Book value represents the net asset value of a company calculated by subtracting total liabilities from total assets on the balance sheet. It provides a baseline measure of a company's intrinsic worth, often used by investors to assess whether a stock is undervalued or overvalued relative to its market price. Explore the upcoming sections to understand how book value impacts your investment decisions and financial analysis.

Table of Comparison

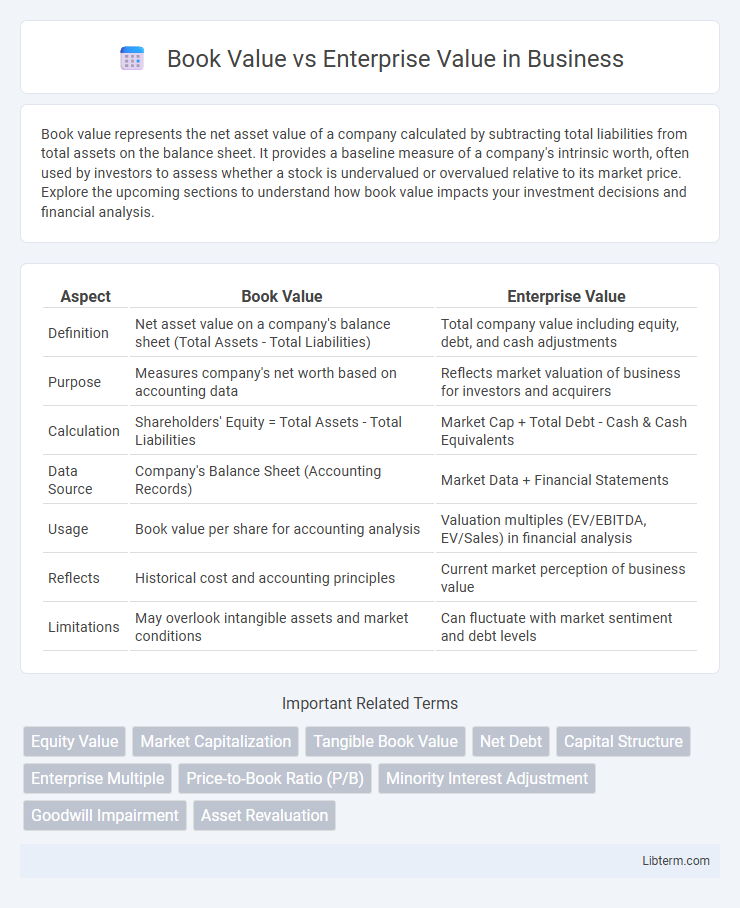

| Aspect | Book Value | Enterprise Value |

|---|---|---|

| Definition | Net asset value on a company's balance sheet (Total Assets - Total Liabilities) | Total company value including equity, debt, and cash adjustments |

| Purpose | Measures company's net worth based on accounting data | Reflects market valuation of business for investors and acquirers |

| Calculation | Shareholders' Equity = Total Assets - Total Liabilities | Market Cap + Total Debt - Cash & Cash Equivalents |

| Data Source | Company's Balance Sheet (Accounting Records) | Market Data + Financial Statements |

| Usage | Book value per share for accounting analysis | Valuation multiples (EV/EBITDA, EV/Sales) in financial analysis |

| Reflects | Historical cost and accounting principles | Current market perception of business value |

| Limitations | May overlook intangible assets and market conditions | Can fluctuate with market sentiment and debt levels |

Introduction to Book Value and Enterprise Value

Book Value represents a company's net asset value calculated as total assets minus total liabilities, reflecting shareholders' equity on the balance sheet. Enterprise Value measures a company's total market value, including equity, debt, and cash, providing a comprehensive valuation for potential investors and acquirers. Understanding the distinction between Book Value and Enterprise Value is crucial for accurate financial analysis and investment decisions.

Defining Book Value: Calculation and Significance

Book value represents a company's net asset value calculated by subtracting total liabilities from total assets, reflecting shareholders' equity on the balance sheet. It is significant as a baseline measure of a company's intrinsic worth, offering investors insight into the company's financial health and liquidation value. Understanding book value aids in evaluating whether a stock is undervalued or overvalued relative to its market price and enterprise value.

Understanding Enterprise Value: Components and Formula

Enterprise Value (EV) represents a company's total market value by combining market capitalization, debt, and preferred stock while subtracting cash and cash equivalents. The formula for EV is: EV = Market Capitalization + Total Debt + Preferred Stock - Cash and Cash Equivalents. This metric offers a comprehensive view of a company's worth, useful for investors comparing firms with different capital structures.

Key Differences Between Book Value and Enterprise Value

Book Value represents a company's net asset value calculated as total assets minus total liabilities, reflecting shareholder equity on the balance sheet. Enterprise Value measures a company's total market value, including market capitalization, debt, minority interest, and preferred shares, minus cash and cash equivalents, providing a comprehensive valuation from an investor's perspective. The key difference lies in Book Value being an accounting metric based on historical cost, while Enterprise Value captures current market conditions and capital structure, making it more relevant for takeover analysis and investment decisions.

Practical Applications in Financial Analysis

Book Value represents a company's net asset value, essential for assessing financial health and balance sheet strength, while Enterprise Value (EV) provides a comprehensive measure of a company's total market value including debt and equity, facilitating accurate valuation comparisons. Practical applications in financial analysis include using Book Value to gauge liquidation value and EV to evaluate acquisition costs, analyze capital structure, and benchmark companies across industries regardless of differing debt levels. Investors and analysts integrate both metrics to obtain a nuanced perspective on profitability, risk, and growth potential when making investment decisions or conducting mergers and acquisitions.

Advantages and Limitations of Book Value

Book Value provides a clear and straightforward measure of a company's net asset value based on its balance sheet, offering a tangible assessment of shareholder equity that is less influenced by market fluctuations. Its advantages include simplicity, reliability, and usefulness in valuing companies with significant physical assets, especially in industries like manufacturing or finance. Limitations arise from its reliance on historical cost, ignoring intangible assets and future growth potential, which can lead to undervaluation of innovative or technology-driven firms.

Strengths and Weaknesses of Enterprise Value

Enterprise Value (EV) provides a comprehensive measure of a company's total value by including market capitalization, debt, and cash, which offers a more accurate reflection of acquisition costs compared to Book Value. EV captures the true economic worth by considering debt obligations and cash reserves, but its reliance on market-driven data can introduce volatility and may be skewed by short-term market conditions. Despite these weaknesses, EV is highly useful for comparing companies with different capital structures and assessing takeover targets in mergers and acquisitions.

Use Cases: When to Use Book Value vs Enterprise Value

Book value is best used in asset-heavy industries like manufacturing or finance to assess a company's net worth based on its balance sheet, providing insight into liquidation value and accounting precision. Enterprise value offers a more comprehensive metric for valuing companies in mergers and acquisitions or comparing firms with different capital structures by including debt, equity, and cash components. Investors and analysts prefer enterprise value when evaluating operational performance and takeover potential, while book value suits scenarios demanding a conservative valuation rooted in historical cost.

Impact on Investment Decisions and Valuation

Book Value provides a baseline measure of a company's net asset value based on historical cost, influencing investment decisions by highlighting accounting-based equity but often underestimating market potential. Enterprise Value (EV) offers a comprehensive valuation by including market capitalization, debt, and cash, reflecting the true cost to acquire a company and serving as a crucial metric in comparing firms regardless of capital structure. Investors prioritize EV over Book Value for assessing acquisition targets and making valuation judgments because EV accounts for leverage and operational scale, impacting strategic investment decisions more effectively.

Conclusion: Choosing the Right Metric for Analysis

Selecting between book value and enterprise value depends on the specific analytical goals and context of the valuation. Book value offers insight into a company's net asset worth based on historical costs, making it useful for assessing liquidation scenarios or balance sheet strength. Enterprise value provides a comprehensive market-based measure of a company's total value, ideal for investment decisions involving mergers, acquisitions, or evaluating overall financial health.

Book Value Infographic

libterm.com

libterm.com