Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering professional management and reduced risk. They provide a convenient way for You to access various markets without needing to pick individual investments. Explore the rest of this article to understand how mutual funds can fit into Your financial strategy.

Table of Comparison

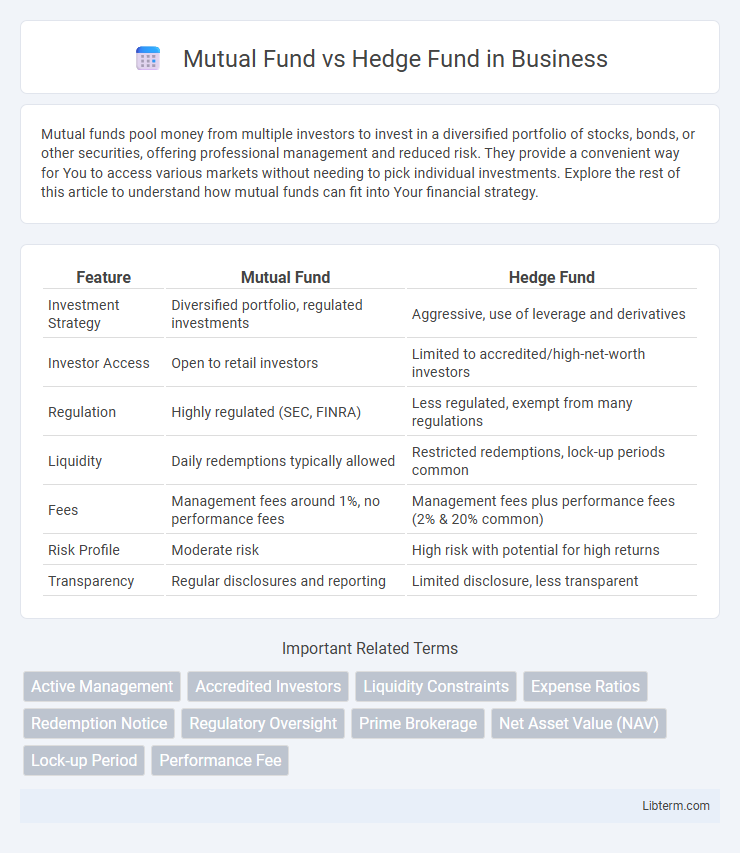

| Feature | Mutual Fund | Hedge Fund |

|---|---|---|

| Investment Strategy | Diversified portfolio, regulated investments | Aggressive, use of leverage and derivatives |

| Investor Access | Open to retail investors | Limited to accredited/high-net-worth investors |

| Regulation | Highly regulated (SEC, FINRA) | Less regulated, exempt from many regulations |

| Liquidity | Daily redemptions typically allowed | Restricted redemptions, lock-up periods common |

| Fees | Management fees around 1%, no performance fees | Management fees plus performance fees (2% & 20% common) |

| Risk Profile | Moderate risk | High risk with potential for high returns |

| Transparency | Regular disclosures and reporting | Limited disclosure, less transparent |

Introduction to Mutual Funds and Hedge Funds

Mutual funds pool capital from individual investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering professional management and liquidity. Hedge funds, limited to accredited investors, employ complex strategies such as leverage, short selling, and derivatives to achieve higher returns, often with less regulatory oversight. Both investment vehicles aim to grow capital but differ in risk, regulatory framework, and investor access.

Key Differences Between Mutual Funds and Hedge Funds

Mutual funds primarily cater to retail investors offering diversified portfolios with strict regulatory oversight, emphasizing liquidity and transparency. Hedge funds target accredited investors with aggressive strategies including leverage, short selling, and derivatives, aiming for high returns often accompanied by higher risk and less regulatory scrutiny. Fee structures differ, with mutual funds charging a percentage of assets under management while hedge funds typically impose a "2 and 20" fee model, combining management and performance fees.

Structure and Management Styles

Mutual funds are typically structured as open-end investment companies regulated by the SEC, offering daily liquidity and managed by professional portfolio managers following predefined investment objectives. Hedge funds operate as private partnerships or limited liability companies with fewer regulatory constraints, employing diverse and often aggressive management styles including long/short equity, leverage, and derivatives to achieve absolute returns. The management of mutual funds emphasizes transparency and diversification, while hedge fund managers utilize flexible strategies and performance-based fee structures to maximize risk-adjusted returns.

Investment Strategies Employed

Mutual funds primarily employ diversified investment strategies, focusing on stocks, bonds, and other securities to minimize risk and provide steady returns for a broad investor base. Hedge funds utilize aggressive strategies such as leverage, short selling, derivatives, and arbitrage to achieve higher risk-adjusted returns, often targeting absolute gains regardless of market direction. The distinct regulatory environments influence these strategies, with mutual funds adhering to stricter rules and hedge funds operating under more flexible frameworks.

Accessibility and Investor Requirements

Mutual funds offer broad accessibility to individual investors with low minimum investment requirements, often starting as low as $500, making them suitable for retail investors. Hedge funds typically require high minimum investments, sometimes exceeding $1 million, and are restricted to accredited or institutional investors due to regulatory constraints. The limited liquidity and stringent eligibility criteria of hedge funds contrast with the daily liquidity and regulatory protections found in mutual funds.

Fee Structures and Cost Comparison

Mutual funds typically charge an expense ratio averaging 0.5% to 1.5% annually, encompassing management fees and operating costs, with no performance fees, making them more cost-efficient for average investors. Hedge funds employ a "2 and 20" fee structure, charging a 2% management fee plus 20% of profits, substantially increasing costs but aiming to deliver higher returns through active management and alternative strategies. While mutual funds offer lower fees and greater liquidity, hedge funds justify their premium charges by employing complex investment tactics targeting alpha generation.

Regulation and Oversight

Mutual funds are regulated by the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940, ensuring strict transparency, investor protection, and regular reporting requirements. Hedge funds operate with less regulatory oversight, often exempt from many SEC regulations due to their limited number of accredited investors and ability to pursue riskier investment strategies. This regulatory difference results in mutual funds offering greater liquidity and transparency, while hedge funds provide more flexibility but higher risk for sophisticated investors.

Risk Profiles and Performance Potential

Mutual funds typically offer lower risk profiles due to diversified portfolios and regulatory constraints limiting leverage and short selling, making them suitable for conservative investors seeking steady returns. Hedge funds employ aggressive strategies such as leverage, derivatives, and short selling, resulting in higher risk profiles but also the potential for superior performance and absolute returns regardless of market conditions. The performance potential of hedge funds can be significantly higher but comes with increased volatility and less liquidity compared to the more transparent and regulated mutual funds.

Liquidity and Redemption Policies

Mutual funds offer high liquidity with daily redemption options, allowing investors to cash out at the net asset value (NAV) at the end of each trading day. Hedge funds typically impose lock-up periods ranging from six months to several years, restricting investor withdrawals to maintain portfolio stability. Redemption policies in hedge funds often include advance notice requirements and redemption fees, contrasting with mutual funds' more flexible and frequent withdrawal terms.

Which Fund Type Is Right for You?

Choosing between mutual funds and hedge funds depends on your investment goals, risk tolerance, and liquidity needs. Mutual funds offer diversified, regulated investments with lower minimums, ideal for conservative investors seeking steady growth. Hedge funds cater to high-net-worth individuals seeking aggressive strategies, higher returns, and higher risk, often requiring longer lock-up periods.

Mutual Fund Infographic

libterm.com

libterm.com