The Dodd-Frank Act established comprehensive financial regulations designed to increase transparency and reduce risks in the banking system following the 2008 financial crisis. It introduced new oversight mechanisms for banks, created the Consumer Financial Protection Bureau, and imposed stricter rules on derivatives trading and executive compensation. Explore the article to understand how these changes impact your financial security and the broader economy.

Table of Comparison

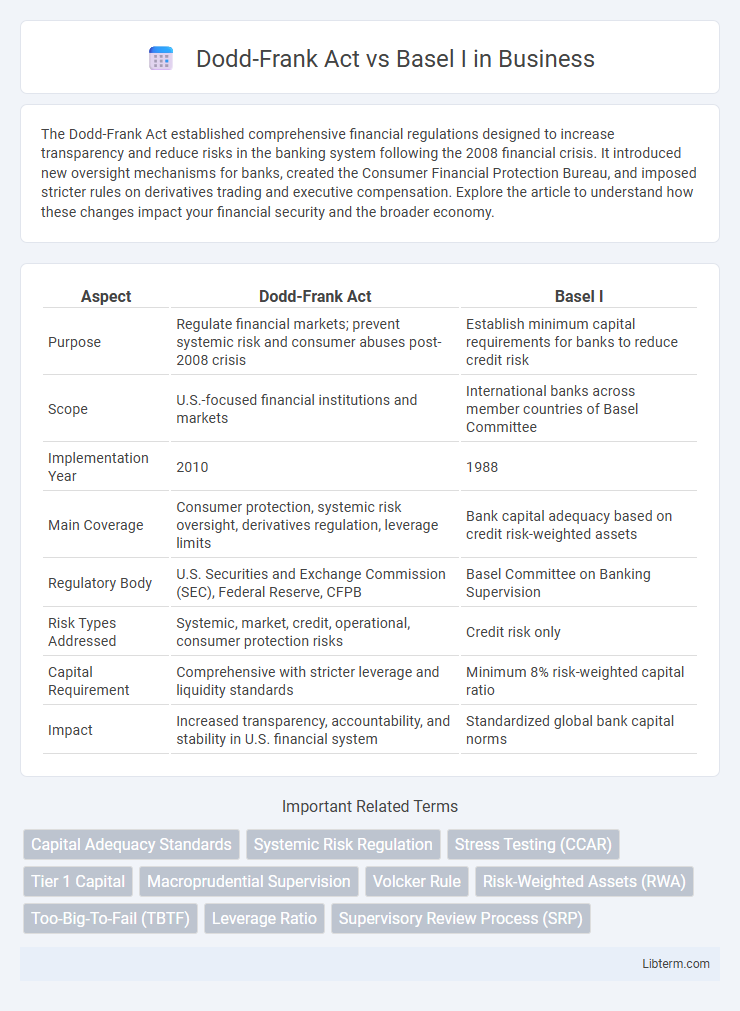

| Aspect | Dodd-Frank Act | Basel I |

|---|---|---|

| Purpose | Regulate financial markets; prevent systemic risk and consumer abuses post-2008 crisis | Establish minimum capital requirements for banks to reduce credit risk |

| Scope | U.S.-focused financial institutions and markets | International banks across member countries of Basel Committee |

| Implementation Year | 2010 | 1988 |

| Main Coverage | Consumer protection, systemic risk oversight, derivatives regulation, leverage limits | Bank capital adequacy based on credit risk-weighted assets |

| Regulatory Body | U.S. Securities and Exchange Commission (SEC), Federal Reserve, CFPB | Basel Committee on Banking Supervision |

| Risk Types Addressed | Systemic, market, credit, operational, consumer protection risks | Credit risk only |

| Capital Requirement | Comprehensive with stricter leverage and liquidity standards | Minimum 8% risk-weighted capital ratio |

| Impact | Increased transparency, accountability, and stability in U.S. financial system | Standardized global bank capital norms |

Overview of the Dodd-Frank Act

The Dodd-Frank Act introduced comprehensive financial regulatory reforms aimed at reducing systemic risk and protecting consumers after the 2008 financial crisis. It established the Consumer Financial Protection Bureau (CFPB) and imposed stricter capital and liquidity requirements on banks, surpassing the limited scope of Basel I's focus on minimum capital adequacy ratios. The Act also enhanced transparency, risk management, and oversight of derivatives markets to prevent future financial instability.

Introduction to Basel I

Basel I, established by the Basel Committee on Banking Supervision in 1988, set the foundational international regulatory framework for bank capital requirements to enhance financial stability. It introduced risk-weighted assets and minimum capital adequacy ratios, primarily targeting credit risk and ensuring banks maintain sufficient capital to cover potential losses. The Dodd-Frank Act, enacted in 2010, complements Basel I by focusing on systemic risk reduction, consumer protection, and increased regulatory oversight in the aftermath of the 2008 financial crisis.

Key Objectives: Dodd-Frank vs Basel I

The Dodd-Frank Act aims to enhance financial stability by increasing transparency, reducing systemic risk, and protecting consumers through stringent regulatory reforms, including the establishment of the Consumer Financial Protection Bureau. Basel I focuses primarily on setting minimum capital requirements for banks to ensure adequate capital reserves and mitigate credit risk, emphasizing the standardization of risk-weighted assets. While Dodd-Frank addresses broader financial system reforms and consumer protection, Basel I centers on quantifying and managing credit risk within banking institutions.

Scope and Applicability

The Dodd-Frank Act primarily targets U.S. financial institutions, emphasizing consumer protection and systemic risk reduction post-2008 crisis, applying broadly to banks, non-bank financial companies, and derivatives markets. Basel I, developed by the Basel Committee on Banking Supervision, focuses globally on banking institutions' capital adequacy, setting minimum capital requirements to ensure stability in international banking. While Dodd-Frank has a wider regulatory scope including derivatives and consumer finance, Basel I concentrates on credit risk and bank capital standards across international banks.

Capital Requirements Comparison

The Dodd-Frank Act enforces rigorous capital requirements on U.S. financial institutions, emphasizing stress testing and higher capital buffers to mitigate systemic risks. Basel I established a foundational international framework, setting a minimum capital adequacy ratio of 8% based on risk-weighted assets but lacked detailed risk sensitivity and stress testing protocols. The Dodd-Frank Act's capital standards are more stringent and comprehensive, reflecting lessons from the 2008 financial crisis and targeting enhanced financial stability.

Risk Management Approaches

The Dodd-Frank Act emphasizes comprehensive risk management by increasing regulatory oversight, mandating stress testing, and enhancing transparency to mitigate systemic risks in U.S. financial institutions. Basel I primarily focuses on credit risk through the implementation of minimum capital requirements based on risk-weighted assets, setting a global standard for banking regulation. Unlike Basel I's capital adequacy approach, Dodd-Frank incorporates broader macroprudential measures and stricter supervision to address complex risk profiles in modern financial markets.

Regulatory Oversight and Supervision

The Dodd-Frank Act significantly expanded regulatory oversight by enhancing the authority of the Consumer Financial Protection Bureau (CFPB) and increasing supervision of systemic financial institutions to prevent future crises. Basel I primarily focused on setting minimum capital requirements for banks but lacked comprehensive supervisory measures and macroprudential oversight. Dodd-Frank introduced stricter risk management standards and stress testing, contrasting Basel I's more limited scope on capital adequacy without direct regulatory enforcement mechanisms.

Impact on Financial Institutions

The Dodd-Frank Act significantly increased regulatory oversight on financial institutions by imposing stricter capital requirements, stress testing, and risk management protocols to prevent another financial crisis. Basel I focused primarily on credit risk by setting minimum capital standards based on risk-weighted assets but lacked comprehensive provisions for liquidity and systemic risk. Financial institutions under Dodd-Frank face heightened compliance costs and operational changes due to its broad regulatory scope beyond Basel I's foundational capital adequacy framework.

Criticisms and Challenges

The Dodd-Frank Act faces criticism for its complexity, imposing significant compliance costs on smaller financial institutions and potentially stifling economic growth. Basel I is often challenged for its simplistic risk weighting system, which failed to accurately capture credit risk and incentivized regulatory arbitrage. Both frameworks struggle with balancing financial stability goals against fostering innovation and maintaining competitive market environments.

Future Perspectives and Reforms

Future perspectives for the Dodd-Frank Act emphasize enhancing transparency and systemic risk oversight through advanced data analytics and stress testing, aiming to prevent another financial crisis. Basel I, originally focused on credit risk with minimum capital requirements, faces ongoing reforms moving toward Basel III standards, incorporating market and operational risk for more resilient banking regulation. Both frameworks continue evolving to address emerging financial technologies, climate risks, and global regulatory convergence to strengthen stability and protect consumers.

Dodd-Frank Act Infographic

libterm.com

libterm.com