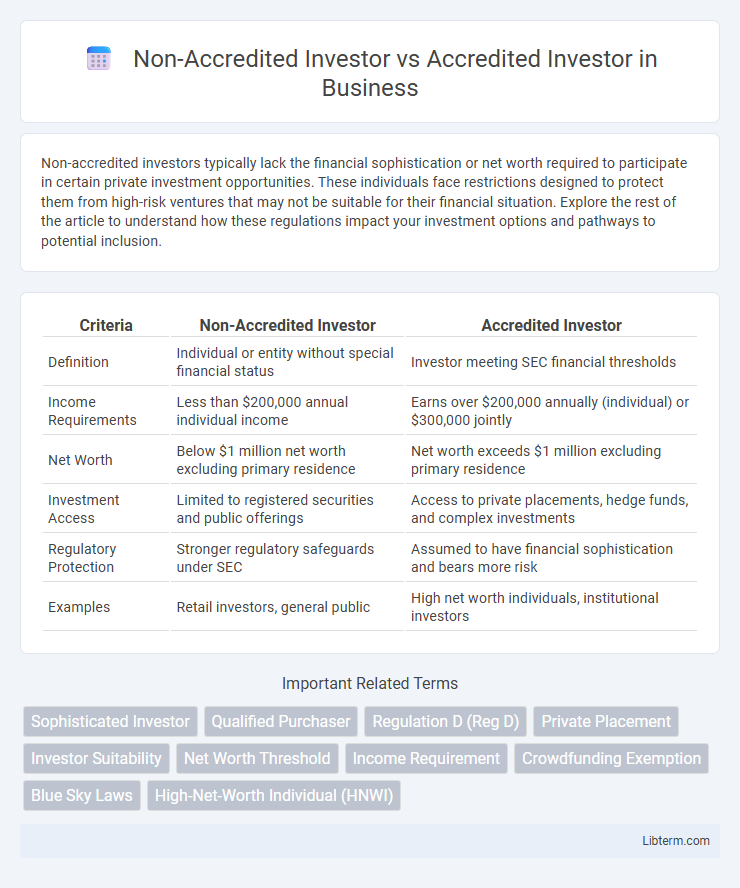

| Criteria | Non-Accredited Investor | Accredited Investor |

|---|---|---|

| Definition | Individual or entity without special financial status | Investor meeting SEC financial thresholds |

| Income Requirements | Less than $200,000 annual individual income | Earns over $200,000 annually (individual) or $300,000 jointly |

| Net Worth | Below $1 million net worth excluding primary residence | Net worth exceeds $1 million excluding primary residence |

| Investment Access | Limited to registered securities and public offerings | Access to private placements, hedge funds, and complex investments |

| Regulatory Protection | Stronger regulatory safeguards under SEC | Assumed to have financial sophistication and bears more risk |

| Examples | Retail investors, general public | High net worth individuals, institutional investors |

Understanding Non-Accredited vs Accredited Investors

Non-accredited investors are individuals or entities that do not meet the financial criteria set by the SEC, typically having less than $1 million in net worth or annual income under $200,000. Accredited investors meet these thresholds, granting them access to private securities offerings often restricted to reduce risk exposure. Understanding the distinction is crucial for compliance with securities regulations and accessing different investment opportunities.

Key Definitions: Non-Accredited and Accredited Investors

Non-accredited investors are individuals or entities that do not meet specific financial criteria set by regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), including net worth below $1 million or annual income under $200,000. Accredited investors satisfy these requirements, possessing higher income, net worth, or professional qualifications, allowing access to private placement investments and other exclusive financial opportunities. Understanding the distinction is crucial for compliance with securities regulations and determining eligibility for various investment options.

Main Criteria for Accredited Investor Status

The main criteria for accredited investor status include an individual having an annual income exceeding $200,000 ($300,000 with a spouse) for the past two years or a net worth over $1 million, excluding the primary residence. Accredited investors can also qualify based on professional certifications, knowledge, or job experience, such as holding certain licenses like FINRA Series 7, 65, or 82. These criteria distinguish accredited investors from non-accredited investors, granting access to a broader range of private investment opportunities under U.S. securities regulations.

Rights and Limitations of Non-Accredited Investors

Non-accredited investors face limitations in accessing certain high-risk investment opportunities, such as private placements and hedge funds, which are predominantly reserved for accredited investors meeting specific income or net worth criteria. Their rights include access to publicly registered securities and some crowdfunding platforms, but they often encounter restrictions on the amount they can invest to protect against significant financial loss. Regulatory bodies like the SEC impose these limitations to balance investor protection with market participation, ensuring non-accredited investors are shielded from undue risk while still enabling reasonable investment opportunities.

Investment Opportunities Available to Each Group

Accredited investors access a broader range of investment opportunities, including private equity, hedge funds, and venture capital, due to regulatory allowances. Non-accredited investors are typically limited to public securities and registered investment products, with fewer options in alternative investments. This distinction impacts portfolio diversification potential and risk exposure for each group.

Regulatory Protections and Restrictions

Non-accredited investors face stricter regulatory protections under securities laws, limiting their access to high-risk investments to reduce potential losses due to limited financial literacy and resources. Accredited investors, defined by the SEC through income and net worth thresholds, have fewer restrictions, enabling them to participate in private placements and hedge funds with greater risk exposure. Regulatory frameworks prioritize investor safety for non-accredited investors while granting accredited investors broader market access based on presumed financial sophistication and capacity to absorb investment risk.

Risks Associated with Each Investor Type

Non-accredited investors face higher risks due to limited access to vetted investment opportunities and lower financial literacy, increasing exposure to potential fraud or market volatility. Accredited investors, while having access to more sophisticated investment options such as hedge funds and private equity, encounter risks related to higher investment minimums and less regulatory protection. Both investor types must carefully assess their risk tolerance and financial goals before participating in complex investment markets.

How to Qualify as an Accredited Investor

To qualify as an accredited investor, an individual must meet specific financial criteria set by the U.S. Securities and Exchange Commission (SEC), including having a net worth exceeding $1 million excluding primary residence or earning an individual income over $200,000 annually in the past two years, or $300,000 combined income with a spouse. Entities such as banks, insurance companies, and trusts with assets over $5 million also qualify as accredited investors. Meeting these qualifications grants access to private investment opportunities not available to non-accredited investors, who do not meet these financial thresholds.

Impact on Fundraising for Startups and Companies

Non-accredited investors face legal restrictions that limit their ability to participate in private funding rounds, reducing the pool of potential capital for startups and companies. Accredited investors, meeting specific income or net worth criteria, enable access to larger investments and sophisticated funding opportunities, significantly enhancing a startup's fundraising potential. Restricting fundraising efforts to accredited investors can speed capital acquisition and attract institutional investors, but it may limit broader community engagement and smaller individual contributions.

Choosing the Right Investment Path for You

Non-accredited investors, typically individuals with lower net worth or income, face more limitations on investment opportunities compared to accredited investors who meet specific financial criteria set by the SEC, such as having a net worth over $1 million or annual income exceeding $200,000. Choosing the right investment path depends on your financial situation, risk tolerance, and access to private equity, hedge funds, or startup investments often available only to accredited investors. Understanding eligibility requirements and evaluating potential returns and risks can help you determine whether conventional public market investments or exclusive private market opportunities better align with your financial goals.

Non-Accredited Investor Infographic

libterm.com

libterm.com